Correct Answer

verified

Correct Answer

verified

True/False

Because the number of shares of common stock outstanding during the year can fluctuate,computing return on common stockholders' equity is not a useful indicator of profitability.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If current liabilities are $90,000,long-term liabilities are $270,000,and total assets are $600,000,what is the percentage of total liabilities to total assets?

A) 15 percent

B) 45 percent

C) 60 percent

D) 100 percent

F) All of the above

Correct Answer

verified

Correct Answer

verified

True/False

Comparison of amounts and percentages for only two years is adequate to indicate long-term trends.

B) False

Correct Answer

verified

Correct Answer

verified

Essay

What is the PE ratio? How is it calculated and why is it that the PE ratio for a privately held company often cannot be calculated?

Correct Answer

verified

The PE ratio is the price-earnings ratio...View Answer

Show Answer

Correct Answer

verified

View Answer

True/False

The current ratio measures a company's ability to pay its current debts using current assets.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The Terence Hill Company has current assets of $350,000 and a current ratio of .7.Its current liabilities therefore must equal $500,000.

B) False

Correct Answer

verified

Correct Answer

verified

Essay

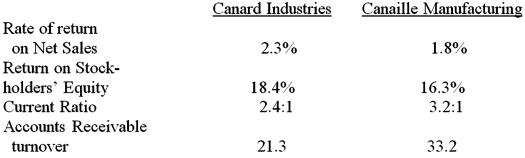

Selected financial ratios are given for Canard Industries and Canaille Manufacturing.Both firms have come to your bank and requested loans.You are a loan officer at Noir Bank but can only loan funds to one of the firms.Make your decision based on the information provided.In a short paragraph,explain the basis for the selection you made.

Correct Answer

verified

Student answers will vary.They should to...View Answer

Show Answer

Correct Answer

verified

View Answer

Essay

A company reported net income of $80,000 for 2016,and net income of $100,000 for 2017.Net income increased by ____________________ percent.

Correct Answer

verified

Correct Answer

verified

True/False

The rate of return on sales measures how effectively management has used the assets of the company.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Peterson Company has current liabilities of $130,000 and working capital of $32,000.Its current assets therefore must equal $162,000.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

In horizontal analysis,the change from year to year itself can be interpreted to represent the changes in external prices that impact the business.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Simon Company has current liabilities of $30,000 and a current ratio of 1.2.Its current assets therefore must equal $25,000.

B) False

Correct Answer

verified

Correct Answer

verified

Essay

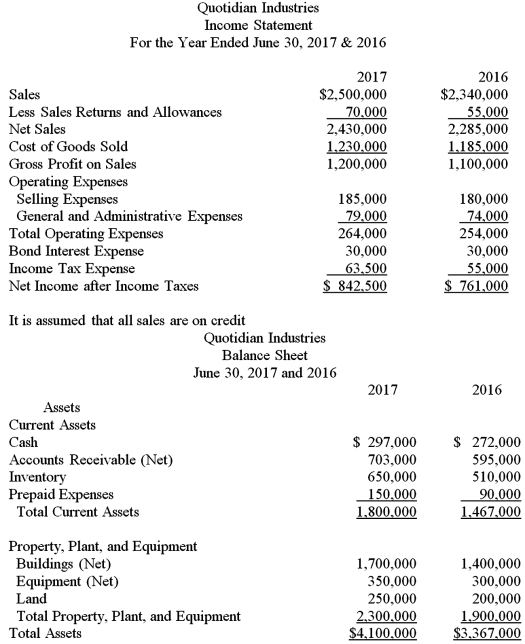

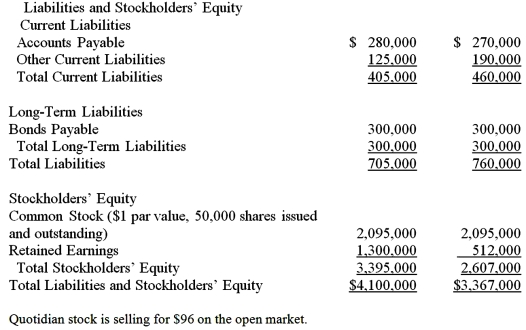

Using the information given,analyze the liquidity of Quotidian Industries for 2017.

Using the information given,analyze the liquidity of Quotidian Industries for 2017.

Correct Answer

verified

Working capital = $1,395,000

Current rat...View Answer

Show Answer

Correct Answer

verified

Current rat...

View Answer

True/False

As a result of extraordinary losses during the year,the number of times bond interest earned ratio decreased from 4.5 times to 1.5 times.This change is indicative of increasing financial strength.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If total merchandise available for sale is 72 percent of net sales and cost of goods sold is 64 percent of net sales,gross profit on sales is

A) 8 percent of net sales.

B) 36 percent of net sales.

C) 28 percent of net sales.

D) 20 percent of net sales.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A firm has current liabilities of $60,000,stockholders' equity of $180,000 and total assets of $300,000.The percentage of total liabilities to total assets is

A) 20 percent.

B) 40 percent.

C) 60 percent.

D) 80 percent.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Essay

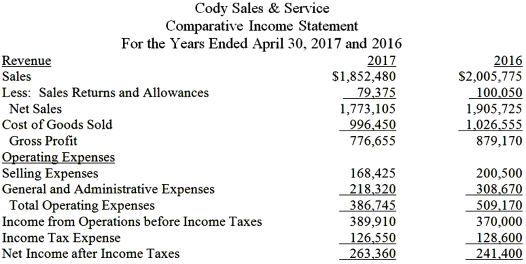

Using the information shown,prepare a horizontal analysis.Carry all calculations to two decimal places and then round to one decimal place.

Using the information shown,prepare a horizontal analysis.Carry all calculations to two decimal places and then round to one decimal place.

Correct Answer

verified

Correct Answer

verified

True/False

The current ratio is a measure of profitability.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

In horizontal analysis,the base year is the most recent year.

B) False

Correct Answer

verified

Correct Answer

verified

Showing 81 - 100 of 107

Related Exams