A) Controllable management.

B) Management by variance.

C) Performance management.

D) Management by objectives.

E) Management by exception.

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Essay

If Mercury Company's actual overhead incurred during a period was $32,700 and the company reported a favorable overhead controllable variance of $1,200 and an unfavorable overhead volume variance of $900,how much standard overhead cost was assigned to the products produced during the period?

Correct Answer

verified

Correct Answer

verified

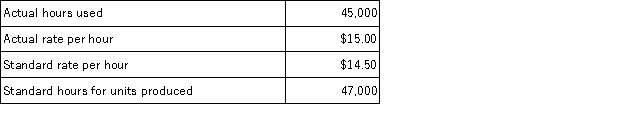

Multiple Choice

The following information describes a company's usage of direct labor in a recent period.The direct labor efficiency variance is:

A) $29,000 unfavorable.

B) $29,000 favorable.

C) $22,500 unfavorable.

D) $52,500 favorable.

E) $52,500 unfavorablE.

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Sanchez Company's output for the current period was assigned a $200,000 standard direct materials cost.The direct materials variances included a $5,000 favorable price variance and a $3,000 unfavorable quantity variance.What is the actual total direct materials cost for the current period?

A) $208,000.

B) $198,000.

C) $202,000.

D) $192,000.

E) $205,000.

G) B) and E)

Correct Answer

verified

Correct Answer

verified

True/False

A fixed budget performance report never provides useful information for evaluating variances.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Based on a predicted level of production and sales of 12,000 units,a company anticipates reporting operating income of $26,000 after deducting variable costs of $72,000 and fixed costs of $10,000.Based on this information,the budgeted amounts of fixed and variable costs for 15,000 units would be:

A) $10,000 of fixed costs and $72,000 of variable costs.

B) $10,000 of fixed costs and $90,000 of variable costs.

C) $12,500 of fixed costs and $90,000 of variable costs.

D) $12,500 of fixed costs and $72,000 of variable costs.

E) $10,000 of fixed costs and $81,000 of variable costs.

G) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The variable overhead spending variance,the fixed overhead spending variance,and the variable overhead efficiency variance can be combined to find the:

A) Production variance.

B) Quantity variance.

C) Volume variance.

D) Price variance.

E) Controllable variance.

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Essay

Naches Co.assigned direct labor cost to its products in May for 1,300 standard hours of direct labor at the standard $8 per hour rate.The direct labor rate variance for the month was $200 favorable and the direct labor efficiency variance was $150 favorable.Prepare the journal entry to charge Work in Process Inventory for the standard labor cost of the goods manufactured in May and to record the direct labor variances.Assuming that the direct labor variances are immaterial,prepare the journal entry that Naches would make to close the variance accounts.

Correct Answer

verified

Correct Answer

verified

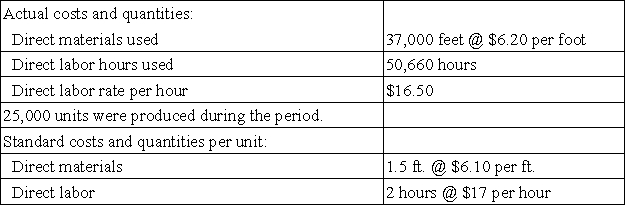

Essay

The following information comes from the records of Barney Co.for the current period.

a.Compute the direct materials price and quantity variances,direct labor rate and efficiency variances and state whether the variance is favorable or unfavorable.

b.Prepare the journal entries to charge direct materials and direct labor costs to work in process and the materials and labor variances to their proper accounts.

Correct Answer

verified

Correct Answer

verified

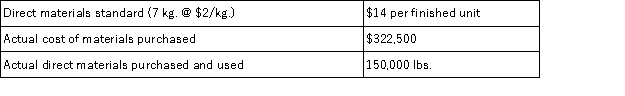

Multiple Choice

Parallel Enterprises has collected the following data on one of its products.During the period the company produced 25,000 units.The direct materials price variance is:

A) $27,500 unfavorable.

B) $50,000 unfavorable.

C) $50,000 favorable.

D) $22,500 unfavorable.

E) $22,500 favorablE.

G) B) and D)

Correct Answer

verified

Correct Answer

verified

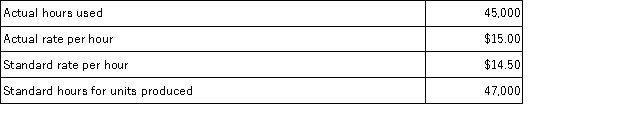

Multiple Choice

The following information describes a company's usage of direct labor in a recent period.The direct labor rate variance is:

A) $29,000 favorable.

