B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

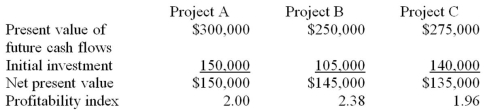

Carmen,Inc.is considering three different independent investment opportunities.The present value of future cash flows,initial investment,net present value,and profitability index for each of the projects are as follows: In what order should Carmen prioritize investment in the projects?

A) A,C,B

B) B,C,A

C) A,B,C

D) B,A,C

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If cash flows are not equal each year,the payback period

A) cannot be calculated.

B) is calculated by dividing the initial investment by the average cash flows.

C) is calculated by subtracting each year's cash flows from the initial investment until zero is reached.

D) is calculated by dividing the total years in the project by two.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Palmer Corp is considering the purchase of a new piece of equipment.The cost savings from the equipment would result in an annual increase in net income after tax of $100,000.The equipment will have an initial cost of $400,000 and have a 7 year life.If the salvage value of the equipment is estimated to be $75,000,what is the accounting rate of return?

A) 14.28%

B) 25.00%

C) 42.11%

D) 147.37%

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

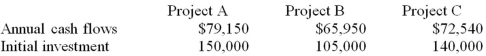

Iron,Inc. ,which has a hurdle rate of 10%,is considering three different independent investment opportunities.Each project has a five-year life.The annual cash flows and initial investment for each of the projects are as follows: In what order should Iron prioritize investment in the projects?

A) A,C,B

B) B,C,A

C) A,B,C

D) B,A,C

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

The net present value method compares a project's future net income to the initial investment.The net present value method compares the present value of a project's future cash flows to the initial investment.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

You are saving for a car that costs $28,000 that you hope to purchase in five years.How much will you need to deposit today in a savings account that earns 8%,compounded annually,to withdraw enough for the purchase?

A) $16,800

B) $19,057

C) $25,760

D) $41,140

F) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

An example of a future value of a single amount problem would be finding how much the right to receive a certain amount in the future would be worth today.The future value of a single amount is how much money you will have in the future as a result of investing a certain amount in the present.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Newport Corp is considering the purchase of a new piece of equipment.The cost savings from the equipment would result in an annual increase in cash flow of $200,000.The equipment will have an initial cost of $900,000 and have a 6 year life.There is no salvage value for the equipment.If the hurdle rate is 8%,what is the approximate net present value? Ignore income taxes.

A) $924,580

B) $24,580

C) $900,000

D) $300,000

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

When deciding between mutually exclusive investments,a manager should choose the option with the lowest depreciation.When deciding between mutually exclusive investments,a manager should choose the option with the lowest cost on a net present value basis.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

If a project has a positive net present value,it means the project is expected to provide returns that are greater than the cost of capital.If a project has a positive net present value,it means that the project is expected to provide returns that are greater than the cost of capital,creating economic value or wealth for the company and its shareholders.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

You invest $13,420 in an annuity contract that earns 8% interest,compounded annually.You are to receive annual payments for the next ten years.How much will each of the payments be?

A) $1,342

B) $1,449

C) $1,459

D) $2,000

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The minimum required rate of return for a project is the

A) Annual rate of return.

B) Accounting rate of return.

C) Hurdle rate.

D) Internal rate of return.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

You will need at least $5,000 in four years and your friend says she can either loan you $5,000 all at once four years from now or she can deposit $1,200 in your savings account at the end of each year for the next four years.Your savings account earns 7% interest,compounded annually.Which option would be worth more to you four years from now,and how much more?

A) The $5,000 in four years will be worth $328 more than the annual deposits.

B) The annual deposits will be worth $328 more than the $5,000 in four years.

C) The $5,000 in four years will be worth $136 more than the annual deposits.

D) The annual deposits will be worth $136 more than the $5,000 in four years.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Belmont Corp is considering the purchase of a new piece of equipment.The cost savings from the equipment would result in an annual increase in net income after tax of $200,000.The equipment will have an initial cost of $1,000,000 and have an 8 year life.If there is no salvage value of the equipment,what is the accounting rate of return?

A) 12.5%

B) 20%

C) 40%

D) 15%

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following would be included in net income but not in annual cash flows?

A) Sales revenue

B) Depreciation

C) Initial investment

D) Direct labor

F) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

Sensitivity analysis helps determine whether changing the underlying assumptions would affect the decision.This is the purpose of sensitivity analysis.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

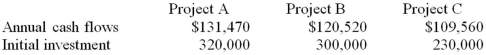

Ironwood,Inc. ,which has a hurdle rate of 12%,is considering three different independent investment opportunities.Each project has a seven-year life.The annual cash flows and initial investment for each of the projects are as follows: In what order should Ironwood prioritize investment in the projects?

A) A,B,C

B) C,B,A

C) A,C,B

D) C,A,B

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Projects that are unrelated to one another,so that investing in one project does not preclude or affect the choice about investing in the other alternatives,are

A) Mutually exclusive projects.

B) Screening projects.

C) Independent projects.

D) Preference projects.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

How much would you need to deposit now in a savings account that earns 5% interest,compounded annually,in order to withdraw $5,000 at the end of every year for ten years?

A) $38,609

B) $47,500

C) $47,619

D) $50,000

F) None of the above

Correct Answer

verified

Correct Answer

verified

Showing 61 - 80 of 100

Related Exams