A) Accounts Receivable.

B) Notes Payable.

C) Wages Payable.

D) Accounts Payable.

E) Taxes Payable.

G) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

On December 15 of the current year,Conrad Accounting Services signed a $40,000 contract with a client to provide bookkeeping services to the client in the following year.Which accounting principle would require Conrad Accounting Services to record the bookkeeping revenue in the following year and not the year the cash was received?

A) Monetary unit assumption.

B) Going-concern assumption.

C) Cost principle.

D) Business entity assumption.

E) Revenue recognition principle.

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Decreases in equity that represent costs of providing products or services to customers,used to earn revenues are called:

A) Liabilities.

B) Equity.

C) Withdrawals.

D) Expenses.

E) Owner's Investment.

G) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If a company receives $12,000 from the owner to establish a proprietorship,the effect on the accounting equation would be:

A) Assets decrease $12,000 and equity decreases $12,000.

B) Assets increase $12,000 and liabilities decrease $12,000.

C) Assets increase $12,000 and liabilities increase $12,000.

D) Liabilities increase $12,000 and equity decreases $12,000.

E) Assets increase $12,000 and equity increases $12,000.

G) D) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

All of the following are classified as liabilities except:

A) Accounts Receivable.

B) Notes Payable.

C) Wages Payable.

D) Accounts Payable.

E) Taxes Payable.

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Essay

The term ___________ refers to a liability that promises a future outflow of resources.

Correct Answer

verified

Correct Answer

verified

True/False

External users include lenders,shareholders,customers,and regulators.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Ending capital reported on the statement of owner's equity is calculated by adding owner investments and net losses and subtracting net income and withdrawals.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Technology:

A) Has replaced accounting.

B) Has not improved the clerical accuracy of accounting.

C) Reduces the time,effort and cost of recordkeeping.

D) In accounting has replaced the need for decision makers.

E) In accounting is only available to large corporations.

G) D) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The rule that (1) requires revenue to be recognized at the time it is earned, (2) allows the inflow of assets associated with revenue to be in a form other than cash,and (3) measures the amount of revenue as the cash plus the cash equivalent value of any noncash assets received from customers in exchange for goods or services,is called the:

A) Going-concern assumption.

B) Cost principle.

C) Revenue recognition principle.

D) Objectivity principle.

E) Business entity assumption.

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Charlie's Chocolates' owner made investments of $50,000 and withdrawals of $20,000.The company has revenues of $83,000 and expenses of $64,000.Calculate its net income.

A) $30,000.

B) $83,000.

C) $64,000.

D) $19,000.

E) $49,000.

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

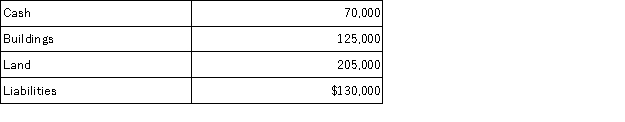

Use the following information for Meeker Corp.to determine the amount of equity to report.

A) $390,000.

B) $140,000.

C) $20,000.

D) $530,000.

E) $270,000.

G) A) and E)

Correct Answer

verified

Correct Answer

verified

True/False

The statement of cash flows shows the net effect of revenues and expenses for a reporting period.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If equity is $300,000 and liabilities are $192,000,then assets equal:

A) $108,000.

B) $192,000.

C) $300,000.

D) $492,000.

E) $792,000.

G) C) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

All of the following regarding a Certified Public Accountant are true except:

A) Must meet education and experience requirements.

B) Must pass an examination.

C) Must exhibit ethical character.

D) May also be a Certified Management Accountant.

E) Cannot hold any certificate other than a CPA.

G) C) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Distributions of cash or other resources by a business to its owners are called:

A) Withdrawals.

B) Expenses.

C) Assets.

D) Retained earnings.

E) Net Income.

G) B) and D)

Correct Answer

verified

Correct Answer

verified

True/False

The fraud triangle asserts that the three factors that must exist for a person to commit fraud are opportunity,pressure,and rationalization.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The statement of cash flows reports all of the following except:

A) Cash flows from operating activities.

B) Cash flows from investing activities.

C) Cash flows from financing activities.

D) The net increase or decrease in assets for the period reported.

E) The net increase or decrease in cash for the period reported.

G) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

Generally accepted accounting principles are the basic assumptions,concepts,and guidelines for preparing financial statements.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The accounting principle that requires accounting information to be based on actual cost and requires assets and services to be recorded initially at the cash or cash-equivalent amount given in exchange,is the:

A) Accounting equation.

B) Cost principle.

C) Going-concern assumption.

D) Realization principle.

E) Business entity assumption.

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Showing 121 - 140 of 233

Related Exams