A) Decrease $25,000

B) Decrease $5,000

C) Increase $20,000

D) Increase $75,000

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The accounting firm of Pie and Lowell is examining its client base to determine how profitable its regular clients are.Its analysis indicates that Chico,Inc.paid $116,000 in fees last year,but cost the firm $124,000 ($106,000 in billable labor,supplies,and copying,and $18,000 in allocated common fixed costs) .If Pie and Lowell dropped Chico,Inc.as a client,and all fixed costs are unavoidable,how would profit be affected?

A) $0

B) Increase $8,000

C) Decrease $10,000

D) Decrease $116,000

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When a firm has limited direct labor hours,it should prioritize the product with

A) the highest selling price per unit.

B) the highest contribution margin per unit.

C) the highest contribution margin per direct labor hour.

D) the lowest direct labor hours per unit.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

A special-order decision analysis cannot be used if the firm is operating at full capacity.If the firm is operating at full capacity,the analysis must consider opportunity costs,but it can still be performed.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

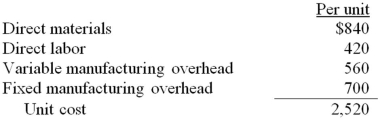

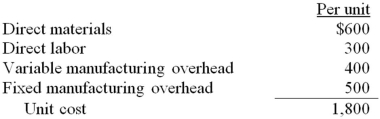

Cranberry has received a special order for 100 units of its product at a special price of $2,100.The product normally sells for $2,800 and has the following manufacturing costs: Assume that Cranberry has sufficient capacity to fill the order without harming normal production and sales.If Cranberry accepts the order,what effect will the order have on the company's short-term profit?

A) $42,000 decrease

B) $42,000 increase

C) $70,000 decrease

D) $28,000 increase

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is not a step in the managerial decision-making process?

A) Identify the decision problem

B) Review the results of the decision-making process

C) Determine the decision alternatives

D) Forecast the potential sales

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

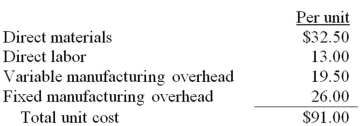

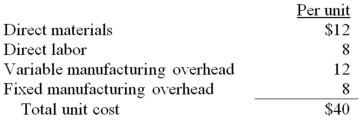

Cotton Corp currently makes 10,000 subcomponents a year in one of its factories.The unit costs to produce are: An outside supplier has offered to provide Cotton Corp with the 10,000 subcomponents at a $84.50 per unit price.Fixed overhead is not avoidable.If Cotton Corp accepts the outside offer,what will be the effect on short-term profits?

A) $260,000 increase

B) $195,000 decrease

C) no change

D) $65,000 increase

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

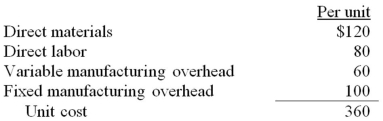

Avocado has received a special order for 2,000 units of its product at a special price.The product normally sells for $400 and has the following manufacturing costs: Assume that Avocado has sufficient capacity to fill the order.What special order price should Avocado charge to make a $20,000 incremental profit?

A) $400

B) $360

C) $270

D) $260

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

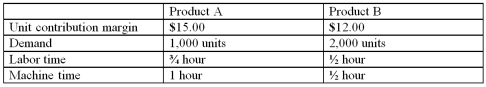

Underwood,Inc.manufactures two products.It currently has 2,000 hours of direct labor and 1,000 hours of machine time available per month.The table below lists the contribution margin,labor and machine time requirements,and demand for each product.What is the total contribution margin if Underwood,Inc.prioritizes production according to its limited resources?

A) $39,000

B) $15,000

C) $24,000

D) $19,500

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

It costs Camp,Inc.$35 per unit to manufacture 1,000 units per month of a product that it can sell for $50 each.Alternatively,Camp could process the units further into a more complex product,which would cost an additional $30 per unit.Camp could sell the more complex product for $75 each.How would processing the product further affect Camp's profit?

A) Profit would increase by $5,000.

B) Profit would increase by $25,000.

C) Profit would decrease by $5,000.

D) Profit would decrease by $25,000.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

The final step in the decision making process is to make the decision.The final step in the decision making process is to review the results of the decision-making process.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A ______________ is one that can be attributed to a specific segment of the business.

A) common fixed cost

B) direct fixed cost

C) variable fixed cost

D) fixed variable cost

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is irrelevant to the decision to eliminate an unprofitable segment?

A) The segment margin.

B) Direct fixed costs.

C) Common fixed costs.

D) Segment revenue.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Violet has received a special order for 100 units of its product.The product normally sells for $2,000 and has the following manufacturing costs: Assume that Violet has sufficient capacity to fill the order without harming normal production and sales.What minimum price should Violet charge to achieve a $25,000 incremental profit?

A) $1,300

B) $1,550

C) $1,680

D) $1,800

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

It costs Glenwood,Inc.$70 per unit to manufacture 1,000 units per month of a product that it can sell for $100 each.Alternatively,Glenwood could process the units further into a more complex product,which would cost an additional $40 per unit.Glenwood could sell the more complex product for $145 each.How would processing the product further affect Glenwood's profit?

A) Profit would increase by $5,000.

B) Profit would increase by $45,000.

C) Profit would decrease by $5,000.

D) Profit would decrease by $45,000.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Olive Corp currently makes 20,000 subcomponents a year in one of its factories.The unit costs to produce are: An outside supplier has offered to provide Olive Corp with the 20,000 subcomponents at a $36 per unit price.Fixed overhead is not avoidable.What is the maximum price Olive Corp should pay the outside supplier?

A) $32

B) $36

C) $40

D) $44

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Maple Inc.manufactures a product that costs $45 per unit plus $50,000 in fixed costs each month.Maple currently sells 5,000 of these units per month for $60 each.If Maple leased a machine for $30,000 a month,it could add features to the product that would allow it to sell for $75 each.It would cost an additional $10 per unit to add these features.How much would Maple's profit be affected if it leased the machine and added features to its product?

A) Increase $5,000

B) Decrease $5,000

C) Increase $295,000

D) Decrease $295,000

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

If machine hours are a constraining factor,the product with the highest contribution margin per machine hour should be prioritized in production.Managers should maximize the contribution margin earned per amount of constrained resource.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following types of decisions involves deciding whether to eliminate a particular division or segment of the business?

A) Special-order

B) Make-or-buy

C) Continue-or-discontinue

D) Sell-or-process further

F) B) and D)

Correct Answer

verified

Correct Answer

verified

True/False

A special-order decision analysis cannot be used to make long-term pricing decisions.Prices must cover all costs if the company is to be profitable in the long run,and all costs are not considered in a special-order decision analysis.

B) False

Correct Answer

verified

Correct Answer

verified

Showing 41 - 60 of 91

Related Exams