B) $29,000 unfavorable.

C) $22,500 unfavorable.

D) $52,500 favorable.

E) $52,500 unfavorablE.

G) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Regarding overhead costs,as volume increases:

A) Total fixed cost increases,total variable cost remains constant.

B) Total fixed cost remains constant,total variable cost increases.

C) Total variable cost decreases,total fixed cost remains constant.

D) Both total fixed cost and total variable cost increase.

E) Both total fixed cost and total variable cost remain constant.

G) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

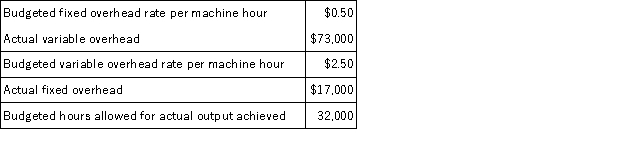

The following information relating to a company's overhead costs is available.  Based on this information,the total overhead variance is:

Based on this information,the total overhead variance is:

A) $7,000 favorable.

B) $6,000 favorable.

C) $1,000 unfavorable.

D) $6,000 unfavorable.

E) $1,000 favorablE.

G) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

The total sales variance can be divided into the sales price variance and the sales volume variance.

B) False

Correct Answer

verified

Correct Answer

verified

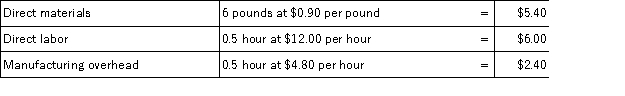

Multiple Choice

A company uses the following standard costs to produce a single unit of output.  During the latest month,the company purchased and used 58,000 pounds of direct materials at a price of $1.00 per pound to produce 10,000 units of output.Direct labor costs for the month totaled $56,350 based on 4,900 direct labor hours worked.Variable manufacturing overhead costs incurred totaled $15,000 and fixed manufacturing overhead incurred was $10,400.Based on this information,the direct materials price variance for the month was:

During the latest month,the company purchased and used 58,000 pounds of direct materials at a price of $1.00 per pound to produce 10,000 units of output.Direct labor costs for the month totaled $56,350 based on 4,900 direct labor hours worked.Variable manufacturing overhead costs incurred totaled $15,000 and fixed manufacturing overhead incurred was $10,400.Based on this information,the direct materials price variance for the month was:

A) $6,000 unfavorable

B) $1,800 favorable

C) $1,000 favorable

D) $5,800 unfavorable

E) $1,800 unfavorable

G) A) and C)

Correct Answer

verified

Correct Answer

verified

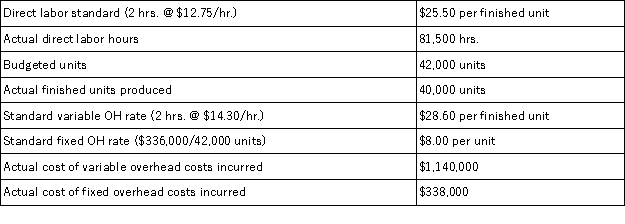

Multiple Choice

Fletcher Company collected the following data regarding production of one of its products.Compute the fixed overhead cost variance.

A) $18,300 favorable.

B) $18,000 favorable.

C) $18,000 unfavorable.

D) $18,300 unfavorable.

E) $14,300 unfavorablE.Actual fixed overhead $338,000 - Applied (40,000 * $8.00 = $320,000) = $18,000 unfavorable.

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Based on a predicted level of production and sales of 30,000 units,a company anticipates total contribution margin of $105,000,fixed costs of $40,000,and operating income of $52,000.Based on this information,the budgeted operating income for 28,000 units would be:

A) $52,000.

B) $135,333.

C) $58,000.

D) $72,500.

E) $105,000.

G) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

While companies strive to achieve ideal standards,reality implies that some loss of materials usually occurs with any process.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Cost variances are ignored under management by exception.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A flexible budget performance report compares the differences between:

A) Actual performance and budgeted performance based on actual sales volume.

B) Actual performance over several periods.

C) Budgeted performance over several periods.

D) Actual performance and budgeted performance based on budgeted sales volume.

E) Actual performance and standard costs at the budgeted sales volume.

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Showing 21 - 40 of 177

Related Exams