A) $52,600

B) $40,400

C) $42,400

D) $64,800

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The T-account approach

A) may be used with the direct method.

B) creates one big T-account for cash that replaces separate schedules to show all the changes in the cash account.

C) shows cash provided as credits and cash used as debits.

D) does not determine the change in each balance sheet account.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following represent cash outflows from financing activities?

A) Distributing a stock dividend.

B) Paying a bond's face value at maturity.

C) Issuing long-term bonds at a discount.

D) Paying interest on promissory notes.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

Under the indirect method,changes in current assets are used in determining cash flows from operating activities and changes in current liabilities are used in determining cash flows from financing activities.Both changes in current assets and current liabilities are used in determining cash flows from operating activities.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When the direct method is used to determine the cash flows from operating activities,which of the following adjustments must be made to interest expense to determine total interest payments?

A) Add all changes in interest payable.

B) Add decreases in interest payable and subtract increases in interest payable.

C) Add increases in interest payable and subtract decreases in interest payable.

D) Subtract all changes in interest payable.

F) All of the above

Correct Answer

verified

Correct Answer

verified

True/False

Interest and dividends from investments held by a company are reported as cash inflows from investing activities on the statement of cash flows.Since interest and dividends from investments are reported as revenues on the income statement,they are reported as cash inflows from operating activities on the statement of cash flows.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Investing activities include receiving cash from selling land and any resulting gain or loss on the sale.Investing activities include cash received from selling land,but any gain or loss on the sale would be deducted from or added to net income in the operating section,if the indirect method is used.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A company reported that its bonds with a face value of $50,000 and a carrying value of $53,000 are retired for $56,000 cash.The amount to be reported under cash flows from financing activities is:

A) ($53,000) .

B) ($3,000) .

C) ($56,000) .

D) $0.This is an operating activity.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The purchase of $100,000 of equipment by issuing a note would be reported:

A) as a $100,000 investing inflow,and a $100,000 financing outflow.

B) as a $100,000 investing outflow,and a $100,000 financing inflow.

C) as a $100,000 operating inflow,and a $100,000 financing outflow.

D) in a supplementary schedule.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following would be classified as a financing activity on the statement of cash flows?

A) Cash receipts from accounts receivable collections.

B) Cash receipts from sale of equipment.

C) Cash paid to purchase treasury stock.

D) Cash receipts from short-term notes receivable.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is true?

A) The accumulated depreciation account includes cash flows that may be categorized as both operating and investing.

B) Inventory includes cash flows that may be categorized as both operating and investing.

C) Retained earnings includes cash flows that may be categorized as both operating and investing.

D) Bonds payable includes cash flows that may be categorized as both operating and financing.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following would be classified as an investing activity on the statement of cash flows?

A) Cash received from sale of land.

B) Cash paid for interest.

C) Cash received from stock issuance.

D) Dividends paiD.Investing activities include cash inflows and outflows from purchases and disposals of investments and long-lived assets.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

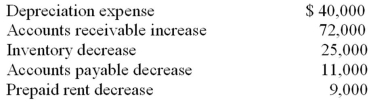

A company's income statement for the year shows a net loss of $90,000.Additional information for the year follows: What is the net cash provided by (used in) operating activities?

A) ($99,000)

B) $27,000

C) $13,000

D) ($45,000)

F) All of the above

Correct Answer

verified

Correct Answer

verified

True/False

Major investing and financing activities that do not involve cash do not have to be reported as part of the statement of cash flows.Significant investing and financing transactions that do not have cash flow effects must be reported in a supplementary schedule to the statement of cash flows.This schedule may be presented on the face of the statement or in the notes to the financial statements but this information is not part of the statement.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

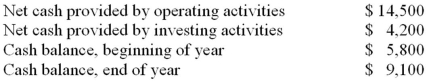

A corporation prepared its statement of cash flows for the year.The following information is taken from that statement: What is the amount of net cash provided by (used in) financing activities?

A) $15,400

B) ($3,300)

C) ($15,400)

D) $3,300

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is true?

A) The change in cash = the change in noncash assets.

B) The change in cash = the change in liabilities + the change in stockholders' equity.

C) The change in cash = the change in liabilities + the change in stockholders' equity - the change in noncash assets.

D) The change in cash = the change in liabilities + the change in stockholders' equity + the change in noncash assets.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements regarding cash flows from investing activities is true?

A) The proceeds from sales of investments are reported as cash inflows from investing activities.

B) Cash flows from investing activities are calculated by making adjustments to net income.

C) Cash paid to acquire long-lived assets is reported as a cash inflow from investing activities.

D) Cash received from issuing a long-term payable is reported as a cash inflow from investing activities.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A company purchases a $300,000 building,paying $200,000 in cash and signing a $100,000 promissory note.What will be reported on the statement of cash flows as a result of this transaction?

A) A $300,000 cash outflow from investing activities.

B) A $200,000 cash outflow from investing activities and a $100,000 cash inflow from financing activities.

C) A $200,000 cash outflow from investing activities and a $100,000 noncash transaction.

D) A $300,000 cash outflow from investing activities and a $100,000 cash inflow from financing activities.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Showing 121 - 138 of 138

Related Exams