A) corrections of errors.

B) updating entries for previously unrecorded expenses or revenues.

C) not required.

D) will always affect cash.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

Prepaid expenses,such as prepaid rent and prepaid insurance,represent assets for a business until they are used.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The normal balance of a contra asset account is a debit.

B) False

Correct Answer

verified

Correct Answer

verified

Essay

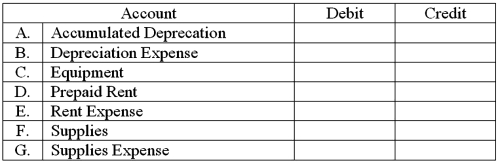

For each of the accounts listed below,enter the words,Increase or Decrease,in the Debit and Credit columns to indicate the effects of each on the account balance.

Correct Answer

verified

Correct Answer

verified

Essay

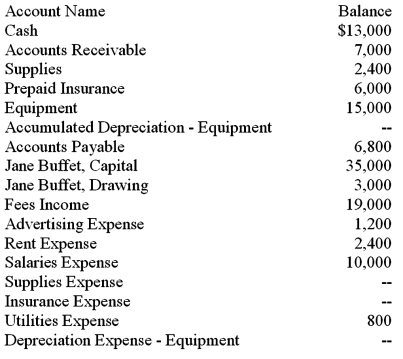

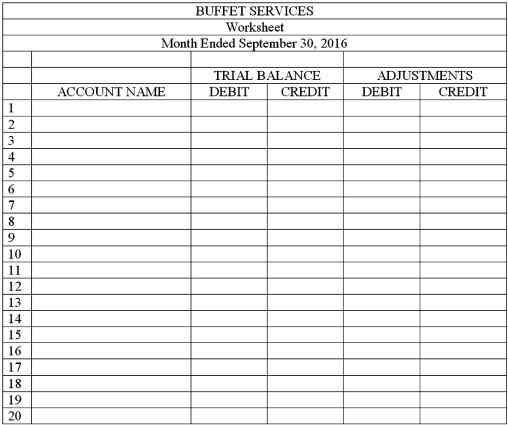

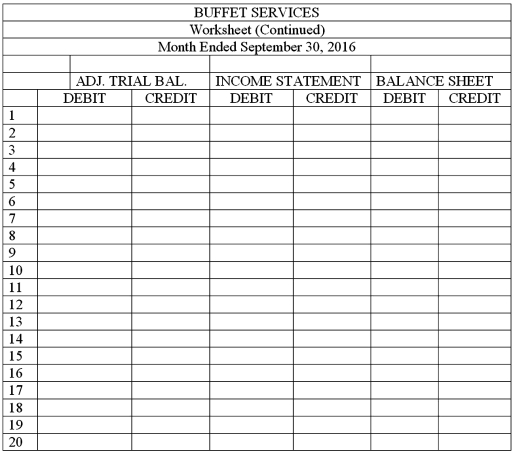

The balances of the ledger accounts for Buffet Services on September 30,2016,and the information needed for adjustments are shown below.Prepare the Trial Balance section,record the adjustments,and complete the worksheet.  Adjustment information:

(a)The supplies were purchased on September 1,2016.An inventory of supplies showed $1,200 on hand on September 30,2016.

(b)The amount of Prepaid Insurance represents a payment made September 1,2016,for a six-month insurance policy.

(c)The equipment,purchased September 1,2016,has an estimated useful life of 5 years with no salvage value.The firm uses the straight-line method of depreciation.

Adjustment information:

(a)The supplies were purchased on September 1,2016.An inventory of supplies showed $1,200 on hand on September 30,2016.

(b)The amount of Prepaid Insurance represents a payment made September 1,2016,for a six-month insurance policy.

(c)The equipment,purchased September 1,2016,has an estimated useful life of 5 years with no salvage value.The firm uses the straight-line method of depreciation.

Correct Answer

verified

Correct Answer

verified

Essay

On a worksheet,the adjusted balance of Supplies is extended from the Adjusted Trial Balance Debit column to the ____________________ Debit column.

