Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is incorrect?

A) Adjustments to prepaid expenses and unearned revenues involve previously recorded assets and liabilities.

B) Accrued expenses and accrued revenues involve assets and liabilities that had not previously been recorded.

C) Adjusting entries can be used to record both accrued expenses and accrued revenues.

D) Prepaid expenses,depreciation,and unearned revenues often require adjusting entries to record the effects of the passage of time.

E) Adjusting entries affect only balance sheet accounts.

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

An adjusting entry could be made for each of the following except:

A) Prepaid expenses.

B) Depreciation.

C) Owner investments.

D) Unearned revenues.

E) Accrued expenses.

G) B) and D)

Correct Answer

verified

Correct Answer

verified

True/False

It is acceptable to record cash received in advance of providing products or services to revenue accounts if an adjusting entry is made at the end of the period to bring the liability account balance to the correct unearned amount.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The accrual basis of accounting:

A) Is generally accepted for external reporting because it is more useful than cash basis for most business decisions.

B) Is flawed because it gives complete information about cash flows.

C) Recognizes revenues when received in cash.

D) Recognizes expenses when paid in cash.

E) Eliminates the need for adjusting entries at the end of each period.

G) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Assuming unearned revenues are originally recorded in balance sheet accounts,the adjusting entry to record earning of unearned revenue is:

A) Increase an expense;increase a liability.

B) Increase an asset;increase revenue.

C) Decrease a liability;increase revenue.

D) Increase an expense;decrease an asset.

E) Increase an expense;decrease a liability.

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If a company records prepayment of expenses in an asset account,the adjusting entry when all or part of the prepaid asset is used or expired would:

A) Result in a debit to an expense and a credit to an asset account.

B) Cause an adjustment to prior expense to be overstated and assets to be understated.

C) Cause an accrued liability account to exist.

D) Result in a debit to a liability and a credit to an asset account.

E) Decrease cash.

G) B) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Financial statements can be prepared directly from the information in the adjusted trial balance.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

On October 1,Goodwell Company rented warehouse space to a tenant for $2,500 per month and received $12,500 for five months' rent in advance on that date.The collection was credited to the Unearned Rent account.The company's annual accounting period ends on December 31.The Unearned Rent account balance at the end of December,after adjustment,should be:

A) $5,000.

B) $7,500.

C) $12,500.

D) $2,500.

E) $10,000.

G) A) and E)

Correct Answer

verified

Correct Answer

verified

True/False

All plant assets,including land,are depreciated.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

A salary owed to employees is an example of an accrued expense.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

All of the following are true regarding prepaid expenses except:

A) They are paid for in advance of receiving their benefits.

B) They are assets.

C) When they are used,their costs become expenses.

D) The adjusting entry for prepaid expenses increases expenses and decreases liabilities.

E) The adjusting entry for prepaid expenses increases expenses and decreases assets.

G) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

On December 31,2015 Winters Company's Prepaid Rent account had a balance before adjustment of $6,000.Three months' rent was paid in advance on December 1.The adjusting entry needed on December 31 is:

A) Debit Prepaid Rent $6,000;credit Cash $6,000.

B) Debit Rent Expense $2,000;credit Accounts Payable $2,000.

C) Debit Rent Expense $2,000;credit Prepaid Rent $2,000.

D) Debit Cash $2,000;credit Prepaid Rent $2,000.

E) Debit Rent Expense $6,000;credit Accounts Payable $6,000.

G) C) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A company purchased new furniture at a cost of $14,000 on September 30.The furniture is estimated to have a useful life of 8 years and a salvage value of $2,000.The company uses the straight-line method of depreciation.What is the book value of the furniture on December 31 of the first year?

A) $13,562.50

B) $12,250.00

C) $12,500.00

D) $13,500.00

E) $13,625.00

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

On January 1,Imlay Company purchases manufacturing equipment costing $95,000 that is expected to have a five-year life and an estimated salvage value of $5,000.Imlay uses the straight-line depreciation method to allocate costs.The adjusting entry needed on December 31 of the first year is:

A) Debit Depreciation Expense,$9,000;credit Accumulated Depreciation,$9,000.

B) Debit Depreciation Expense,$18,000;credit Accumulated Depreciation,$18,000.

C) Debit Depreciation Expense,$90,000;credit Accumulated Depreciation,$90,000.

D) Debit Depreciation Expense,$18,000;credit Equipment,$18,000.

E) Debit Depreciation Expense,$9,000;credit Equipment,$9,000.

