A) Prepared after an invoice is received.

B) Used as a substitute for an invoice if the supplier fails to send one.

C) Used to accumulate information needed to control cash disbursements and to ensure that transactions are properly recorded.

D) Takes the place of a bank check.

E) Prepared before the company orders goods to make sure that all goods are being ordered from an approved vendor list.

G) B) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

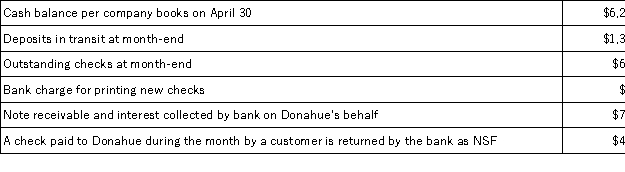

In the process of reconciling its bank statement for April,Donahue Enterprises' accountant compiles the following information:  The adjusted cash balance per the books on April 30 is:

The adjusted cash balance per the books on April 30 is:

A) $6,900

B) $8,160

C) $4,600

D) $6,520

E) $5,840

G) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Internal controls are crucial to companies that convert from U.S.GAAP to IFRS because of all of the following risks except:

A) Possible misstatement of financial information.

B) Possible fraud.

C) Controls are significantly different across the globe.

D) Ineffective communication of the change to investors,creditors,and others.

E) Management's inability to certify the effectiveness of the controls.

G) D) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The principles of internal control include:

A) Separate recordkeeping from custody of assets.

B) Maintain minimal records.

C) Use only computerized systems.

D) Bond all employees.

E) Require automated sales systems.

G) D) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If a check correctly written and paid by the bank for $749 is incorrectly recorded in the company's books for $794,how should this error be treated on the bank reconciliation?

A) Subtract $45 from the bank's balance.

B) Add $45 to the bank's balance.

C) Subtract $45 from the book balance.

D) Add $45 to the book balance.

E) Subtract $45 from the bank's balance and add $45 to the book's balancE.$749 - $794 = $45 too much deducted from the company's cash account balance that must be added back to cash.

G) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

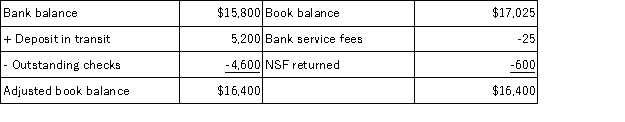

Clayborn Company' bank reconciliation as of May 31 is shown below.  The adjusting journal entries that Clayborn must record as a result of the bank reconciliation include:

The adjusting journal entries that Clayborn must record as a result of the bank reconciliation include:

A) A debit to Cash of $625

B) A debit to Cash of $5,200

C) A credit to Cash of $4,600

D) A credit to Cash of $600

E) A debit to cash of $25

G) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A set of procedures and approvals for verifying,approving and recording obligations for eventual cash disbursement,and for issuing checks for payment only of verified,approved,and recorded obligations is referred to as a(n) :

A) Internal cash system.

B) Petty cash system.

C) Cash disbursement system.

D) Voucher system.

E) Cash control system.

G) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A voucher system is a set of procedures and approvals:

A) Designed to eliminate the need for subsidiary ledgers.

B) Designed to determine if the company is operating profitably.

C) Used almost exclusively by small companies.

D) Used to ensure that the company sells on credit only to creditworthy customers.

E) Designed to control cash disbursements and the acceptance of obligations.

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

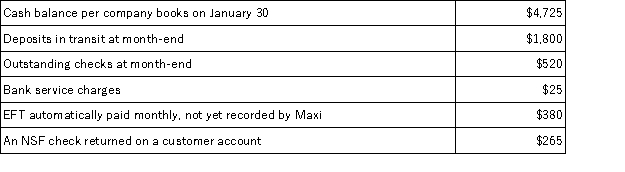

In the process of reconciling its bank statement for January,Maxi's Clothing's accountant compiles the following information:  The adjusted cash balance per the books on January 31 is:

The adjusted cash balance per the books on January 31 is:

A) $5,855

B) $5,335

C) $4,055

D) $4,815

E) $4,585

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The three parties involved with a check are:

A) The writer,the cashier,and the bank.

B) The maker,the payee,and the bank.

C) The maker,the manager,and the payee.

D) The bookkeeper,the payee,and the bank.

E) The signer,the cashier,and the company.

G) B) and D)

Correct Answer

verified

Correct Answer

verified

Essay

The means of recording purchases under the assumption that the cash discount for prompt payment will be taken is called the _________________________.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

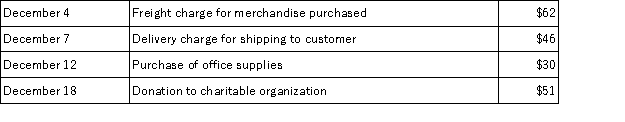

Childers Company has an established petty cash fund in the amount of $400.The fund was last reimbursed on November 30.At the end of December,the fund contained the following petty cash receipts:  If,in addition to these receipts,the petty cash fund contains $201 of cash,the journal entry to reimburse the fund on December 31 will include:

If,in addition to these receipts,the petty cash fund contains $201 of cash,the journal entry to reimburse the fund on December 31 will include:

A) A debit to Transportation-In of $73.

B) A debit to Petty Cash of $189.

C) A credit to Office Supplies of $66.

D) A credit to Cash Over and Short of $10.

E) A credit to Cash of $199.

G) B) and E)

Correct Answer

verified

Correct Answer

verified

Essay

The internal document that is used to notify the appropriate person that ordered goods have been received and to describe the quantities and condition of the goods is the _______________.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A bank does not issue a debit memorandum to notify the depositor of which of the following?

A) All withdrawals through an ATM.

B) A fee assessed to the depositor's account.

C) An uncollectible check.

D) Periodic payments arranged in advance,by a depositor.

E) A deposit to their account.

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Essay

A petty cash fund was originally established with a check for $100.On August 31,which is the period end,the petty cash fund included the following:  Prepare the general journal entry to record the replenishment of the petty cash fund on August 31.

Prepare the general journal entry to record the replenishment of the petty cash fund on August 31.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Cash equivalents:

A) Include savings accounts.

B) Include checking accounts.

C) Are readily converted to a known cash amount.

D) Include time deposits.

E) Have no immediate value.

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A remittance advice is a(n) :

A) Explanation for a payment by check.

B) Bank statement.

C) Internal voucher.

D) Electronic funds transfer.

E) Cancelled check.

G) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Outstanding checks refer to checks that have been:

A) Written,recorded,sent to payees,and received and paid by the bank.

B) Written and not yet recorded in the company books.

C) Held as blank checks.

D) Written,recorded on the company books,sent to the payee,but not yet paid by the bank.

E) Issued by the bank.

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Essay

____________________ are short-term,highly liquid investment assets that are readily convertible to a known amount of cash.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When a petty cash fund is in use:

A) Expenses paid with petty cash are recorded when the fund is replenished.

B) Petty Cash is debited when funds are replenished.

C) Petty Cash is credited when funds are replenished.

D) Expenses are not recorded.

E) Cash is debited when funds are replenished.

G) A) and D)

Correct Answer

verified

Correct Answer

verified

Showing 21 - 40 of 131

Related Exams