A) 22.3.

B) 50.5.

C) 1.98.

D) 447.6.

E) 11.3.

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Calculating return on investment for an investment center is defined by the following formula:

A) Contribution margin/Ending assets.

B) Gross profit/Ending assets.

C) Net income/Ending assets.

D) Income/Average invested assets.

E) Contribution margin/Average invested assets.

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Departmental contribution to overhead is calculated as the amount of sales of the department less:

A) Controllable costs.

B) Product and period costs.

C) Direct expenses.

D) Direct and indirect costs.

E) Joint costs.

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

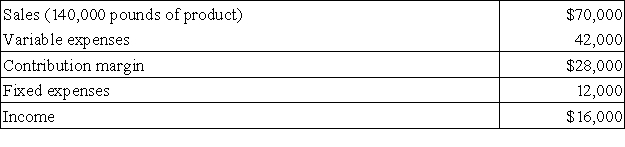

The Mixed Nuts Division of Yummy Snacks,Inc.had the following operating results last year:  Yummy expects identical operating results in the division this year.The Mixed Nuts Division has the ability to produce and sell 200,000 pounds of product annually.Assume that the Trail Mix Division of Yummy wants to purchase an additional 20,000 pounds of nuts from the Mixed Nuts Division.Mixed Nuts will be able to increase its profit by accepting any transfer price above:

Yummy expects identical operating results in the division this year.The Mixed Nuts Division has the ability to produce and sell 200,000 pounds of product annually.Assume that the Trail Mix Division of Yummy wants to purchase an additional 20,000 pounds of nuts from the Mixed Nuts Division.Mixed Nuts will be able to increase its profit by accepting any transfer price above:

A) $0.25 per pound

B) $0.08 per pound

C) $0.15 per pound

D) $0.30 per pound

E) $0.10 per pound

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is not one of the perspectives used to analyze performance using the balanced scorecard?

A) Customer

B) Financial/owners

C) Internal process

D) Number of employees

E) Innovation and learning

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A company pays $15,000 per period to rent a small building that has 10,000 square feet of space.This cost is allocated to the company's three departments on the basis of the amount of the space occupied by each.Department One occupies 2,000 square feet of floor space,Department Two occupies 3,000 square feet of floor space,and Department Three occupies 5,000 square feet of floor space.If the rent is allocated based on the total square footage of the space,Department One should be charged rent expense for the period of:

A) $4,400.

B) $3,000.

C) $4,000.

D) $2,200.

E) $2,000.

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Essay

With respect to cycle time,companies strive to reduce non-value added time in order to improve ________________________.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

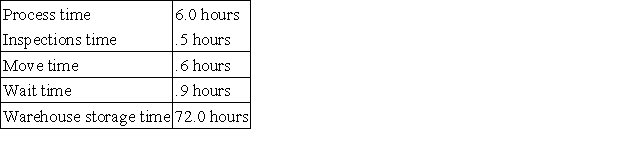

Using the information below,compute the manufacturing cycle time:

A) 7.5 hours.

B) 6.5 hours.

C) 8.0 hours.

D) 80.0 hours.

E) 7.1 hours.

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

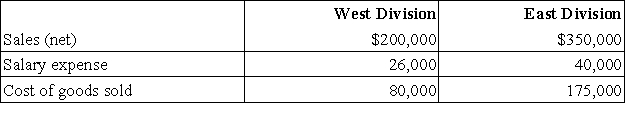

Fallow Corporation has two separate profit centers.The following information is available for the most recent year:  The West Division occupies 5,000 square feet in the plant.The East Division occupies 3,000 square feet.Rent,which was $40,000 for the year,is an indirect expense and is allocated based on square footage.Compute operating income for the West Division.

The West Division occupies 5,000 square feet in the plant.The East Division occupies 3,000 square feet.Rent,which was $40,000 for the year,is an indirect expense and is allocated based on square footage.Compute operating income for the West Division.

A) $120,000.

B) $95,000.

C) $94,000.

D) $69,000.

E) $54,000.

G) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Responsibility accounting performance reports:

A) Become more detailed at higher levels of management.

B) Are usually summarized at higher levels of management.

C) Are equally detailed at all levels of management.

D) Are useful in any format.

E) Are irrelevant at the highest level of management.

G) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Evaluation of the performance of an investment center involves only financial measures.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

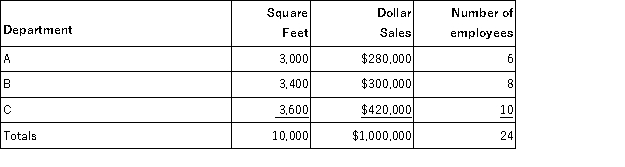

Pepper Department store allocates its service department expenses to its various operating (sales) departments.The following data is available for its service departments:  The following information is available for its three operating (sales) departments:

The following information is available for its three operating (sales) departments:  What is the total expense allocated to Department B?

What is the total expense allocated to Department B?

A) $29,375.

B) $30,462.

C) $30,500.

D) $30,775.

E) $32,160.

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Costs that the manager has the power to determine or at least significantly affect are called:

A) Uncontrollable costs.

B) Controllable costs.

C) Joint costs.

D) Direct costs.

E) Indirect costs.

G) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

Joint costs can be allocated either using a physical basis or a value basis.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Investment center managers are typically evaluated using performance measures that combine income and assets.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A responsibility accounting performance report displays:

A) Only actual costs.

B) Only budgeted costs.

C) Both actual costs and budgeted costs.

D) Only direct costs.

E) Only indirect costs.

G) C) and D)

Correct Answer

verified

Correct Answer

verified

True/False

An example of a controllable cost is equipment depreciation expense.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A company has two departments,Y and Z that incur wage expenses.An analysis of the total wage expense of $19,000 indicates that Dept.Y had a direct wage expense of $2,000 and Dept.Z had a direct wage expense of $3,500.The remaining expenses are indirect and analysis indicates they should be allocated evenly between the two departments.Departmental wage expenses for Dept.Y and Dept.Z,respectively,are:

A) $8,750;$10,250.

B) $10,250;$8,750.

C) $9,500;$9,500.

D) $2,000;$3,500.

E) $6,750;$6,750.

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Part AR3 costs the Southwestern Division of Luxon Corporation $26 to make-direct materials are $10,direct labor is $4,variable manufacturing overhead is $9,and fixed manufacturing overhead is $3.Southwestern Division sells Part AR3 to other companies for $30.The Northeastern Division of Luxon Corporation can use Part AR3 in one of its products.The Southwestern Division has enough idle capacity to produce all of the units of Part AR3 that the Northeastern Division would require.What is the lowest transfer price at which the Southwestern Division should be willing to sell Part AR3 to the Northeastern Division?

A) $30

B) $26

C) $23

D) $27

E) $21

G) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Kragle Corporation reported the following financial data for one of its divisions for the year;average invested assets of $470,000;sales of $930,000;and income of $105,000.The investment center profit margin is:

A) 22.3%.

B) 50.5%.

C) 197.9%.

D) 447.6%.

E) 11.3%.

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Showing 21 - 40 of 162

Related Exams