A) $0.14.

B) $0.16.

C) $0.18.

D) $0.30.

E) $0.37.

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In a process costing system,direct material costs incurred are recorded:

A) Indirectly to a Work in Process Inventory account from Factory Overhead.

B) Indirectly to a Finished Goods Inventory account from Factory Overhead.

C) Directly to a Work in Process Inventory account.

D) Directly to a Finished Goods Inventory account.

E) Directly to a Cost of Goods Sold account.

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The purchase of raw materials on account in a process costing system is recorded with a:

A) Debit to Purchases and credit to Cash.

B) Debit to Purchases and a credit to Accounts Payable.

C) Debit to Raw Materials Inventory and a credit to Accounts Payable.

D) Debit to Accounts Payable and a credit to Raw Materials Inventory.

E) Debit to Work in Process Inventory and a credit to Accounts Payable.

G) B) and E)

Correct Answer

verified

Correct Answer

verified

Essay

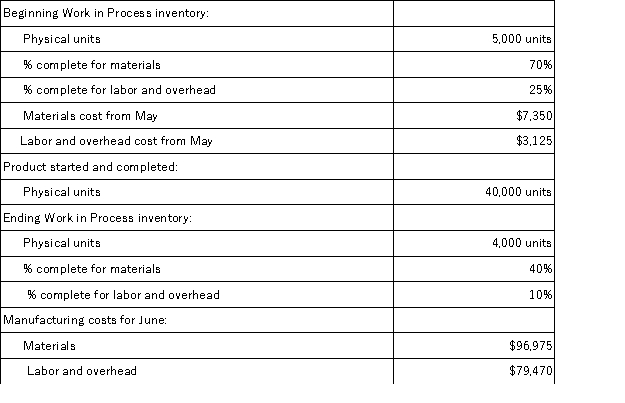

Refer to the following information about the Finishing Department in the Davidson Factory for the month of June.Davidson Factory uses the FIFO method of inventory costing.

Correct Answer

verified

Correct Answer

verified

Essay

An ____________________ is the number of units that could have been started and completed given the costs incurred during the period. Answers must appear in this order.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is most accurate?

A) In process costing,estimating the degree of completion of units is usually more accurate for conversion costs than for direct materials.

B) The FIFO method includes the cost of the beginning Work in Process inventory account in calculating cost per equivalent units.

C) The FIFO method computes equivalent units based only on production activity in the current period,ignoring the percentage of completion in beginning Work in Process inventory.

D) The FIFO method of calculating equivalent units of production merges the work and the costs of the beginning inventory with the work and the costs done during the current period.

E) It is not possible for there to be a significant difference between the cost of completed units between the weighted average and the FIFO methods.

G) All of the above

Correct Answer

verified

Correct Answer

verified

True/False

One section of the process cost summary describes the equivalent units of production for the department during the reporting period and presents the calculations of the direct materials and conversion costs per equivalent unit.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

During March,the production department of a process operations system completed and transferred to finished goods 25,000 units that were in process at the beginning of March and 110,000 that were started and completed in March.March's beginning inventory units were 100% complete with respect to materials and 55% complete with respect to conversion.At the end of March,30,000 additional units were in process in the production department and were 100% complete with respect to materials and 30% complete with respect to conversion.Compute the number of equivalent units with respect to both materials and conversion respectively for March using the FIFO method.

A) 165,000;165,000.

B) 135,000;119,000.

C) 140,000;130,250.

D) 165,000;144,000.

E) 144,000;144,000.

G) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

During November,the production department of a process operations system completed and transferred to finished goods 35,000 units that were in process at the beginning of November and 110,000 that were started and completed in November.November's beginning inventory units were 100% complete with respect to materials and 55% complete with respect to conversion.At the end of November,40,000 additional units were in process in the production department and were 100% complete with respect to materials and 30% complete with respect to conversion.Compute the number of equivalent units with respect to conversion for November using the weighted-average method.

A) 145,000.

B) 157,000.

C) 55,500.

D) 83,500.

E) 185,000.

