A) $100,800

B) $115,200

C) $129,600

D) It cannot be determined from the information given.

F) A) and D)

Correct Answer

verified

C

Correct Answer

verified

Multiple Choice

Rose Corp.has contribution margin of $65,000,variable costs of $10 per unit,and fixed costs of $25,000.If Rose sells 13,000 units,what was the selling price per unit?

A) $5.00

B) $12.50

C) $15.00

D) $17.08

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Gardenia Corp.has a selling price of $15,fixed costs of $25,000,and contribution margin of $65,000.If Gardenia sells 13,000 units,how much are variable costs per unit?

A) $2.00

B) $5.00

C) $7.00

D) $10.00

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Palm,which uses the high-low method,had an average cost per unit of $50 at its lowest level of activity when sales equaled 1,000 units and an average cost per unit of $32.50 at its highest level of activity when sales equaled 2,000 units.Palm would estimate fixed costs as

A) $30.00.

B) $82.50.

C) $17,500.

D) $35,000.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Booble,Inc.has a contribution margin ratio of 45%.This month,sales revenue was $200,000,and profit was $40,000.How much are Booble's fixed costs?

A) $18,000

B) $45,000

C) $50,000

D) $90,000

F) B) and C)

Correct Answer

verified

C

Correct Answer

verified

Multiple Choice

Rodeo,Inc.has a contribution margin ratio of 45%.This month,profit was $40,000 and fixed costs were $50,000.How much was Rodeo's sales revenue?

A) $40,500

B) $90,000

C) $111,111

D) $200,000

F) A) and B)

Correct Answer

verified

D

Correct Answer

verified

Multiple Choice

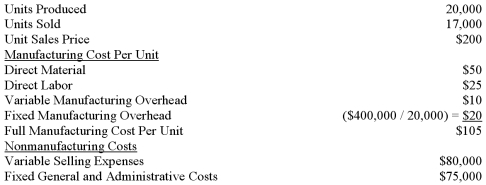

Jasper Enterprises had the following cost and production information for April: How much greater will Jasper Enterprises' income be under absorption costing than under variable costing?

A) $60,000

B) $315,000

C) $340,000

D) $400,000

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Sugar Corp has a selling price of $20,variable costs of $12 per unit,and fixed costs of $25,000.Maple expects profit of $300,000 at its anticipated level of production.If Sugar sells 5,000 units more than expected,how much higher will its profits be?

A) $40,000

B) $100,000

C) $60,000

D) $300,000

F) B) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Contribution margin plus variable cost per unit equals total sales revenue.Contribution margin plus total variable costs equals total sales revenue.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The slope of the cost line on a scattergraph represents

A) fixed cost per unit.

B) total fixed cost.

C) variable cost per unit.

D) sales price per unit.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Carson,which uses the high-low method,reported total costs of $24 per unit at its lowest activity level,when production equaled 10,000 units.When production doubled,at its highest activity level,the total cost per unit dropped to $15.Carson would estimate variable cost per unit as

A) $9.

B) $6.

C) negative $9.

D) negative $0.0009.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

McNeil uses the high-low method of estimating costs.McNeil had total costs of $50,000 at its lowest level of activity,when 5,000 units were sold.When,at its highest level of activity,sales equaled 12,000 units,total costs were $78,000.What would McNeil estimate its total cost to be if sales equaled 8,000 units?

A) $32,000

B) $52,000

C) $62,000

D) $80,000

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

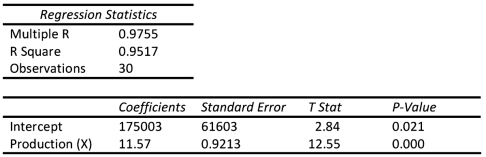

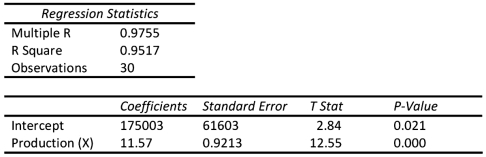

Star,Inc.used Excel to run a least-squares regression analysis,which resulted in the following output: How much of the variation in cost is not explained by production?

A) It is impossible to determine.

B) 4.83%

C) 95.17%

D) 97.55%

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is true?

A) Fixed costs are constant on a per unit basis.

B) Variable costs per unit decrease as activity volume increases.

C) Variable costs are constant in total dollars.

D) Fixed costs are constant in total dollars.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Ajax uses the high-low method of estimating costs.Ajax had total costs of $50,000 at its lowest level of activity,when 5,000 units were sold.When,at its highest level of activity,sales equaled 12,000 units,total costs were $78,000.Ajax would estimate fixed costs as

A) $28,000.

B) $30,000.

C) $64,000.

D) $128,000.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The contribution margin ratio is

A) the difference between sales revenue and variable costs.

B) the difference between variable costs and fixed costs.

C) variable costs divided by fixed costs.

D) contribution margin per unit divided by sales price per unit.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Profit will be the same under variable costing as under full absorption costing whenever

A) production is greater than sales.

B) production is the same as sales.

C) production is less than sales.

D) variable costing is chosen for external reporting purposes.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Star,Inc.used Excel to run a least-squares regression analysis,which resulted in the following output: What is Star's formula for estimating costs?

A) Total cost = $175,003 + ($11.57 × Production)

B) Total cost = $61,603 + ($0.92 × Production)

C) Total cost = $175,003 + ($61,603 × Production)

D) Total cost = $11.57 + ($0.9213 × Production)

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Mohave,Inc.places a quality assurance logo on each of its units.To use this logo,it must pay the quality assurance firm $5,000 per month plus $1 per unit.The cost to Mohave of using the quality assurance logo would be a

A) fixed cost.

B) mixed cost.

C) variable cost.

D) step cost.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is a mixed cost?

A) A cost that is $32.00 per unit when production is 80,000,and $32.00 per unit when production is 128,000.

B) A cost that is $32.00 per unit when production is 80,000,and $40.00 per unit when production is 128,000.

C) A cost that is $32.00 per unit when production is 80,000,and $26.00 per unit when production is 128,000.

D) A cost that is $64.00 per unit when production is 80,000,and $64.00 per unit when production is 128,000.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Showing 1 - 20 of 100

Related Exams