B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A relevant cost is

A) the foregone benefit of choosing to do one thing instead of another.

B) a cost that differs across decision alternatives.

C) a cost that has already been incurred.

D) a cost that is the same regardless of the alternative the manager chooses.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

An opportunity cost is the foregone benefit of choosing to do one thing instead of another.This is the definition of opportunity cost.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

If a company has idle capacity,it means it has reached the limit on its resources.If a company has idle capacity,it means it has not yet reached the limit on its resources.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

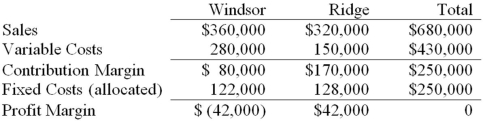

Power Inc.has two divisions,Windsor and Ridge.Following is the income statement for the past month: What would Power's profit margin be if the Windsor division was dropped and all fixed costs are unavoidable?

A) $0

B) $80,000 loss

C) $42,00 profit

D) $80,000 profit

F) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

In deciding whether to eliminate a business segment,managers should consider which costs and benefits will change as a result of the decision.Costs and benefits that will not change will not be relevant to the decision.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

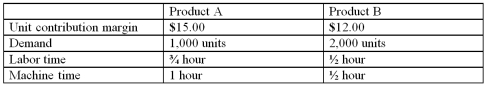

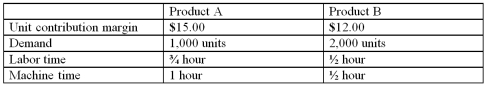

Underwood,Inc.manufactures two products.It currently has 2,000 hours of direct labor and 1,000 hours of machine time available per month.The table below lists the contribution margin,labor and machine time requirements,and demand for each product.What is the contribution margin per machine hour for Product A?

A) $12.00

B) $15.00

C) $20.00

D) $24.00

F) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Another term for relevant cost is opportunity cost.Other terms for relevant costs include differential costs,incremental costs,and avoidable costs.Opportunity costs can be relevant,but the two are not synonymous.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Underwood,Inc.manufactures two products.It currently has 2,000 hours of direct labor and 1,000 hours of machine time available per month.The table below lists the contribution margin,labor and machine time requirements,and demand for each product.What is the contribution margin per machine hour for Product B?

A) $6.00

B) $12.00

C) $15.00

D) $24.00

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The law firm of Regal and Porter is examining its client base to determine how profitable its regular clients are.Its analysis indicates that Hawthorne,Inc.paid $179,200 in fees last year,but cost the firm $208,600 ($168,000 in billable labor,supplies,and copying,and $40,600 in allocated common fixed costs) .If Regal and Porter dropped Hawthorne,Inc.as a client,and all fixed costs are unavoidable,how would profit be affected?

A) $0

B) Increase $29,400

C) Decrease $11,200

D) Decrease $179,200

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

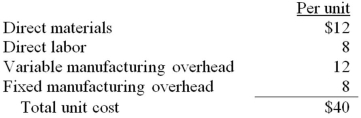

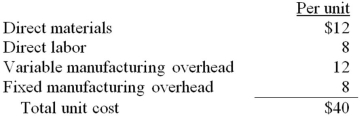

Olive Corp currently makes 20,000 subcomponents a year in one of its factories.The unit costs to produce are: An outside supplier has offered to provide Olive Corp with the 20,000 subcomponents at a $36 per unit price.Fixed overhead is not avoidable.If Olive Corp rejects the outside offer,what will be the effect on short-term profits?

A) $80,000 increase

B) no change

C) $160,000 decrease

D) $80,000 decrease

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Olive Corp currently makes 20,000 subcomponents a year in one of its factories.The unit costs to produce are: An outside supplier has offered to provide Olive Corp with the 20,000 subcomponents at a $36 per unit price.Fixed overhead is not avoidable.If Olive Corp accepts the outside offer,what will be the effect on short-term profits?

A) $160,000 decrease

B) $320,000 increase

C) $160,000 increase

D) $80,000 decrease

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is false?

A) Sunk costs are never relevant.

B) Sunk costs are costs that occurred in the past.

C) To be relevant,a cost must be an opportunity cost.

D) To be relevant,a cost must occur in the future.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

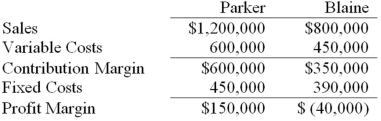

Hamilton,Inc.has two divisions,Parker and Blaine.Following is the income statement for the previous year: Of the total fixed costs,$600,000 are common fixed costs that are allocated equally between the divisions.What would Hamilton's profit margin be if Blaine were dropped?

A) $(240,000)

B) $(150,000)

C) $110,000

D) $150,000

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

It costs Elmwood,Inc.$78 per unit to manufacture 1,000 units per month of a product that it can sell for $90 each.Alternatively,Elmwood could sell the units at an earlier stage of processing,which would save $36 per unit.Elmwood could sell the simpler product for $60 each.How would selling the simpler product affect Elmwood's profit?

A) Profit would increase by $6,000.

B) Profit would increase by $30,000.

C) Profit would decrease by $6,000.

D) Profit would decrease by $30,000.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

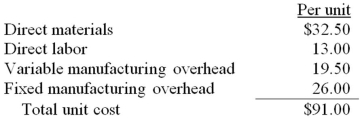

Cotton Corp currently makes 10,000 subcomponents a year in one of its factories.The unit costs to produce are: An outside supplier has offered to provide Cotton Corp with the 10,000 subcomponents at a $84.50 per unit price.Fixed overhead is not avoidable.What is the maximum price Cotton Corp should pay the outside supplier?

A) $65.00

B) $84.50

C) $91.00

D) $58.50

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Spencer Inc.manufactures a product that costs $36 per unit plus $32,000 in fixed costs each month.Spencer currently sells 1,000 of these units per month for $80 each.If Spencer leased a machine for $8,000 a month,it could add features to the product that would allow it to sell for $120 each.It would cost an additional $12 per unit to add these features.How much would Spencer's profit be affected if it leased the machine and added features to its product?

A) Increase $32,000

B) Decrease $32,000

C) Increase $20,000

D) Decrease $20,000

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

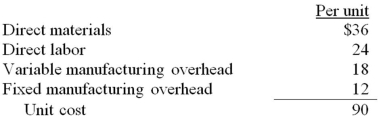

Almond has received a special order for 6,000 units of its product at a special price of $90.The product normally sells for $120 and has the following manufacturing costs: Assume that Almond has sufficient capacity to fill the order.If Almond accepts the order,what effect will the order have on the company's short-term profit?

A) $72,000 increase

B) $180,000 increase

C) $252,000 decrease

D) zero

F) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

The segment margin is the contribution margin of a particular segment.The segment margin is sales revenue less all costs that are directly attributable to the segment,including variable costs and direct fixed costs.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

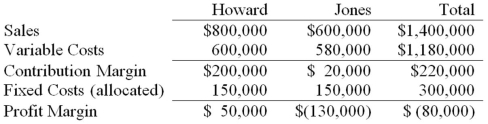

Davenport Inc.has two divisions,Howard and Jones.Following is the income statement for the past month: What would Davenport's profit margin be if the Jones division was dropped?

A) $80,000 loss

B) $100,000 loss

C) $50,000 profit

D) $70,000 profit

F) None of the above

Correct Answer

verified

Correct Answer

verified

Showing 21 - 40 of 91

Related Exams