A) Declaration of a cash dividend.

B) Payment of a cash dividend.

C) Declaration of a stock dividend.

D) Payment of a stock dividend.

E) Stock split.

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Scranton,Inc.reports net income of $230,000 for the year ended December 31.It also reports $87,700 depreciation expense and a $5,000 gain on the sale of equipment.Its comparative balance sheet reveals a $35,500 decrease in accounts receivable,a $15,750 increase in accounts payable,and a $12,500 decrease in wages payable.Calculate the cash provided (used) in operating activities using the indirect method.

A) $376,450.

B) $351,450.

C) $356,450.

D) $319,950.

E) $263,750.

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A machine with a cost of $130,000 and accumulated depreciation of $85,000 is sold for $50,000 cash.The amount that should be reported as a source of cash under cash flows from investing activities is:

A) $50,000.

B) $5,000.

C) $45,000.

D) Zero.This is an operating activity.

E) Zero.This is a financing activity.

G) B) and C)

Correct Answer

verified

Correct Answer

verified

Essay

The reporting of investing and financing activities is _________________ under the direct and indirect methods of preparing the statement of cash flows.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Accounting standards:

A) Allow companies to omit the statement of cash flows from a complete set of financial statements if cash is an insignificant asset.

B) Require that companies omit the statement of cash flows from a complete set of financial statements if the company has no investing activities.

C) Require that companies include a statement of cash flows in a complete set of financial statements.

D) Allow companies to include the statement of cash flows in a complete set of financial statements if the cash balance makes up more than 50% of the current assets.

E) Allow companies to omit the statement of cash flows from a complete set of financial statements if the company has no financing activities.

G) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

Financing activities include receiving cash dividends from investments in other companies' stocks.

B) False

Correct Answer

verified

Correct Answer

verified

Essay

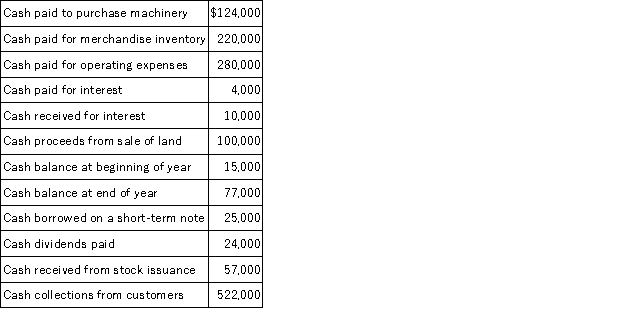

Use the following calendar-year information to prepare Adam Company's statement of cash flows using the direct method.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

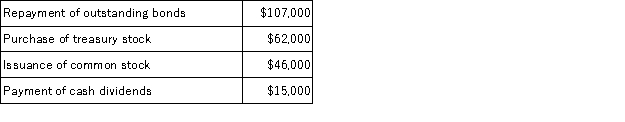

In preparing a company's statement of cash flows for the most recent year,Ransom Corp.reported the following information:  Net cash flows from financing activities for the year were:

Net cash flows from financing activities for the year were:

A) $230,000 of net cash used.

B) $230,000 of net cash provided.

C) $108,000 of net cash used.

D) $138,000 of net cash used.

E) $138,000 of net cash provideD.

G) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

The full disclosure principle requires that noncash investing and financing activities be disclosed in the financial statements.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

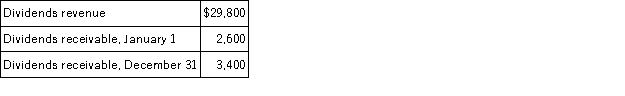

Use the following information to calculate cash received from dividends:

A) $26,400.

B) $29,000.

C) $29,800.

D) $30,600.

E) $32,400.

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When analyzing the changes on a spreadsheet used to prepare a statement of cash flows,the cash flows from investing activities generally affect:

A) Net income,current assets,and current liabilities.

B) Noncurrent assets.

C) Noncurrent liability and equity accounts.

D) Both noncurrent assets and noncurrent liabilities.

E) Equity accounts only.

G) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

A purchase of land in exchange for a long-term note payable is reported in the investing section of the statement of cash flows.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The appropriate section in the statement of cash flows for reporting the receipt of cash dividends from investments in securities is:

A) Operating activities.

B) Financing activities.

C) Investing activities.

D) Schedule of noncash investing or financing activity.

E) This is not reported on the statement of cash flows.

G) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The direct method for the preparation of the operating activities section of the statement of cash flows:

A) Separately lists each major item of operating cash receipts and cash payments.

B) Reports adjustments to reconcile net income to net cash provided or used by operating activities in the statement.

C) Reports a different amount of cash flows from operations than if the indirect method is used.

D) Is required if the company is a merchandiser.

E) Is required by the FASB.

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The statement of cash flows reports all but which of the following?

A) Cash flows from operating activities.

B) Cash flows from financing activities.

C) Cash flows from investing activities.

D) Significant noncash financing and investing activities.

E) The financial position of the company at the end of the accounting period.

G) D) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

An investment that is readily convertible to a known amount of cash and that is sufficiently close to its maturity date so that its market value is unaffected by interest rate changes is a(n) :

A) Short-term marketable equity security.

B) Operating activity.

C) Common stock.

D) Cash equivalent.

E) Financing activity.

G) B) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

All of the following statements related to preparation of the statement of cash flows under U.S.GAAP and IFRS are true except:

A) Both U.S.GAAP and IFRS permit the reporting of cash flows from operating activities using either the direct or indirect method.

B) IFRS permits classification of cash outflows for interest expense under operating or financing based on which one results in better cash flows from operating activities.

C) U.S.GAAP requires cash outflows for income tax be classified as operating activities.

D) IFRS permits the splitting of income tax cash flows among operating,investing,and financing depending on the sources of that tax.

E) IFRS permits classification of interest expense under operating or financing activities provided it is consistently applied across periods.

G) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

A cash equivalent must be readily convertible to a known amount of cash,and must be sufficiently close to its maturity so its market value is unaffected by interest rate changes.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The purchase of stock in another company is classified as a financing activity.

B) False

Correct Answer

verified

Correct Answer

verified

Essay

___________________ activities generally include those transactions and events that affect long-term assets.

Correct Answer

verified

Correct Answer

verified

Showing 141 - 160 of 194

Related Exams