A) that are more complex or difficult to manufacture than others.

B) that sell more units than others.

C) with higher per-unit materials costs than others.

D) with more activity costs than others.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Lincoln,Inc. ,which uses a volume-based cost system,produces cat condos that sell for $90 each.Direct materials cost $15 per unit,and direct labor costs $10 per unit.Manufacturing overhead is applied at a rate of 200% of direct labor cost.Nonmanufacturing costs are $27 per unit.What is the gross profit margin for the cat condos?

A) 20.0%

B) 50.0%

C) 62.5%

D) 80.0%

F) C) and D)

Correct Answer

verified

Correct Answer

verified

True/False

To assign activity costs using the activity proportion method,multiply the activity rate by the activity requirements of each individual product.To assign activity costs using the activity proportion method,multiply the total activity cost by the activity proportion for each product.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A large company that uses activity based costing would do which of the following?

A) Use a volume-based cost driver for each activity.

B) Form a cost pool for each activity performed by the company.

C) Use a single cost pool.

D) Group activities together to simplify the number of activities.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following sets just-in-time systems apart from traditional manufacturing systems?

A) Cost of goods sold includes all manufacturing cost.

B) Materials are purchased only as they are needed to manufacture goods.

C) Cost of goods sold is not calculated.

D) It can be used in conjunction with activity based costing.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

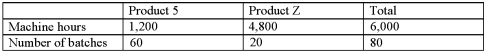

Jefferson,Inc.produces two different products (Product 5 and Product Z) using two different activities: Machining,which uses machine hours as an activity driver,and Inspection,which uses number of batches as an activity driver.The cost of Machining is $500,000,while the cost of Inspection is $30,000.Usage of the activity drivers are as follows: What proportion of Inspection activity is used by Product Z?

A) 25%

B) 33%

C) 67%

D) 75%

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

An activity that is performed to benefit the organization as a whole is a(n)

A) batch-level activity.

B) product-level activity.

C) facility level activity.

D) unit-level activity.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When a traditional,volume-based costing system is used,which of the following products is most likely to suffer from cost distortion?

A) A high-volume,medium-complexity product

B) A low-volume,low-complexity product

C) A low-volume,medium-complexity product

D) A low-volume,high-complexity product

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Jackson,Inc.produces two different products (Product 5 and Product Z) using two different activities: Machining,which uses machine hours as an activity driver,and Inspection,which uses number of batches as an activity driver.The cost of Machining is $500,000,while the cost of Inspection is $30,000.Product uses 20% of total machine hours and 75% of total batches.What is the total Inspection cost assigned to Product 5?

A) $7,500

B) $22,500

C) $125,000

D) $375,000

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Calverton,Inc.produces two different products (Standard and Luxury) using two different activities: Machining,which uses machine hours as an activity driver,and Inspection,which uses number of batches as an activity driver.The cost of Machining is $500,000,while the cost of Inspection is $30,000.Standard is assigned $150,000 in Machining cost,and $22,500 in Inspection cost.What proportion of Inspection activity is used by Luxury?

A) 25%

B) 33%

C) 67%

D) 75%

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The purpose of Stage 1 allocations is to

A) assign indirect manufacturing costs to activity cost pools.

B) assign the indirect costs of each activity to products and services.

C) assign direct manufacturing costs to activity cost pools.

D) assign the direct costs of each activity to products and services.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Pima,Inc.manufactures calculators that sell for $40 each.Each calculator uses $15 in direct materials and $5 in direct labor per unit.Pima has two activities: Machining,which is applied at the rate of $4 per machine hour,and Finishing,which is applied at the rate of $20 per batch.This month,Pima made 400 calculators,using 1,000 machine hours in 40 batches.What is the gross profit for one calculator?

A) $8

B) $20

C) $25

D) $35

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

The only difference between a volume-based cost system and an ABC system is how the methods assign indirect costs to products.Both systems trace direct costs to products;the only difference is how they treat indirect costs.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is the best example of a unit-level activity?

A) Human resources

B) Research and development

C) Painting a final product

D) Product testing

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Monroe,Inc.randomly selects ten units from each production run to be inspected for quality,regardless of the size of the production run.The inspection of these units would most likely be classified as a

A) facility or companywide activity.

B) product-level activity.

C) batch-level activity.

D) unit-level activity.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The gross margin does not take into account

A) sales price.

B) nonmanufacturing cost.

C) manufacturing overhead.

D) direct materials and direct labor.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following would be considered a non-volume-based cost driver?

A) Number of units produced

B) Number of batches

C) Number of machine hours

D) Direct materials cost

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

An activity cost driver is

A) a measure of the underlying activity that occurs in each activity cost pool.

B) a measure of the volume of units produced or customers sold.

C) a number of activities combined into one cost pool.

D) the cost assigned to an activity.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Jackson,Inc.produces two different products (Product 5 and Product Z) using two different activities: Machining,which uses machine hours as an activity driver,and Inspection,which uses number of batches as an activity driver.The cost of Machining is $500,000,while the cost of Inspection is $30,000.Product 5 uses 20% of total machine hours and 75% of total batches.What is the total Inspection cost assigned to Product Z?

A) $7,500

B) $22,500

C) $125,000

D) $375,000

F) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

To compute an activity rate,divide the total activity cost by the total activity driver.This is the formula for an activity rate.

B) False

Correct Answer

verified

Correct Answer

verified

Showing 41 - 60 of 104

Related Exams