B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Palmer Corp is considering the purchase of a new piece of equipment.The cost savings from the equipment would result in an annual increase in net income after tax of $100,000.The equipment will have an initial cost of $400,000 and have a 7 year life.If the salvage value of the equipment is estimated to be $75,000,what is the payback period?

A) 2.73 years

B) 4.00 years

C) 4.75 years

D) 7.00 years

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

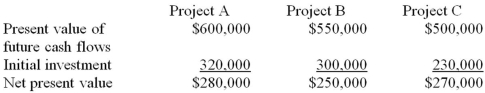

Boxwood,Inc.is considering three different independent investment opportunities.The present value of future cash flows,initial investment,and net present value for each of the projects are as follows: In what order should Boxwood prioritize investment in the projects?

A) A,B,C

B) C,B,A

C) A,C,B

D) C,A,B

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Newport Corp is considering the purchase of a new piece of equipment.The cost savings from the equipment would result in an annual increase in cash flow of $200,000.The equipment will have an initial cost of $900,000 and have a 6 year life.There is no salvage value for the equipment.What is the accounting rate of return? Ignore income taxes.

A) 5.56%

B) 16.67%

C) 22.22%

D) 44.44%

F) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

An annuity is a series of consecutive payments that are equal in dollar amount,have interest periods of equal length,and earn an equal interest rate each period.This is the definition of an annuity.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A positive net present value indicates that a project will

A) generate a return in excess of the firm's cost of capital.

B) generate more cash than is initially invested.

C) generate more cash than alternative projects.

D) generate a return in excess of alternative projects.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The total time to recover an original investment is the

A) net present value.

B) internal rate of return.

C) accounting rate of return.

D) payback perioD.The payback period is the amount of time needed for a capital investment to pay for itself.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Wilson Corp is considering the purchase of a new piece of equipment.The cost savings from the equipment would result in an annual increase in net income after tax of $50,000.The equipment will have an initial cost of $600,000 and have an 8 year life.The salvage value of the equipment is estimated to be $100,000.If the hurdle rate is 10%,what is the approximate net present value?

A) less than zero

B) $100,000

C) $500,000

D) $46,826

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Frank Inc.is trying to decide whether to lease or purchase a piece of equipment needed for the next ten years.The equipment would cost $45,000 to purchase,and maintenance costs would be $5,000 per year.After ten years,Frank estimates it could sell the equipment for $20,000.If Frank leased the equipment,it would pay a set annual fee that would include all maintenance costs.Frank has determined after a net present value analysis that at its hurdle rate of 10%,it would be better off by $5,700 if it buys the equipment.What would the approximate annual cost be if Frank were to lease the equipment?

A) $9,000

B) $7,000

C) $12,000

D) $13,250

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is not a characteristic of an annuity?

A) It is a series of equal payments.

B) It earns an equal interest rate each interest period.

C) Interest is compounded annually.

D) Interest periods are of equal length.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Belmont Corp is considering the purchase of a new piece of equipment.The cost savings from the equipment would result in an annual increase in net income after tax of $200,000.The equipment will have an initial cost of $1,000,000 and have an 8 year life.If there is no salvage value of the equipment,what is the payback period?

A) 1.6 years

B) 3.08 years

C) 5 years

D) 8 years

F) B) and D)

Correct Answer

verified

Correct Answer

verified

True/False

The internal rate of return method uses cash flows rather than net income.The internal rate of return is calculated using cash flows.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Your grandmother has told you she can either give you $4,000 now or $5,000 when you graduate from college in three years.Your savings account earns 7% interest,compounded annually.Which option would be worth more to you now,and how much more?

A) The $4,000 now is worth $81.50 more than the $5,000 in the future.

B) The $4,000 now is worth $100.00 more than the $5,000 in the future.

C) The $5,000 in the future is worth $81.50 more than the $4,000 now.

D) The $5,000 in the future is worth $100.00 more than the $4,000 now.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

You have a savings account that earns 5% interest,compounded annually.A friend has offered you an investment opportunity;he says that if you invest in his new business,he will pay you $10,000 a year for the next five years.What is the most you would be willing to invest in your friend's business?

A) $43,295

B) $47,500

C) $47,619

D) $50,000

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Foster Inc.is trying to decide whether to lease or purchase a piece of equipment needed for the next ten years.The equipment would cost $45,000 to purchase,and maintenance costs would be $5,000 per year.After ten years,Foster estimates it could sell the equipment for $20,000.If Foster leases the equipment,it would pay $12,000 each year,which would include all maintenance costs.If the hurdle rate for Foster is 10%,Foster should

A) lease the equipment,as net present value of cost is about $5,700 less.

B) buy the equipment,as net present value of cost is about $5,700 less.

C) lease the equipment,as net present value of cost is about $2,000 less.

D) buy the equipment,as net present value of cost is about $45,000 less.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Nelson Corp is considering the purchase of a new piece of equipment.The cost savings from the equipment would result in an annual increase in cash flow of $100,000.The equipment will have an initial cost of $400,000 and have a 5 year life.If the salvage value of the equipment is estimated to be $75,000,what is the payback period? Ignore income taxes.

A) 3.25 years

B) 4.00 years

C) 4.75 years

D) 7.00 years

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Grace Corp,whose required rate of return is10%,is considering the purchase of a new piece of equipment.The internal rate of return of the project,which has a life of 8 years,is 12%.The project would have

A) an accounting rate of return greater than 10%.

B) a payback period more than 8 years.

C) a net present value of zero.

D) a net present value greater than zero.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Newport Corp is considering the purchase of a new piece of equipment.The cost savings from the equipment would result in an annual increase in cash flow of $200,000.The equipment will have an initial cost of $900,000 and have a 6 year life.There is no salvage value for the equipment.If the hurdle rate is 10%,what is the approximate net present value? Ignore income taxes.

A) negative $28,940

B) positive $28,940

C) zero

D) positive $300,000

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Byron Corp is considering the purchase of a new piece of equipment.The cost savings from the equipment would result in an annual increase in cash flow of $100,000.The equipment will have an initial cost of $400,000 and have a 5 year life.The salvage value of the equipment is estimated to be $75,000.If the hurdle rate is 10%,what is the approximate net present value? Ignore income taxes.

A) $25,648

B) $100,000

C) $175,000

D) ($20,291)

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When making screening decisions using the net present value method,a project is acceptable if

A) the NPV is greater than the hurdle rate.

B) the NPV is greater than the IRR.

C) the NPV is positive.

D) the NPV is negative.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Showing 41 - 60 of 100

Related Exams