A) 5.51 years

B) 5.97 years

C) 6.00 years

D) 6.18 years

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Cortland Corp is considering the purchase of a new piece of equipment.The cost savings from the equipment would result in an annual increase in net cash flows of $100,000.The equipment will have an initial cost of $400,000 and have a 5 year life.If the salvage value of the equipment is estimated to be $75,000,what is the annual net income? Ignore income taxes.

A) $25,000

B) $35,000

C) $165,000

D) $175,000

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

You have $10,000 that you can invest in a savings account that earns 7% interest,compounded annually.If you want to withdraw at least $18,000 at some point in the future,how long will you need to keep the money invested?

A) 9 years

B) 10 years

C) 11 years

D) 12 years

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A problem in which you must calculate how much money you will have in the future as a result of investing a certain amount in the present is a

A) future value of a single amount problem.

B) present value of a single amount problem.

C) future value of an annuity problem.

D) present value of an annuity problem.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When cash flows are equal each year,the payback period is calculated as:

A) Initial investment × Annual net cash flow

B) Initial investment/Annual net cash flow

C) Annual net cash flow/Initial investment

D) Annual net cash flow - Initial investment/Project life

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The value now of a cash flow to be received in the future is called

A) present value.

B) cash value.

C) future value.

D) accounting value.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following methods is calculated as annual net income as a percentage of the original investment in assets?

A) Accounting rate of return

B) Payback period

C) Net present value

D) Internal rate of return

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

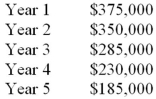

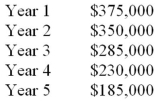

Wright Corp is considering the purchase of a new piece of equipment,which would have an initial cost of $1,000,000 and a 5 year life.There is no salvage value for the equipment.The increase in net income each year of the equipment's life would be as follows: What is the payback period?

A) 1.77 years

B) 2.06 years

C) 2.96 years

D) 3.51 years

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Lawrence Corp is considering the purchase of a new piece of equipment.When discounted at a hurdle rate of 8%,the project has a net present value of $24,580.When discounted at a hurdle rate of 10%,the project has a net present value of ($28,940) .The internal rate of return of the project is

A) zero.

B) between zero and 8%.

C) between 8% and 10%.

D) greater than 10%.

F) All of the above

Correct Answer

verified

Correct Answer

verified

True/False

A profitability index greater than zero means that a project has a positive NPV.A profitability index greater than one means that a project has a positive NPV.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Wright Corp is considering the purchase of a new piece of equipment,which would have an initial cost of $1,000,000 and a 5 year life.There is no salvage value for the equipment.The increase in cash flow each year of the equipment's life would be as follows: What is the payback period?

A) 2.39 years

B) 2.96 years

C) 3.00 years

D) 3.51 years

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is the formula for accounting rate of return?

A) Initial investment/net income

B) Annual net cash flow/Initial investment

C) Initial investment/Annual net cash flow

D) Net income/Initial investment

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Nelson Corp is considering the purchase of a new piece of equipment.The cost savings from the equipment would result in an annual increase in cash flow of $100,000.The equipment will have an initial cost of $400,000 and have a 5 year life.If the salvage value of the equipment is estimated to be $75,000,what is the accounting rate of return? Ignore income taxes.

A) 6.25%

B) 8.75%

C) 25.00%

D) 26.67%

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The discount rate that would return a net present value equal to zero is the

A) Annual rate of return.

B) Accounting rate of return.

C) Hurdle rate.

D) Internal rate of return.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Newport Corp is considering the purchase of a new piece of equipment.The cost savings from the equipment would result in an annual increase in cash flow of $200,000.The equipment will have an initial cost of $900,000 and have a 6 year life.There is no salvage value for the equipment.If the hurdle rate is 10%,what is the internal rate of return? Ignore income taxes.

A) between 6% and 8%

B) between 8% and 10%

C) between 10% and 12%

D) less than zero

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A problem in which you must calculate the value now of a series of equal amounts to be received for some specified number of periods in the future is a

A) future value of a single amount problem.

B) present value of a single amount problem.

C) future value of an annuity problem.

D) present value of an annuity problem.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When a project has a positive net present value,it has a profitability index

A) greater than zero.

B) less than zero.

C) greater than one.

D) less than one.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

How much would you need to deposit in a savings account that earns 7%,compounded annually,to withdraw $20,000 eight years from now?

A) $11,640

B) $18,600

C) $18,692

D) $34,364

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Devon Corp is trying to decide whether to lease or purchase a piece of equipment.The total cost lease the equipment will be $150,000 over its estimated life,while the total cost to buy the equipment will be $120,000 over its estimated life.At Devon's required rate of return,the net present value of the cost of leasing the equipment is $108,000 and the net present value of the cost of buying the equipment is $119,000.Based on financial factors,Devon should

A) lease the equipment,saving $30,000 over buying.

B) buy the equipment,saving $30,000 over leasing.

C) lease the equipment,saving $11,000 over buying.

D) buy the equipment,saving $11,000 over leasing.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

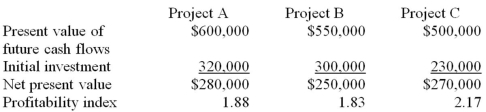

Norwood,Inc.is considering three different independent investment opportunities.The present value of future cash flows,initial investment,net present value,and profitability index for each of the projects are as follows: In what order should Norwood prioritize investment in the projects?

A) A,B,C

B) C,B,A

C) A,C,B

D) C,A,B

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Showing 81 - 100 of 100

Related Exams