A) $6,800 favorable.

B) $6,800 unfavorable.

C) $3,200 favorable.

D) $3,200 unfavorable.

E) $10,000 favorablE.

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

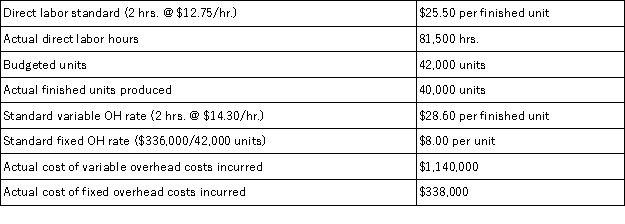

Fletcher Company collected the following data regarding production of one of its products.Compute the variable overhead efficiency variance.

A) $14,300 unfavorable.

B) $21,450 favorable.

C) $4,000 unfavorable.

D) $4,000 favorable.

E) $21,450 unfavorablE.AH * SVR = (81,500 * $14.30) = $1,165,450

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Essay

During November,Gliem Company allocated overhead to products at the rate of $26.00 per direct labor hour.This figure was based on 80% of capacity or 1,600 direct labor hours.However,Gliem Company operated at only 70% of capacity,or 1,400 direct labor hours.Budgeted overhead at 70% of capacity is $38,900,and overhead actually incurred was $38,000.What is the company's volume variance for November? (Indicate whether the variance is favorable or unfavorable)

Correct Answer

verified

Correct Answer

verified

True/False

An overhead cost variance is the difference between the total overhead actually incurred for the period and the standard overhead applied to products.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A company has established 5 pounds of Material J at $2 per pound as the standard for the material in its Product Z.The company has just produced 1,000 units of this product,using 5,200 pounds of Material J that cost $9,880.The direct materials price variance is:

A) $520 unfavorable.

B) $400 unfavorable.

C) $120 favorable.

D) $520 favorable.

E) $400 favorablE.

G) C) and E)

Correct Answer

verified

Correct Answer

verified

Essay

Anniston Co.planned to produce and sell 40,000 units.At that volume level,variable costs are determined to be $320,000 and fixed costs are $30,000.The planned selling price is $10 per unit.Anniston actually produced and sold 42,000 units. Using a contribution margin format: (a)Prepare a fixed budget income statement for the planned level of sales and production. (b)Prepare a flexible budget income statement for the actual level of sales and production.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A job was budgeted to require 3 hours of labor per unit at $8.00 per hour.The job consisted of 8,000 units and was completed in 22,000 hours at a total labor cost of $198,000.What is the total labor cost variance?

A) $2,000 unfavorable.

B) $3,000 unfavorable.

C) $6,000 unfavorable.

D) $8,000 unfavorable.

E) $9,000 unfavorablE.

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Essay

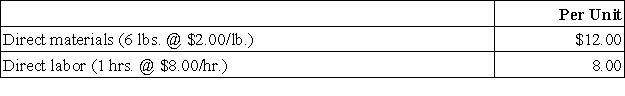

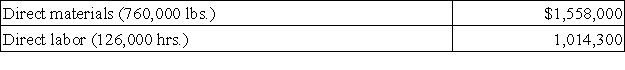

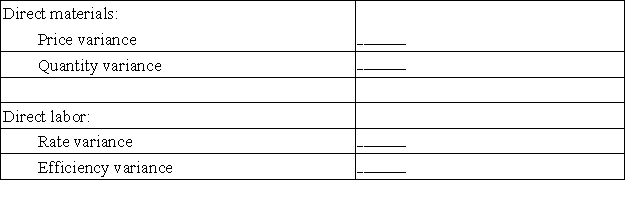

Lionaire,Inc.has developed the following standard cost data based on 60,000 direct labor hours,which is 75% of capacity.  During the last period,the company operated at 80% of capacity and produced 128,000 units.Actual costs were:

During the last period,the company operated at 80% of capacity and produced 128,000 units.Actual costs were:  Determine the direct materials price and quantity variances and the direct labor rate and efficiency variances.Indicate whether each variance is favorable or unfavorable.

Determine the direct materials price and quantity variances and the direct labor rate and efficiency variances.Indicate whether each variance is favorable or unfavorable.

