A) unpredictable fluctuations in cash flow from quarter to quarter.

B) the largest cash inflow from operations in the second and third quarters (April - September) .

C) a fairly stable cash flow across all four quarters.

D) the largest cash inflow from operations in the fourth and first quarters (October - March) .

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If a company uses the indirect method to determine cash flows from operating activities:

A) gains must be added to net income and losses subtracted from net income.

B) gains and losses must be added to net income.

C) gains must be subtracted from net income and losses added to net income.

D) gains and losses must be subtracted from net income.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

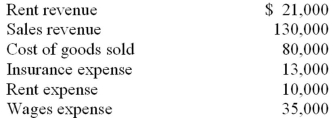

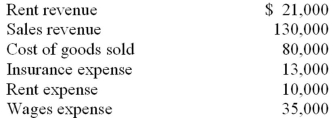

The following information is taken from the 2014 income statement of Muir Company: Based on this information,what is the amount of net cash flow from operating activities?

A) $149,000

B) $140,000

C) $146,000

D) $134,000

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When the direct method is used to determine the cash flows from operating activities,other operating expenses are converted into cash outflows by:

A) adding changes in prepaid expenses and accrued liabilities to other expenses.

B) subtracting increases in prepaid expenses and subtracting decreases in accrued liabilities from other expenses.

C) adding increases in prepaid expenses and adding decreases in accrued liabilities to other expenses.

D) subtracting changes in prepaid expenses and accrued liabilities from other expenses.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following would be included in cash flows from investing activities?

A) Cash proceeds from sales.

B) Cash received from an issuance of bonds.

C) Dividends paid to stockholders.

D) Cash used to purchases of equipment.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

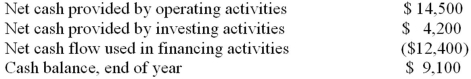

A corporation prepared its statement of cash flows for the year.The following information is taken from that statement: What is the cash balance at the beginning of the year?

A) $5,600

B) $2,800

C) $6,300

D) $15,400

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose a company generally records revenues and expenses before receiving or making cash payments.Which of the following statements is not true?

A) If sales are falling,net losses could occur even though the company reports a net cash inflow from operating activities.

B) If sales are rising,net profits could occur even though the company reports a net cash outflow from operating activities.

C) Net income and cash flows will always agree because even though revenues and expenses can be recorded in different time periods than their related cash flows the differences will cancel out and the results will be the same.

D) When the indirect method is used,net cash flow from operating activities includes adjustments for non-cash expenses such as depreciation which would cause net cash from operating activities to be different from net income.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

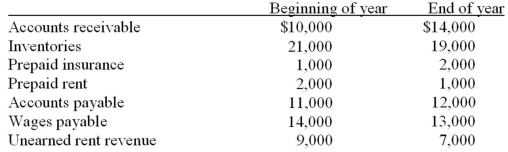

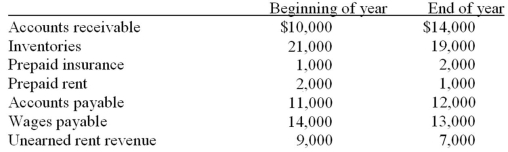

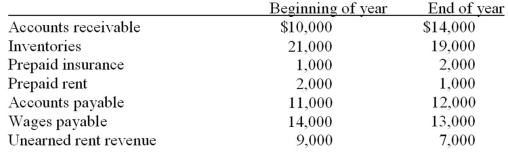

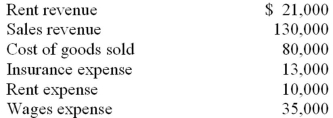

The income statement for the year contains the following: Use the information above to answer the following question.What is the amount of cash paid for insurance?

A) $13,000

B) $12,000

C) $14,000

D) $16,000

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following would not be considered cash and cash equivalents for purposes of preparing a statement of cash flows?

A) Money market funds.

B) Checking accounts.

C) Treasury bills.

D) Notes receivable.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A company has a net cash inflow from operating activities of $789,000,a net cash outflow of $50,000 from investing activities and a net cash inflow of $100,000 from financing activities.The company paid $124,000 in interest,$186,500 in income taxes,and $200,000 in dividends.Which of the following statements about the statement of cash flows is not true?

A) Dividends of $200,000 will be reported as a cash outflow in the cash flow from investing activities section.

B) Supplemental disclosures required for a company using the indirect method include the amount of interest and the amount of income taxes paid.

C) The statement of cash flows will show a net increase to cash and cash equivalents of $839,000.

D) If the direct method is used,the $124,000 of interest paid and the $186,500 of income taxes paid will be reported in the cash flows from operating activities.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The income statement for the year contains the following: Use the information above to answer the following question.What is the amount of cash paid for inventory?

A) $77,000

B) $78,000

C) $80,000

D) $81,000

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Cash flows from investing activities include cash:

A) inflows and outflows reflecting revenues and expenses.

B) outflows from the sale of long-term investments.

C) inflows from the sale of long-term investments.

D) inflows from the sale of a company's own stock to its stockholders.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Cinno Company reported net income of $20,000 for the year ended December 31,2014.During the year,inventories decreased by $7,000,accounts payable decreased by $8,000,depreciation expense was $10,000,and accounts receivable increased by $6,500.Net cash provided by operations in 2014,computed using the indirect method was:

A) $10,500.

B) $22,500.

C) $38,500.

D) $51,500.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The income statement for the year contains the following: Use the information above to answer the following question.What is the amount of cash paid for rent?

A) $9,000

B) $11,000

C) $10,000

D) $12,000

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If insurance expense is $7,000 and the beginning and ending balances of prepaid insurance are $1,500 and $2,000,respectively,the cash paid for insurance is

A) $7,000.

B) $6,500.

C) $5,000.

D) $7,500.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A company loaned $1,000,000 with interest at 7% to another company.The interest revenue from this loan would be reported on the statement of cash flows as

A) cash inflow from operating activities.

B) cash inflow from investing activities.

C) cash inflow from financing activities.

D) noncash transaction in a supplemental disclosure.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

Using the indirect method,the increase in accumulated depreciation is added to net income in the operating section.The increase in accumulated depreciation could be due to a combination of depreciation expense and sales of property,plant,and equipment.Depreciation expense would be added to net income in the operating section.Sales of property,plant and equipment would be reported as a cash inflow in the investing section.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Using the T-account approach to preparing the statement of cash flows,an increase in accounts payable would appear on the debit side of the cash account.An increase in accounts payable indicates that purchases on account exceed payments on account,so cash would increase.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following items would be reported on a statement of cash flows using the indirect method,but not on a statement prepared using the direct method?

A) Cash paid for dividends.

B) Cash received from stock issuances.

C) Depreciation expense.

D) Cash paid for purchase of treasury stock.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

When the net cash flows from operating,investing,and financing activities are combined to arrive at the overall net change in cash,a net decrease in cash is subtracted from the beginning cash balance to calculate the ending cash balance.The statement of cash flows explains the change in cash.If the change is positive,it is added to the beginning cash balance;if the change is negative,it is subtracted from the beginning cash balance to arrive at the ending cash balance.

B) False

Correct Answer

verified

Correct Answer

verified

Showing 81 - 100 of 138

Related Exams