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Holman Company owns equipment with an original cost of $95,000 and an estimated salvage value of $5,000 that is being depreciated at $15,000 per year using the straight-line depreciation method.The adjusting entry needed to record annual depreciation is:

A) Debit Depreciation Expense,$15,000;credit Equipment,$15,000.

B) Debit Equipment,$15,000;credit Accumulated Depreciation,$15,000.

C) Debit Depreciation Expense,$10,000;credit Accumulated Depreciation,$10,000.

D) Debit Depreciation Expense,$10,000;credit Equipment,$10,000.

E) Debit Depreciation Expense,$15,000;credit Accumulated Depreciation,$15,000.

G) B) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

On May 1,a two-year insurance policy was purchased for $18,000 with coverage to begin immediately.What is the amount of insurance expense that would appear on the company's income statement for the first year ended December 31?

A) $750.

B) $5,270.

C) $6,000.

D) $6,750.

E) $18,000.

G) None of the above

Correct Answer

verified

Correct Answer

verified

Essay

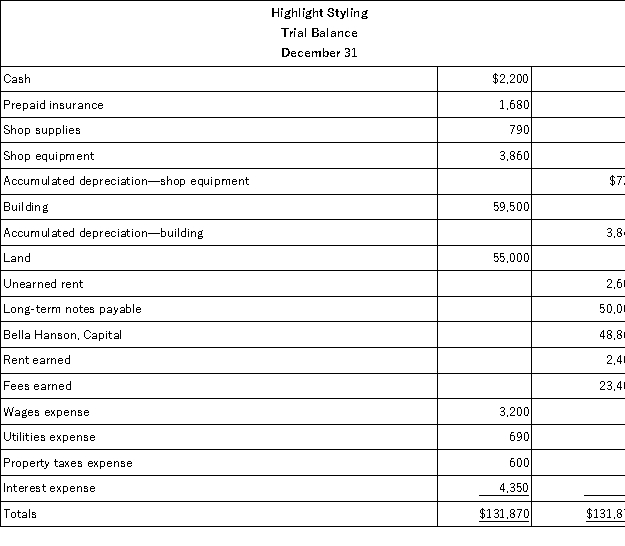

Based on the unadjusted trial balance for Highlight Styling and the adjusting information given below,prepare the adjusting journal entries for Highlight Styling.

Highlight Stylings' unadjusted trial balance for the current year follows:  Additional information:

a.An insurance policy examination showed $1,040 of expired insurance.

b.An inventory count showed $210 of unused shop supplies still available.

c.Depreciation expense on shop equipment,$350.

d.Depreciation expense on the building,$2,020.

e.A beautician is behind on space rental payments,and this $200 of accrued revenues was unrecorded at the time the trial balance was prepared.

f.$800 of the Unearned Rent account balance was still unearned by year-end.

g.The one employee,a receptionist,works a five-day workweek at $50 per day.The employee was paid last week but has worked four days this week for which she has not been paid.

h.Three months' property taxes,totaling $450,have accrued.This additional amount of property taxes expense has not been recorded.

i.One month's interest on the note payable,$600,has accrued but is unrecorded.

Additional information:

a.An insurance policy examination showed $1,040 of expired insurance.

b.An inventory count showed $210 of unused shop supplies still available.

c.Depreciation expense on shop equipment,$350.

d.Depreciation expense on the building,$2,020.

e.A beautician is behind on space rental payments,and this $200 of accrued revenues was unrecorded at the time the trial balance was prepared.

f.$800 of the Unearned Rent account balance was still unearned by year-end.

g.The one employee,a receptionist,works a five-day workweek at $50 per day.The employee was paid last week but has worked four days this week for which she has not been paid.

h.Three months' property taxes,totaling $450,have accrued.This additional amount of property taxes expense has not been recorded.

i.One month's interest on the note payable,$600,has accrued but is unrecorded.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

On December 1,Simpson Marketing Company received $3,600 from a customer for a marketing plan to be completed January 31 of the following year.The cash receipt was recorded as unearned fees.The adjusting entry for the year ended December 31 would include:

A) a debit to Earned Fees for $3,600.

B) a debit to Unearned Fees for $1,800.

C) a credit to Unearned Fees for $1,800.

D) a debit to Earned Fees for $1,800.

E) a credit Earned Fees for $3,600.

G) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

A contra account is an account linked with another account;it is added to that account to show the proper amount for the item recorded in the associated account.

B) False

Correct Answer

verified

Correct Answer

verified

Showing 101 - 120 of 161

Related Exams