G) A) and E)

Correct Answer

verified

Correct Answer

verified

True/False

If Department R uses $60,000 of direct materials and Department S uses $15,000 of direct materials,the following journal entry would be recorded by the process costing system

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

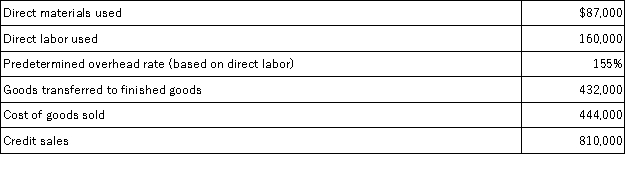

Dazzle,Inc.produces beads for jewelry making use.The following information summarizes production operations for June.The journal entry to record June production activities for overhead allocation is:

A) Debit Factory Overhead $248,000;credit Cash $248,000.

B) Debit Work in Process Inventory $160,000;credit Factory Payroll $160,000.

C) Debit Work in Process Inventory $248,000;credit Factory Overhead $248,000.

D) Debit Work in Process Inventory $160,000;credit Factory Overhead $160,000.

E) Debit Work in Process Inventory $160,000;credit Cash $160,000.

G) C) and E)

Correct Answer

verified

Correct Answer

verified

True/False

The FIFO method of computing equivalent units includes the beginning inventory costs in computing the cost per equivalent unit for the current period.

B) False

Correct Answer

verified

Correct Answer

verified

Essay

Prepare journal entries to record the following production activities for Oaks Manufacturing. a.Used $93,900 of direct labor in the production department. b.Used $11,200 of indirect labor.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A company uses a process costing system.Its Weaving Department completed and transferred out 120,000 units during the current period.The ending inventory in the Weaving Department consists of 40,000 units (20% complete with respect to direct materials and 60% complete with respect to conversion costs) . Determine the equivalent units of production for the Weaving Department for direct materials and conversion costs assuming the weighted average method.

A) 120,000;120,000

B) 120,000;160,000

C) 128,000;120,000

D) 128,000;144,000

E) 128,000;184,000

G) B) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

An organizational unit of a factory that has the responsibility for partially manufacturing or producing a product is called a:

A) Production department.

B) Service department.

C) Primary department.

D) Responsibility department.

E) Control department.

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Wyman Corporation uses a process costing system.The company manufactured certain goods at a cost of $800 and sold them on credit to Percy Corporation for $1,075.The complete journal entry to be made by Wyman at the time of this sale is:

A) Debit Accounts Receivable $1,075;credit Sales $1,075;debit Cost of Goods Sold $800;credit Finished Goods Inventory $800.

B) Debit Accounts Receivable $1,075;credit Sales $275;credit Finished Goods Inventory $800.

C) Debit Cost of Goods Sold $1,075;credit Sales $1,075.

D) Debit Finished Goods Inventory $800;debit Sales $1,075;credit Accounts Receivable $1,075;credit Cost of Goods Sold $800.

E) Debit Accounts Receivable $1,075;debit Selling expense $800;credit Sales $1,075;credit Cost of Goods Sold $800.

G) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

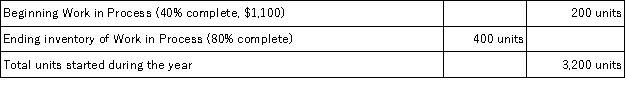

Metaline Corp.uses the weighted average method for inventory costs and had the following information available for the year.The number of units transferred to finished goods during the year is:

A) 3,200 units.

B) 3,000 units.

C) 3,400 units.

D) 3,160 units.

E) 3,500 units.

G) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

Process costing systems are commonly used by companies that manufacture standardized products by passing them through a series of manufacturing steps.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In a process costing system,when manufacturing overhead costs are applied to the cost of production,they are debited to:

A) the Finished Goods Inventory account.

B) the Cost of Goods Sold account.

C) the Work in Process Inventory account.

D) the Manufacturing Overhead account.

E) the Raw Materials Inventory account.

G) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following products is most likely to be produced in a process operations system?

A) Airplanes

B) Cereal

C) Bridges

D) Designer bridal gowns

E) Custom cabinets

G) All of the above

Correct Answer

verified

Correct Answer

verified

Showing 81 - 100 of 179

Related Exams