Correct Answer

verified

Correct Answer

verified

Essay

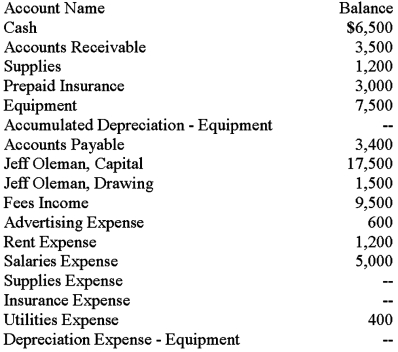

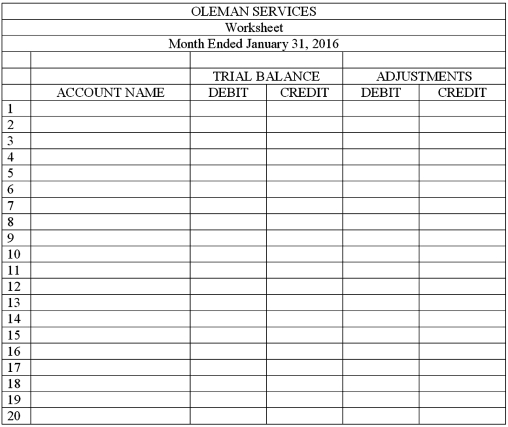

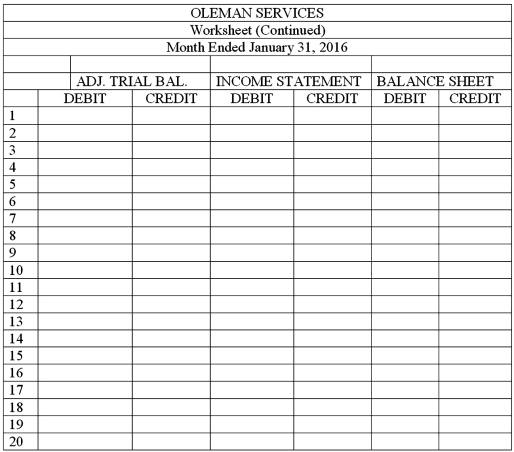

The balances of the ledger accounts for Oleman Services on January 31,2016,and the information needed for adjustments are shown below.Prepare the Trial Balance section,record the adjustments,and complete the worksheet.  Adjustment information:

(a)The supplies were purchased on January 1,2016.An inventory of supplies showed $600 on hand on January 31,2016.

(b)The amount of Prepaid Insurance represents a payment made January 1,2016,for a six-month insurance policy.

(c)The equipment,purchased January 1,2016,has an estimated useful life of 5 years with no salvage value.The firm uses the straight-line method of depreciation.

Adjustment information:

(a)The supplies were purchased on January 1,2016.An inventory of supplies showed $600 on hand on January 31,2016.

(b)The amount of Prepaid Insurance represents a payment made January 1,2016,for a six-month insurance policy.

(c)The equipment,purchased January 1,2016,has an estimated useful life of 5 years with no salvage value.The firm uses the straight-line method of depreciation.

Correct Answer

verified

11eac063_c40a_0e21_9623_bd1c83cc193a_TB5411_00 11eac063_c40a_3532_9623_11b01b602f08_TB5411_00

Correct Answer

verified

Essay

The account credited in the adjusting entry made to record the expiration of a portion of prepaid rent is the ____________________ account.

Correct Answer

verified

Prepaid Rent

Correct Answer

verified

Essay

The process of allocating the cost of a long-term asset as an expense of operations during the asset's expected useful life is known as ____________________.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

On a balance sheet,Accumulated Depreciation-Equipment is reported

A) as a deduction from the cost of the equipment.

B) as a liability.

C) as an expense.

D) as a deduction from the total of the assets.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

On November 25,2016,the company paid $24,000 rent in advance for a six-month period (December 2016 through May 2017) .On December 31,2016,the adjustment for expired rent would include

A) a $4,000 debit to Prepaid Rent.

B) a $4,000 credit to Rent Expense.

C) a $24,000 debit to Rent Expense.

D) a $4,000 credit to Prepaid Rent.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Equipment cost $36,000 and is expected to be useful for 5 years and have no salvage value.Under the straight-line method,monthly depreciation will be

A) $600.

B) $720.

C) $60.

D) $12.

F) A) and C)

Correct Answer

verified

A

Correct Answer

verified

Multiple Choice

On a worksheet,a net loss is

A) recorded in the Income Statement Debit column.

B) recorded in the Balance Sheet Debit column.

C) recorded in the Balance Sheet Credit column.

D) not recorded.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

On Jan.1,2016 Johnson Consulting purchased a truck for $12,000.The truck was expected to last 60 months and have no salvage value.Calculate the book value of the truck after two years?

A) $4,800

B) $7,200

C) $11,600

D) $12,000

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

Land is a long-term asset that is not subject to depreciation.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The book value of long-term assets is reported on

A) the income statement.

B) the statement of owner's equity.

C) the balance sheet.

D) the worksheet.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

On a worksheet,the adjusted balance of the Supplies Expense account is extended to:

A) the Income Statement Debit column.

B) the Income Statement Credit column.

C) the Balance Sheet Debit column.

D) the Balance Sheet Credit column.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Equipment costing $13,500 with an estimated salvage value of $1,020 and an estimated life of 4 years was purchased on November 1,2016.Using the straight-line depreciation method,what is the amount of depreciation expense to be recorded at December 31,2016?

A) $260

B) $520

C) $3,120

D) $1,020

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

During its first year of business,XYZ Inc.purchased $2,400 of supplies.By the end of the year,only $500 of supplies remain in the supply cabinet.Determine the amount to be reported in the Supplies account in the Adjusted Trial Balance section of the worksheet prepared on December 31.

A) $500

B) $1,900

C) $2,400

D) $2,900

F) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

The statement of owner's equity is prepared from the data in the Income Statement section of the worksheet.

B) False

Correct Answer

verified

Correct Answer

verified

Showing 1 - 20 of 76

Related Exams