A) Merchandise Inventory.

B) Sales Discounts.

C) Discounts Lost.

D) Cash.

E) Accounts Receivable.

G) C) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

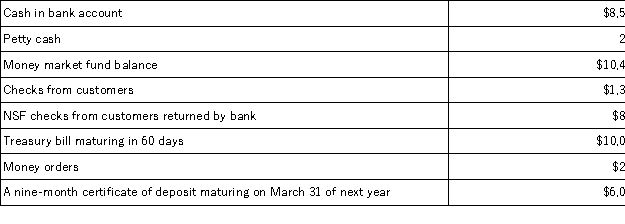

The following information is available for Montrose Company at December 31:  Based on this information,the amounts considered Cash and Cash Equivalents,respectively on December 31 are:

Based on this information,the amounts considered Cash and Cash Equivalents,respectively on December 31 are:

A) Cash $10,430;Cash equivalents $20,400

B) Cash $8,540;Cash equivalents $22,290

C) Cash $8,790;Cash equivalents $26,400

D) Cash $19,190;Cash equivalents $16,000

E) Cash $11,235;Cash equivalents $26,400

G) All of the above

Correct Answer

verified

Correct Answer

verified

Essay

The following information is available for the Topper Company for the month of July. a.On July 31,after all transactions have been recorded,the balance in the company's Cash account has a balance of $15,244. b.The company's bank statement shows a balance on July of $16,450. c.Outstanding checks at July total $2,063. d.A credit memo included with the bank statement indicates that the bank collected $570 on a note receivable for Topper.The $570 includes $550 principle and $20 interest. e.A debit memo included with the bank statement shows a $107 NSF check from a customer,P.Flank. f.A deposit placed in the bank's night depository on July 31 totaling $1,275 did not appear on the bank statement. h.Included with the bank statement was a debit memorandum in the amount of $45 for check printing charges that have not been recorded on the company's books. Prepare the July bank reconciliation for the Topper Company.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Internal control policies and procedures have limitations not including:

A) Human error.

B) Human fraud.

C) Cost-benefit principle.

D) Collusion.

E) Establishing responsibilities.

G) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Merchandise with an invoice price of $2,000 was purchased on February 3,terms 2/15,n/60.The company uses the net method to record purchases.The entry to record the cash payment of this purchase obligation on February 17 is:

A) Debit Accounts Payable $1,960;credit Cash $1,960.

B) Debit Accounts Payable $2,000;credit Cash $2,000.

C) Debit Accounts Payable $1,960;debit Discounts Lost $40;credit Cash $2,000.

D) Debit Accounts Payable $2,000;credit Merchandise Inventory $40;credit Cash $1,960.

E) Debit Accounts Payable $2,000;credit Discounts Lost $40;credit Cash $1,960.

G) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The internal document prepared to notify the appropriate persons that goods ordered have been received,describing the quantities and condition of the goods is the

A) Purchase requisition.

B) Purchase order.

C) Invoice.

D) Receiving report.

E) Invoice approval.

G) D) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

An expense resulting from failing to take advantage of cash discounts when using the net method of recording purchases is called:

A) Sales discounts.

B) Trade discounts.

C) Purchases discounts.

D) Discounts lost.

E) Discounts earned.

G) C) and D)

Correct Answer

verified

Correct Answer

verified

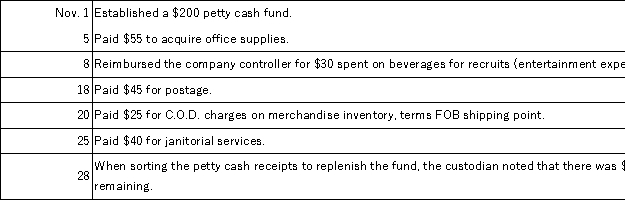

Essay

A company established a petty cash fund in November of the current year and experienced the following transactions affecting the fund during November:  Prepare the journal entries to establish the fund on November 1 and to reimburse the fund on November 28.

Prepare the journal entries to establish the fund on November 1 and to reimburse the fund on November 28.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Ferguson Co.has a $200 petty cash fund.At the end of the first month the accumulated receipts represent $43 for delivery expenses,$127 for merchandise inventory,and $12 for miscellaneous expenses.The fund has a balance of $18.The journal entry to record the reimbursement of the account includes a:

A) Debit to Petty Cash for $200.

B) Debit to Cash Over and Short for $18.

