A) $99,625 profit

B) $91,000 profit

C) $384,000 profit

D) $71,000 loss

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Spencer Inc.manufactures a product that costs $36 per unit plus $32,000 in fixed costs each month.Spencer currently sells 1,000 of these units per month for $80 each.If Spencer leased a machine for $8,000 a month,it could add features to the product that would allow it to sell for $120 each.It would cost an additional $12 per unit to add these features.How much would Spencer have to charge for the product with additional features to make it worthwhile to lease the machine?

A) $48

B) $76

C) $88

D) $100

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

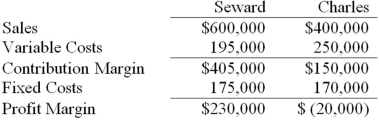

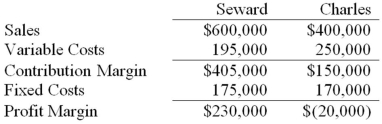

Franklin,Inc.has two divisions,Seward and Charles.Following is the income statement for the previous year: Of the total fixed costs,$300,000 are common fixed costs that are allocated equally between the divisions.How much did the Charles division incur in direct fixed costs?

A) $20,000

B) $150,000

C) $170,000

D) $300,000

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is not a step in the managerial decision-making process?

A) Identify the decision problem

B) Calculate the payback period

C) Determine the decision alternatives

D) Evaluate the costs and benefits of the alternatives

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is not a step in the managerial decision-making process?

A) Identify the activity cost drivers.

B) Review the results of the decision-making process.

C) Determine the alternatives.

D) Evaluate the costs and benefits of the alternatives.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

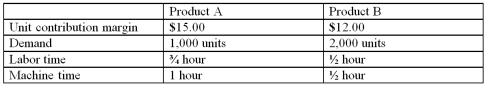

Underwood,Inc.manufactures two products.It currently has 2,000 hours of direct labor and 1,000 hours of machine time available per month.The table below lists the contribution margin,labor and machine time requirements,and demand for each product.How much of each product should Underwood manufacture per month?

A) 1,000 units of A and 2,000 units of B

B) 1,000 units of A and 0 units of B

C) 0 units of A and 2,000 units of B

D) 500 units of A and 1,000 units of B

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

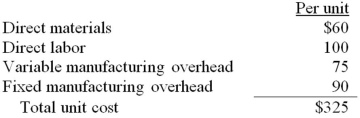

Clifford,Inc.currently manufactures 2,000 subcomponents in one of its factories.The unit costs to produce the subcomponents are: The unit costs to produce are:

Due to a labor strike,Clifford is considering purchasing the subcomponents from an outside supplier for $250 per unit rather than paying the 10% increase in direct labor costs demanded by the union.Fixed overhead is not avoidable.If Clifford purchases the subcomponent from the outside supplier,how much will profit differ from what it would be if it manufactured the subcomponents with the increase in direct labor cost?

A) $30,000 less

B) $20,000 less

C) $10,000 less

D) $20,000 more

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Costs that change across decision alternatives are

A) accounting costs.

B) activity-based costs.

C) differential costs.

D) capital costs.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following steps in the managerial decision-making process involves differential analysis?

A) Identify the decision problem

B) Determine the decision alternatives

C) Evaluate the costs and benefits of the alternatives

D) Make the decision

F) C) and D)

Correct Answer

verified

Correct Answer

verified

True/False

An avoidable cost is one that has already been spent.An avoidable cost is one a manager can avoid by choosing one alternative instead of another.A sunk cost is one that has already been spent.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

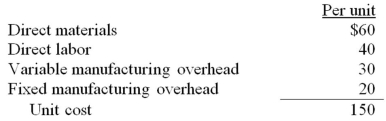

Walnut has received a special order for 2,000 units of its product at a special price of $270.The product normally sells for $360 and has the following manufacturing costs: Walnut is currently operating at full capacity and cannot fill the order without harming normal production and sales.If Walnut accepts the order,what effect will the order have on the company's short-term profit?

A) $108,000 decrease

B) $108,000 increase

C) $180,000 decrease

D) zero

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

Capacity is a measure of the limit placed on specific resources.This is the definition of capacity.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

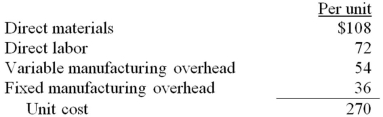

Crystal has received a special order for 2,000 units of its product.The product normally sells for $200 and has the following manufacturing costs: Crystal is currently operating at full capacity and cannot fill the order without harming normal production and sales.What minimum price should Crystal charge to earn an incremental profit of $50,000?

A) $175

B) $200

C) $225

D) $155

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following costs is not relevant in a special-order decision?

A) Direct labor

B) Direct materials

C) Variable overhead

D) Fixed overhead

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Franklin,Inc.has two divisions,Seward and Charles.Following is the income statement for the previous year: Of the total fixed costs,$300,000 are common fixed costs that are allocated equally between the divisions.What is Seward's segment margin?

A) $230,000

B) $380,000

C) $405,000

D) $600,000

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is not a step in the managerial decision-making process?

A) Identify the decision problem

B) Review the results of the decision-making process

C) Choose the appropriate hurdle rate

D) Evaluate the costs and benefits of the alternatives

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

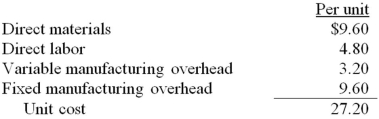

Potter has received a special order for 10,000 units of its product at a special price of $24.The product normally sells for $32 and has the following manufacturing costs: Potter is currently operating at full capacity and cannot fill the order without harming normal production and sales.If Potter accepts the order,what effect will the order have on the company's short-term profit?

A) $64,000 decrease

B) $64,000 increase

C) $80,000 decrease

D) $16,000 increase

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

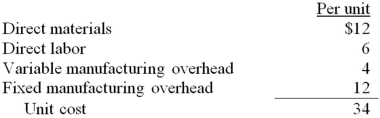

Ross has received a special order for 10,000 units of its product at a special price of $30.The product normally sells for $40 and has the following manufacturing costs: Assume that Ross has sufficient capacity to fill the order.If Ross accepts the order,what effect will the order have on the company's short-term profit?

A) $40,000 decrease

B) $180,000 increase

C) $60,000 decrease

D) $80,000 increase

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The manager of Hampton,Inc.is trying to decide whether to make or buy a component of the product it sells.Which of the following costs and benefits is not relevant to the decision?

A) Direct labor cost involved in making the component

B) The purchase price of the component if it is bought

C) Variable manufacturing overhead involved in making the component

D) The selling price of the product

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following types of decisions involves deciding whether to sell a product as is or continue to refine it so that it can be sold at a higher price?

A) Special-order

B) Make-or-buy

C) Continue-or-discontinue

D) Sell-or-process further

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Showing 61 - 80 of 91

Related Exams