Correct Answer

verified

horizontal analysis ...View Answer

Show Answer

Correct Answer

verified

View Answer

Multiple Choice

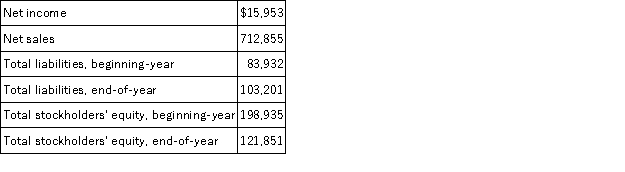

Selected current year company information follows:  The return on total assets is:

The return on total assets is:

A) 2.24%

B) 2.81%

C) 3.64%

D) 4.67%

E) 6.28%

G) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

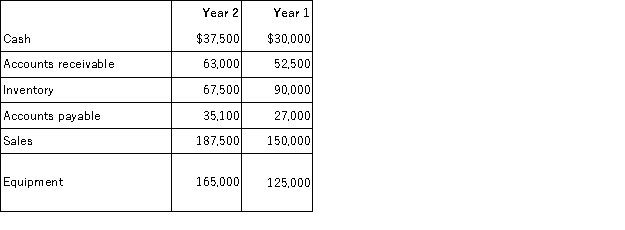

Refer to the following selected financial information from McCormik,LLC.Compute the company's accounts receivable turnover for Year 2.

A) 8.62.

B) 8.28.

C) 8.94.

D) 5.78.

E) 7.90.

G) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Rajan Company's most recent balance sheet reported total assets of $1.9 million,total liabilities of $0.8 million,and total equity of $1.1 million.Its Debt to equity ratio is:

A) 0.42

B) 0.58

C) 1.38

D) 0.73

E) 1.00

G) D) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Quick assets divided by current liabilities is the:

A) Acid-test ratio.

B) Current ratio.

C) Working capital ratio.

D) Current liability turnover ratio.

E) Quick asset turnover ratio.

G) A) and C)

Correct Answer

verified

Correct Answer

verified

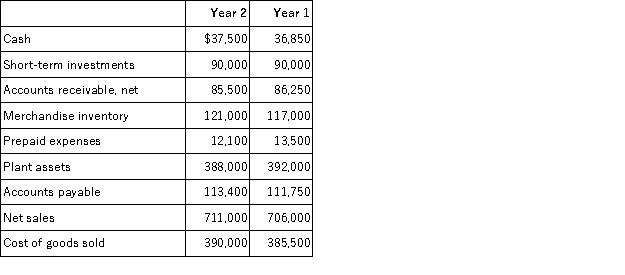

Essay

Express the following balance sheets for Safety Company in common-size percentages.

Correct Answer

verified

Correct Answer

verified

Essay

_______________ financial statements are reports where financial amounts are placed side-by-side in columns on a single statement for analytical purposes.

Correct Answer

verified

Correct Answer

verified

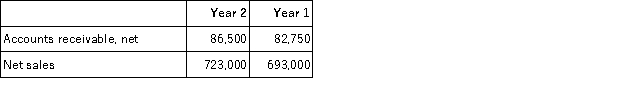

Multiple Choice

Refer to the following selected financial information from Marston Company.Compute the company's accounts receivable turnover for Year 2.

A) 8.36.

B) 8.37.

C) 4.78.

D) 8.59.

E) 8.54.

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

All of the following statements regarding a business segment are true except:

A) A business segment is a part of a company's operations that serves a particular product line.

B) A segment has assets,liabilities,and financial results of operations that can be distinguished from those of other parts of the company.

C) A company's gain or loss from selling or closing down a segment is reported separately.

D) The income tax effects of a discontinued segment are combined with income tax from continuing operations.

E) A segment's income for the period prior to the disposal and the gain or loss resulting from disposing of the segment's assets are reported separately.

G) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

Liquidity refers to the availability of resources to meet short-term cash requirements.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

A corporation reported cash of $14,000 and total assets of $178,300.Its common-size percent for cash equals 7.85%. ($14,000/$178,300)* 100 = 7.85%

B) False

Correct Answer

verified

Correct Answer

verified

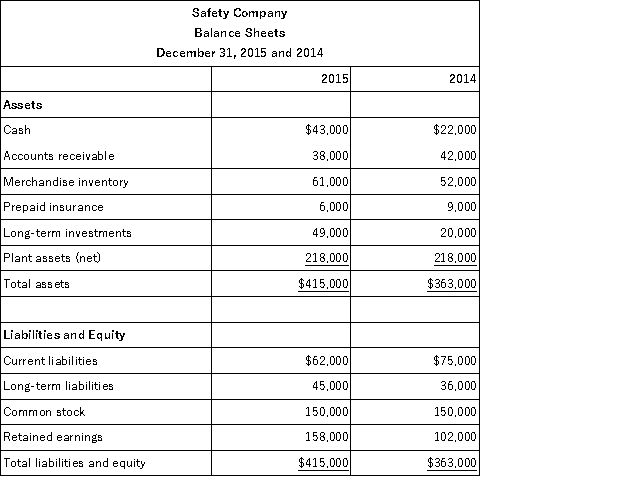

Multiple Choice

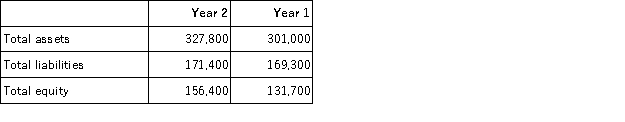

Refer to the following selected financial information from Keller Company.Compute the company's debt to equity for Year 2.

A) 0.9.

B) 1.1.

C) 0.5.

D) 1.9.

E) 2.1.

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Essay

Calculate the percent increase or decrease for each of the following financial statement items:

Correct Answer

verified

Correct Answer

verified

True/False

A trend percent,or index number,is calculated by dividing the analysis period amount by the base period amount and multiplying the result by 100.

B) False

Correct Answer

verified

Correct Answer

verified

Essay

The debt ratio,the equity ratio,pledged assets to secured liabilities,and times interest earned are all ___________________ ratios.

Correct Answer

verified

Correct Answer

verified

True/False

Trend analysis of financial statement items can include comparisons of relations between items on different financial statements.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

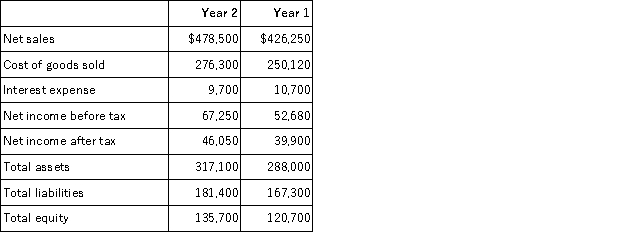

Refer to the following selected financial information from Shakley's Incorporated.Compute the company's return on total assets for Year 2.

A) 9.6%.

B) 15.2%.

C) 2.6%.

D) 22.2%.

E) 14.5%.

G) B) and D)

Correct Answer

verified

Correct Answer

verified

True/False

A financial statement analysis report helps to reduce uncertainty in business decisions through a rigorous and sound evaluation.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Financial statement analysis lessens the need for expert judgment.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Vertical analysis is the comparison of a company's financial condition and performance across time.

B) False

Correct Answer

verified

Correct Answer

verified

Showing 21 - 40 of 194

Related Exams