C) Credit to Cash for $182.

D) Credit to Inventory for $127.

E) Credit to Cash Over and Short for $18.

G) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following procedures would weaken control over cash receipts that arrive through the mail?

A) After the mail is opened,a list (in triplicate) of the money received is prepared with a record of the sender's name,the amount,and an explanation of why the money is sent.

B) The bank reconciliation is prepared by a person who does not handle cash or record cash receipts.

C) For safety,only one person should open the mail,and that person should immediately deposit the cash received in the bank.

D) The cashier deposits the money in the bank and the recordkeeper records the amounts received in the accounting records.

E) The employees handling the cash receipts are bonded.

G) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

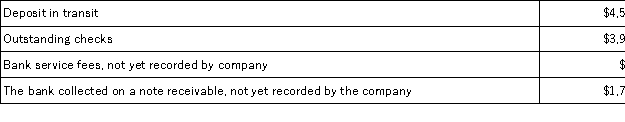

Franklin Company deposits all cash receipts on the day they are received and makes all cash payments by check.At the close of business on August 31,its Cash account shows a debit balance of $13,162.Franklin's August bank statement shows $14,237 on deposit in the bank.Determine the adjusted cash balance using the following information:  The adjusted cash balance should be:

The adjusted cash balance should be:

A) $18,737

B) $10,337

C) $14,887

D) $13,112

E) $14,837

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If a company made a bank deposit on September 30 that did not appear on the bank statement dated September 30,in preparing the September 30 bank reconciliation,the company should:

A) Deduct the deposit from the bank statement balance.

B) Send the bank a debit memorandum.

C) Deduct the deposit from the September 30 book balance and add it to the October 1 book balance.

D) Add the deposit to the book balance of cash.

E) Add the deposit to the bank statement balance.

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The days' sales uncollected ratio is used to:

A) Measure how many days of sales remain until the end of the year.

B) Determine the number of days that have passed without collecting on accounts receivable.

C) Identify the likelihood of collecting sales on account.

D) Estimate how much time is likely to pass before the current amount of accounts receivable is received in cash.

E) Measure the amount of cash sales during a period.

G) A) and D)

Correct Answer

verified

Correct Answer

verified

Essay

On a bank statement,deposits are shown as __________________,because the depositor's account is a liability on the bank's records.

Correct Answer

verified

Correct Answer

verified

Essay

________________ includes currency,coins,and amounts on deposit in checking accounts and savings accounts.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A company's internal control system:

A) Eliminates the company's risk of loss.

B) Monitors company and employee performance.

C) Eliminates human error.

D) Eliminates the need for audits.

E) Eliminates the need for managers' certification of controls.

G) A) and E)

Correct Answer

verified

Correct Answer

verified

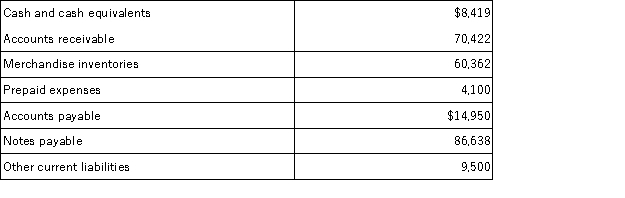

Multiple Choice

The following information is taken from Reagan Company's December 31 balance sheet:  If net credit sales for the current year were $612,000,the firm's days' sales uncollected for the year is:

If net credit sales for the current year were $612,000,the firm's days' sales uncollected for the year is:

A) 60 days

B) 85 days

C) 42 days

D) 154 days

E) 70 days

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Essay

When a company purchases an insurance policy against losses from theft by an employee,that employee is ________________.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Internal control procedures for cash receipts do not require that:

A) Custody over cash is kept separate from its recordkeeping.

B) All collections for sales are be received immediately upon making the sales.

C) Clerks having access to cash in a cash register should not have access to the register tape or file.

D) An employee with no access to cash receipts should compare the total cash recorded by the register with the record of cash receipts reported by the cashier.

E) Cash sales should be recorded on a cash register at the time of each sale.

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The Cash Over and Short account:

A) Is used when the cash account reports a credit balance.

B) Is used to record the income effects of errors in making change and/or processing petty cash transactions.

C) Is not necessary in a computerized accounting system.

D) Can never have a debit balance.

E) Can never have a credit balance.

G) B) and E)

Correct Answer

verified

Correct Answer

verified

Showing 61 - 80 of 131

Related Exams