A) $30,000.

B) $6.25.

C) $1.75.

D) $50,000.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

A variable cost increases in total as the volume increases.Variable costs are those that change,in total,in direct proportion to changes in activity levels.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The difference between variable costing and full absorption costing is due to differences in the treatment of

A) direct costs.

B) variable manufacturing overhead.

C) fixed manufacturing overhead.

D) period costs.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

The contribution margin ratio is calculated as total contribution margin divided by total sales revenue.This is the formula for contribution margin ratio.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Carson,which uses the high-low method of estimating costs,reported total costs of $24 per unit when production was at its lowest level,at 10,000 units.When production doubled to its highest level,the total cost per unit dropped to $15.Carson would estimate its total fixed cost as

A) $9.

B) $33.

C) $180,000.

D) $585,000.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Fremont,which uses the high-low method,reported total costs of $10 per unit at its lowest production level,5,000 units.When production tripled to its highest level,the total cost per unit dropped to $5.Fremont would estimate its variable cost per unit as

A) $2.50.

B) $5.00.

C) $15.00.

D) negative $0.0005.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Stella,Inc.must perform maintenance on its production machinery after every 10,000 units produced.Production varies between 12,000 and 30,000 units a year.The cost of this maintenance would be classified as a

A) variable cost.

B) fixed cost.

C) step cost.

D) mixed cost.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Star,Inc.used Excel to run a least-squares regression analysis,which resulted in the following output: What is Star's variable cost per unit?

A) $0.92

B) $2.84

C) $11.57

D) $12.55

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If sales revenue doubles,fixed costs will

A) decrease in total.

B) increase in total.

C) decrease on a per unit basis.

D) increase on a per unit basis.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Lark,which uses the high-low method,had total costs of $25,000 at its lowest level of activity when 5,000 units were sold.When,at its highest level of activity,sales equaled 12,000 units,total costs were $39,000.Lark would estimate fixed costs as

A) $14,000.

B) $15,000.

C) $32,000.

D) $60,000.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The intercept of the cost line on a scattergraph represents

A) fixed cost per unit.

B) total fixed cost.

C) variable cost per unit.

D) sales price per unit.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

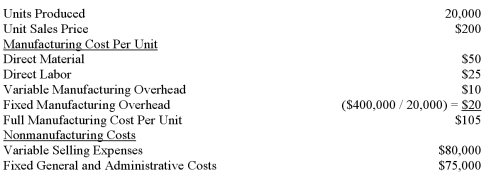

Flint Enterprises had the following cost and production information for April: Inventory increased by 3,000 units during April.How much greater will Flint Enterprises' income be under absorption costing than under variable costing?

A) $60,000

B) $315,000

C) $340,000

D) $400,000

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If a firm uses absorption costing,which of the following actions taken by management would increase gross profit even if sales do not increase?

A) Decreasing production and using items from inventory for sales.

B) Increasing production and building up inventory.

C) Increasing fixed costs by investing in new production technology.

D) Increasing variable costs by purchasing higher-quality materials.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The contribution margin ratio is

A) the contribution margin stated as a percentage of sales.

B) the contribution margin stated as a percentage of profit.

C) the contribution margin stated as a percentage of total costs.

D) the contribution margin stated as a percentage of fixed costs.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Jasmine Corp.has a selling price of $15,variable costs of $10 per unit,and fixed costs of $25,000.Contribution margin is $65,000.How many units did Jasmine sell?

A) 7,000

B) 10,000

C) 13,000

D) 17,000

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A cost that remains the same,in total,regardless of changes in activity level is a

A) variable cost.

B) fixed cost.

C) mixed cost.

D) step cost.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A step cost

A) is a fixed cost over the relevant range and a variable cost everywhere else.

B) contains both fixed and variable components.

C) increases in direct proportion to changes in activity.

D) is fixed over some range of activity.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is a fixed cost?

A) A cost that is $28.00 per unit when production is 70,000,and $28.00 per unit when production is 112,000.

B) A cost that is $28.00 per unit when production is 70,000,and $17.50 per unit when production is 112,000.

C) A cost that is $28.00 per unit when production is 70,000,and $56.00 per unit when production is 112,000.

D) A cost that is $56.00 per unit when production is 70,000,and $56.00 per unit when production is 112,000.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Contribution margin is defined as sales revenue less variable costs.This is the definition of contribution margin.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Cost behavior is

A) the way in which costs change when the activity level changes.

B) the difference between sales revenue and fixed costs.

C) the same as absorption costing.

D) the amount of sales necessary to achieve a specific profit.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Showing 41 - 60 of 100

Related Exams