A) $250,000

B) $225,000

C) $213,750

D) $237,500

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Manufacturing overhead was estimated to be $400,000 for the year along with 20,000 direct labor hours.Actual manufacturing overhead was $415,000,and actual labor hours were 21,000.To dispose of the balance in the Manufacturing Overhead account,which of the following would be correct?

A) Cost of Goods Sold would be credited for $15,000

B) Cost of Goods Sold would be credited for $5,000

C) Cost of Goods Sold would be debited for $5,000

D) Cost of Goods Sold would be debited for $15,000

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following represents the cost of materials purchased but not yet issued to production?

A) Raw Materials Inventory

B) Work in Process Inventory

C) Finished Goods Inventory

D) Cost of Goods Sold

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

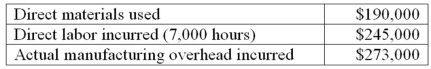

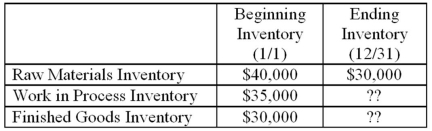

Sawyer Company had the following information for the year: Sawyer Company used a predetermined overhead rate using estimated overhead of $320,000 and 8,000 estimated direct labor hours.Assume the only inventory balance is an ending Finished Goods balance of $9,000.How much overhead was applied during the year?

A) $245,000

B) $273,000

C) $280,000

D) $320,000

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Manufacturing overhead was estimated to be $200,000 for the year along with 20,000 direct labor hours.Actual manufacturing overhead was $215,000,and actual labor hours were 21,000.The amount debited to the Manufacturing Overhead account would be

A) $200,000

B) $215,000

C) $210,000

D) $225,750

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

Direct labor costs are recorded using labor time tickets.A direct labor time ticket shows how much time a worker has spent on various jobs each week,and the cost of that time.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Sawyer Company had the following information for the year: Sawyer Company used a predetermined overhead rate using estimated overhead of $320,000 and 8,000 estimated direct labor hours.Assume the only inventory balance is an ending Finished Goods Inventory balance of $9,000.What was cost of goods manufactured?

A) $715,000

B) $708,000

C) $755,000

D) $706,000

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Manufacturing overhead was estimated to be $200,000 for the year along with 20,000 direct labor hours.Actual manufacturing overhead was $215,000,actual labor hours were 21,000.The amount of manufacturing overhead applied to production would be

A) $200,000

B) $215,000

C) $210,000

D) $225,750

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When direct materials are used in production,which of the following accounts is credited?

A) Raw Materials Inventory

B) Work in Process Inventory

C) Finished Goods Inventory

D) Cost of Goods Sold

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

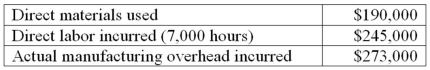

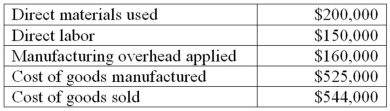

Santos Inc.had the following information for the preceding year: Additional information for the year is as follows:

What was the ending Work in Process Inventory balance on 12/31?

A) $20,000

B) $11,000

C) $50,000

D) $54,000

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

Labor that can be traced to a specific job is recorded directly on the job cost sheet.If the labor can be traced to a specific job,the cost is added to the job cost sheet and the Work in Process Inventory account.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The cost of materials used on a specific job is first captured on which source document?

A) Cost driver sheet

B) Materials requisition form

C) Labor time ticket

D) Process cost sheet

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Manufacturing overhead was estimated to be $200,000 for the year along with 20,000 direct labor hours.Actual manufacturing overhead was $215,000,and actual labor hours were 21,000.Which of the following would be correct?

A) Overhead is underapplied by $15,000

B) Overhead is underapplied by $5,000

C) Overhead is overapplied by $5,000

D) Overhead is overapplied by $15,000

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Manufacturing overhead was estimated to be $400,000 for the year along with 20,000 direct labor hours.Actual manufacturing overhead was $415,000,actual labor hours were 21,000.The predetermined manufacturing overhead rate would be

A) $20.00

B) $0.05

C) $20.75

D) $19.05

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following would be used to record the depreciation of manufacturing equipment?

A) Raw Materials Inventory would be debited

B) Work in Process Inventory would be debited

C) Manufacturing Overhead would be debited

D) Manufacturing Overhead would be credited

F) All of the above

Correct Answer

verified

Correct Answer

verified

True/False

Allocation base and cost driver are two terms that can often be used interchangably.The following terms are used somewhat interchangeably: Indirect Cost and Overhead;Assign,Allocate,and Apply;Allocation Base and Cost Driver.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following represents the cost of jobs completed but not yet sold?

A) Raw Materials Inventory

B) Work in Process Inventory

C) Finished Goods Inventory

D) Cost of Goods Sold

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Manufacturing overhead was estimated to be $200,000 for the year along with 20,000 direct labor hours.Actual manufacturing overhead was $215,000,and actual labor hours were 21,000.To dispose of the balance in the Manufacturing Overhead account,which of the following would be correct?

A) Manufacturing Overhead would be credited for $5,000

B) Manufacturing Overhead would be credited for $15,000

C) Manufacturing Overhead would be debited for $5,000

D) Manufacturing Overhead would be debited for $15,000

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Optimum Finance Inc.provides budget,savings,and investment services to clients who want a stress-free financial lifestyle.The company customizes a program for each client based on their individual goals that includes budget recommendations,investment counseling,and savings techniques.The company uses a job order cost system that keeps track of the cost of the amount of time financial consultants spend with each client.Optimum applies all indirect operating costs (e.g. ,rent,utilities,and management salaries) as a percentage of the consultant's labor cost.During the most recent year,the firm estimated that it would pay $500,000 to its consultants and incur indirect operating costs of $750,000.Actual consultant labor costs were $537,500 and actual indirect operating costs were $725,000.During the year,Optimum provided 64 hours of consulting services to Robert Howard for which Optimum pays an average of $18 per hour.What is the total cost of providing services to Robert?

A) $2,707.

B) $2,822.

C) $1,924.

D) $2,880.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

All the costs assigned to an individual job are summarized on a

A) Cost driver sheet.

B) Job cost sheet.

C) Materials requisition form.

D) Labor time ticket.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Showing 21 - 40 of 112

Related Exams