Correct Answer

verified

Correct Answer

verified

Essay

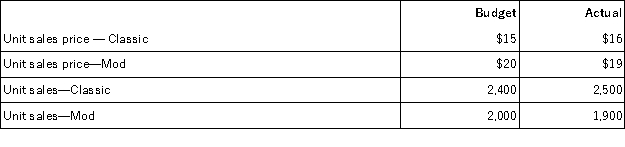

Oxford Co.produces and sells two lines of t-shirts,Classic and Mod.Oxford provides the following data.Compute the sales price and the sales volume variances for each product.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

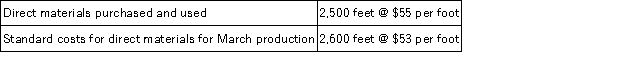

The following company information is available for March.The direct materials price variance is:

A) $5,000 favorable.

B) $300 favorable.

C) $5,200 unfavorable.

D) $5,000 unfavorable.

E) $5,200 favorablE.

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Summerlin Company budgeted 4,000 pounds of material costing $5.00 per pound to produce 2,000 units.The company actually used 4,500 pounds that cost $5.10 per pound to produce 2,000 units.What is the direct materials quantity variance?

A) $400 unfavorable.

B) $450 unfavorable.

C) $2,500 unfavorable.

D) $2,550 unfavorable.

E) $2,950 unfavorablE.

G) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Based on a predicted level of production and sales of 22,000 units,a company anticipates total variable costs of $99,000,fixed costs of $30,000,and operating income of $36,000.Based on this information,the budgeted amount of sales for 20,000 units would be:

A) $165,000.

B) $150,000.

C) $117,272.

D) $181,500.

E) $141,900.

G) B) and C)

Correct Answer

verified

Correct Answer

verified

Essay

The fixed overhead variance can be broken down into the _________________ variance and the _________________ variance. Answers can appear in any order.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The difference between actual quantity of input used and the standard quantity of input used results in a:

A) Controllable variance.

B) Standard variance.

C) Budget variance.

D) Quantity variance.

E) Price variance.

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In this type of control system,the master budget is based on a single prediction for sales volume,and the budgeted amount for each cost essentially assumes that a specific amount of sales will occur:

A) Sales budget.

B) Standard budget.

C) Flexible budget.

D) Fixed budget.

E) Variable budget.

G) B) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Overhead cost variance is:

A) The difference between the overhead costs actually incurred and the overhead budgeted at the actual operating level.

B) The difference between the actual overhead incurred during a period and the standard overhead applied.

C) The difference between actual and budgeted cost caused by the difference between the actual price per unit and the budgeted price per unit.

D) The costs that should be incurred under normal conditions to produce a specific product (or component) or to perform a specific service.

E) The difference between the total overhead cost that would have been expected if the actual operating volume had been accurately predicted and the amount of overhead cost that was allocated to products using the standard overhead rate.

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

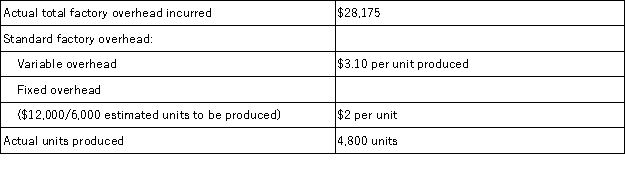

Claymore Corp.has the following information about its standards and production activity for September.The volume variance is:

A) $1,295U.

B) $1,295F.

C) $2,400U.

D) $2,400F.

E) $3,695U.

G) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Standard costs are:

A) Actual costs incurred to produce a specific product or perform a service.

B) Preset costs for delivering a product or service under normal conditions.

C) Established by the IMA.

D) Rarely achieved.

E) Uniform among companies within an industry.

G) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Claremont Company specializes in selling refurbished copiers.During the month,the company sold 180 copiers at an average price of $3,000 each.The budget for the month was to sell 175 copiers at an average price of $3,200.The expected total sales for 180 copiers were.

A) $540,000.

B) $576,000.

C) $525,000.

D) $560,000.

E) $550,000.

G) D) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

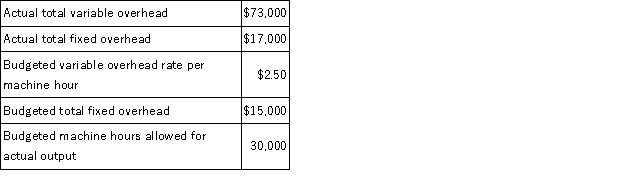

The following information relating to a company's overhead costs is available.  Based on this information,the total variable overhead variance is:

Based on this information,the total variable overhead variance is:

A) $2,000 favorable.

B) $6,000 favorable.

C) $2,000 unfavorable.

D) $6,000 unfavorable.

E) $1,000 favorablE.

G) None of the above

Correct Answer

verified

Correct Answer

verified

Showing 81 - 100 of 177

Related Exams