A) $3,485.

B) $3,445.

C) $3,500.

D) $3,472.

E) $3,461.

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Jefferson Company has sales of $300,000 and cost of goods available for sale of $270,000.If the gross profit ratio is typically 30%,the estimated cost of the ending inventory under the gross profit method would be:

A) $60,000

B) $180,000

C) $30,000

D) $90,000

E) $120,000

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A company's warehouse contents were destroyed by a flood on September 12.The following information was the only information that was salvaged: 1.Inventory,beginning: $28,000 2) Purchases for the period: $17,000 3) Sales for the period: $55,000 4) Sales returns for the period: $700 The company's average gross profit ratio is 35%.What is the estimated cost of the lost inventory?

A) $9,705.

B) $25,995.

C) $29,250.

D) $44,000.

E) $45,000.

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Essay

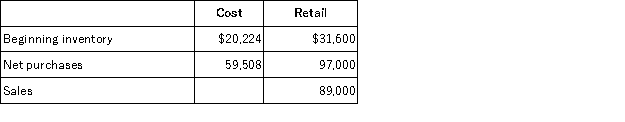

Apply the retail method to the following company information to calculate the cost of the ending inventory for the current period.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

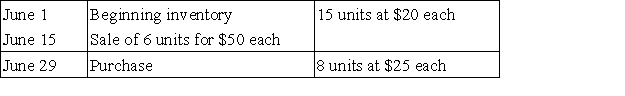

Given the following information,determine the cost of the inventory at June 30 using the LIFO perpetual inventory method.  The cost of the ending inventory is:

The cost of the ending inventory is:

A) $200

B) $220

C) $380

D) $275

E) $300

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When costs to purchase inventory regularly decline,which method of inventory costing will yield the lowest cost of goods sold?

A) FIFO.

B) LIFO.

C) Weighted average.

D) Specific identification.

E) Gross margin.

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Internal controls that should be applied when a business takes a physical count of inventory should include all of the following except:

A) Prenumbered inventory tickets.

B) A manager confirms that all inventories are ticketed only once.

C) Counters confirm the validity of inventory existence,amounts,and quality.

D) Second counts by a different counter.

E) Counters of inventory should be those who are responsible for the inventory.

G) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The inventory valuation method that has the advantages of assigning an amount to inventory on the balance sheet that approximates its current cost,and also mimics the actual flow of goods for most businesses is:

A) FIFO.

B) Weighted average.

C) LIFO.

D) Specific identification.

E) Lower of cost or market.

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Avanti purchases inventory from overseas and incurs the following costs: the merchandise cost is $50,000,credit terms 2/10,n/30 that apply only to the $50,000;FOB shipping point freight charges are $1,500;insurance during transit is $500;and import duties are $1,000.Avanti paid within the discount period and incurred additional costs of $1,200 for advertising and $5,000 for sales commissions.Compute the cost that should be assigned to the inventory.

A) $50,000

B) $53,000

C) $52,000

D) $51,500

E) $53,200

G) A) and D)

Correct Answer

verified

Correct Answer

verified

Essay

The _________________ method is commonly used to estimate the value of inventory that has been destroyed,lost,or stolen.

Correct Answer

verified

Correct Answer

verified

Essay

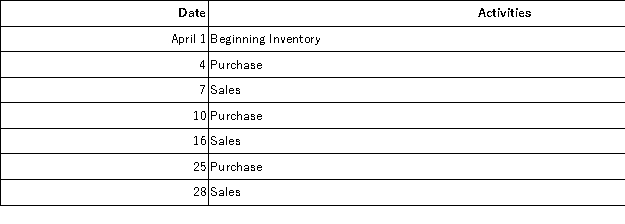

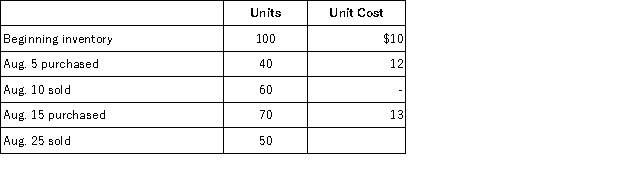

A company reported the current month purchase and sales data for its only product and uses the perpetual inventory system.Determine the cost assigned to ending inventory and cost of goods sold using FIFO.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Beckenworth had cost of goods sold of $9,421 million,ending inventory of $2,089 million,and average inventory of $1,965 million.Its days' sales in inventory equals:

A) 0.21.

B) 4.51.

C) 4.79.

D) 76.1 days.

E) 80.9 days.

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

IFRS reporting currently does not allow which method of inventory costing?

A) Specific identification.

B) FIFO.

C) LIFO.

D) Weighted average.

E) Lower of cost or market.

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Acceptable methods of assigning specific costs to inventory and cost of goods sold include all of the following except:

A) LIFO method.

B) FIFO method.

C) Specific identification method.

D) Weighted average method.

E) Retail method.

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Essay

Calculate the ending inventory using LIFO for a company that uses a perpetual inventory system,using the information given below.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

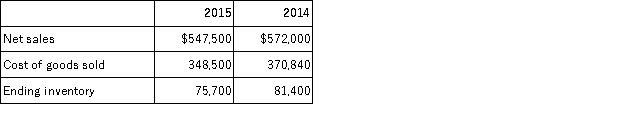

Use the following information for Ephron Company to compute days' sales in inventory for 2015.

A) 52.4

B) 82.3

C) 50.5

D) 76.8

E) 79.3

G) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A company's current inventory consists of 5,000 units purchased at $6 per unit.Replacement cost has now fallen to $5 per unit.What is the entry the company must record to adjust inventory to market?

A) Debit Merchandise Inventory $25,000;credit Cost of Goods Sold $25,000.

B) Debit Cost of Goods Sold $30,000;credit Merchandise Inventory $30,000.

C) Debit Cost of Goods Sold $5,000;credit Merchandise Inventory $5,000.

D) Debit Loss on Inventory $5,000;credit Cost of Goods Sold $5,000.

E) Debit Merchandise Inventory $30,000;credit Cost of Goods Sold $25,000.

G) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

On April 24 of the current year,The Memphis Pecan Company experienced a tornado that destroyed the company's entire inventory.At the beginning of April,the company reported beginning inventory of $226,750.Inventory purchased during April (until the date of the tornado) was $197,800.Sales for the month of April through April 24 were $642,500.Assuming the company's typical gross profit ratio is 50%,estimate the amount of inventory destroyed in the tornado.

A) $212,275

B) $103,300

C) $217,950

D) $321,250

E) $157,788

G) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

During a period of steadily rising costs,the inventory valuation method that yields the highest reported net income is:

A) Specific identification method.

B) Average cost method.

C) Weighted-average method.

D) FIFO method.

E) LIFO method.

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

McCarthy Company has inventory of 8 units at a cost of $200 each on October 1.On October 2,it purchased 20 units at $205 each.11 units are sold on October 4.Using the FIFO perpetual inventory method,what is the value of inventory after the October 4 sale?

A) $3,485.

B) $3,445.

C) $3,500.

D) $3,472.

E) $3,461.

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Showing 101 - 120 of 133

Related Exams