A) shown by the expense accounts such as Wages Expense and Utilities Expense that are listed in the Operating Expenses section of the income statement.

B) shown as Direct Labor,Raw Materials,and Manufacturing Overhead in the Operating Expenses section of the income statement.

C) used in the computation of cost of goods manufactured.

D) shown in the Cost of Goods Sold section of the income statement.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

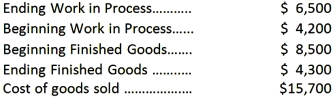

Compute cost of goods manufactured from the information given:

A) $13,400.

B) $11,500.

C) $19,900.

D) $18,000.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Essay

The salary paid to a factory supervisor would be classified as ____________________ labor.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

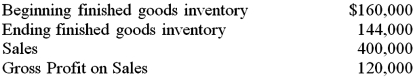

The following information appears on the income statement of the Richer Company at the end of the year.  Cost of Goods Manufactured was:

Cost of Goods Manufactured was:

A) $246,000.

B) $280,000.

C) $264,000.

D) $240,000.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Wages paid to the factory maintenance and repair personnel of a manufacturing business are shown

A) in the Operating Expenses section of the income statement.

B) as Direct Labor on the statement of cost goods manufactured.

C) as part of Manufacturing Overhead on the statement cost of goods manufactured.

D) as a part of the Cost of Goods Sold section of the income statement.

F) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

Raw materials purchased during the month were $66,000.During that same period,$95,000 was used and ending inventory was $35,000.The beginning raw material inventory must have been $60,000.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The balance sheet of a manufacturing firm will include Raw Materials,Work in Process,Manufacturing Overhead and Finished Goods inventory accounts.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In adjusting entries for a manufacturing business,the beginning balance of the work in process inventory is eliminated by crediting Work in Process Inventory and debiting

A) Finished Goods Inventory.

B) Manufacturing Summary.

C) Income Summary.

D) Merchandise Inventory.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

True/False

The balance of the Manufacturing Summary account is closed into the Income Summary account.

B) False

Correct Answer

verified

Correct Answer

verified

Essay

Bolton Company's total manufacturing cost for the year was $1,785,000.The firm's manufacturing overhead was $315,000,and its cost of raw materials used was $842,000.What was the direct labor cost for the year?

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The cost of goods manufactured is computed by

A) adding raw materials used and direct labor to manufacturing overhead.

B) deducting the ending work in process inventory from the sum of the total manufacturing cost and the beginning work in process inventory.

C) deducting the ending finished goods inventory from the beginning finished goods inventory.

D) adding operating expenses to direct labor costs.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Essay

On a worksheet for a manufacturing business,the beginning inventory of finished goods is extended to the ____________________ Debit column.

Correct Answer

verified

Correct Answer

verified

True/False

Amounts paid to factory repair and maintenance employees are considered direct labor.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The beginning and ending balances of the finished goods inventory are not used in the computation of cost of goods manufactured.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

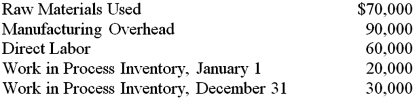

The following information appears on the Statement of Cost of Goods Manufactured for the Ethridge Company at the end of the year.  Cost of Goods Manufactured for the year was:

Cost of Goods Manufactured for the year was:

A) $200,000.

B) $210,000.

C) $220,000.

D) $240,000.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

The total component costs of a manufactured item include direct materials,direct labor and manufacturing overhead.

B) False

Correct Answer

verified

Correct Answer

verified

Essay

The beginning and ending ____________________ inventories appear in the Cost of Goods Sold section of the income statement of a manufacturing business.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is NOT an adjusting entry?

A) ![]()

B) ![]()

C) ![]()

D) ![]()

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Once the financial statements have been prepared,the steps in the accounting cycle are complete.Which of the following is NOT one of the steps in the accounting cycle?

A) Adjusting entries

B) Closing Trial Balance

C) Post Closing Trial Balance

D) Closing entries

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Reversing entries are required by

A) the Internal Revenue Service.

B) Generally Accepted Accounting Principles.

C) the International Accounting Standards Board.

D) none of these.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Showing 41 - 60 of 103

Related Exams