Filters

Question type

A) $500 loss

B) $79,000 loss

C) $33,500 profit

D) $213,000 profit

E) None of the above

F) A) and B)

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Question 52

Multiple Choice

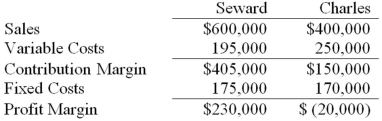

Franklin,Inc.has two divisions,Seward and Charles.Following is the income statement for the previous year: Of the total fixed costs,$300,000 are common fixed costs that are allocated equally between the divisions.What would Franklin's profit margin be if Charles were dropped?

A) $60,000

B) $80,000

C) $100,000

D) $230,000

E) All of the above

F) None of the above

F) None of the above

Correct Answer

verified

Correct Answer

verified

Question 53

Multiple Choice

It costs Hickory,Inc.$220 per unit to manufacture 1,000 units per month of a product that it can sell for $290 each.Alternatively,Hickory could sell the units at an earlier stage of processing,which would save $80 per unit.Hickory could sell the simpler product for $200 each.How would selling the simpler product affect Hickory's profit?

A) Profit would increase by $10,000.

B) Profit would increase by $50,000.

C) Profit would decrease by $10,000.

D) Profit would decrease by $50,000.

E) A) and B)

F) B) and C)

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Question 54

True/False

A sunk cost is never a relevant cost.Sunk costs cannot change depending on the alternative,so they are never relevant.

A) True

B) False

B) False

Correct Answer

verified

Correct Answer

verified

Question 55

True/False

When managers make a decision,they base it strictly on the numerical analysis performed in step three of the decision making process.Managers base decisions on the numerical analysis and a variety of other factors.

A) True

B) False

B) False

Correct Answer

verified

Correct Answer

verified

Question 56

Multiple Choice

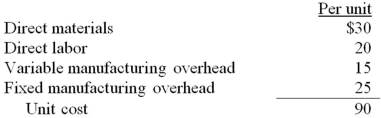

Pinto Co.has received a special order for 2,000 units of its product at a special price of $75.The product normally sells for $100 and has the following manufacturing costs: Assume that Pinto Co.has sufficient capacity to fill the order without harming normal production and sales.If Pinto Co.accepts the order,what effect will the order have on the company's short-term profit?

A) $30,000 decrease

B) $30,000 increase

C) $50,000 decrease

D) $20,000 increase

E) A) and B)

F) A) and D)

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Question 57

True/False

The first step in the managerial decision making process is to identify the decision problem.The first step in the managerial decision making process is to identify the decision problem.

A) True

B) False

B) False

Correct Answer

verified

Correct Answer

verified

Question 58

True/False

Opportunity costs are important in special-order and make-or-buy decisions,but not in keep-or-drop decisions.Any time business managers must choose one alternative over another,they will face opportunity costs.

A) True

B) False

B) False

Correct Answer

verified

Correct Answer

verified

Question 59

True/False

The quality of the goods in question is irrelevant to a make-or-buy decision.The quality of the goods in question is a qualitative factor that should be considered in a make-or-buy decision.

A) True

B) False

B) False

Correct Answer

verified

Correct Answer

verified

Question 60

Multiple Choice

Maple Inc.manufactures a product that costs $45 per unit plus $50,000 in fixed costs each month.Maple currently sells 5,000 of these units per month for $60 each.If Maple leased a machine for $30,000 a month,it could add features to the product that would allow it to increase the selling price.It would cost an additional $10 per unit to add these features.How much would Maple have to charge for the product with additional features to make it worthwhile to lease the machine?

A) $55

B) $60

C) $71

D) $76

E) None of the above

F) B) and D)

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Question 61

True/False

Opportunity costs are not relevant when a company has idle capacity.If a company has idle capacity,it does not have to give up the opportunity to do something else.

A) True

B) False

B) False

Correct Answer

verified

Correct Answer

verified

Showing 81 - 91 of 91

Related Exams