A) classified income statement.

B) multiple-step income statement.

C) single-step income statement.

D) categorized income statement.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

If the Income Summary account has a credit balance after revenues,and expenses are closed,the firm had a net income for the fiscal period.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Use the following account balances from the adjusted trial balance columns of RB Auto's worksheet to answer below question.  Select the closing entry that RB Auto would make at the end of the accounting period to close their revenue accounts and income statement accounts with credit balances.

Select the closing entry that RB Auto would make at the end of the accounting period to close their revenue accounts and income statement accounts with credit balances.

A) debit Sales and credit Income Summary for $15,000.

B) debit Income Summary for $15,000 and credit Sales for $15,000.

C) debit Sales and credit R Holloway,Capital for $15,000.

D) debit Sales $15,000;debit Purchase Returns and Allowances $200 and credit Income Summary for $15,200.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Use the following account balances from the adjusted trial balance columns of RB Auto's worksheet to answer below question.  Select the correct closing entry that RB Auto would make to close their expense account(s) at the end of the accounting period.

Select the correct closing entry that RB Auto would make to close their expense account(s) at the end of the accounting period.

A) debit Salary Expense $4,000;debit Rent Expense $3,000;debit Purchases $2,000 and credit Income Summary $9,000

B) debit Income Summary $9,000 and credit Salary Expense $4,000;credit Rent Expense $3,000;credit Purchases $2,000

C) debit Income Summary $9,000 and credit R.Holloway,Capital for $9,000

D) debit R.Holloway,Capital $9,000 and credit Salary Expense $4,000;credit Rent Expense $3,000;credit Purchases $2,000

F) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

The balance of the Sales Returns and Allowances account is reported as a selling expense in Operating Expenses section of a multiple-step income statement.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The balance of the owner's drawing account is

A) listed in the Other Expenses section of the income statement.

B) listed in the Current Assets section of the balance sheet.

C) used in the calculation of ending capital on a statement of owner's equity.

D) listed in the Operating Expenses section of the income statement.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

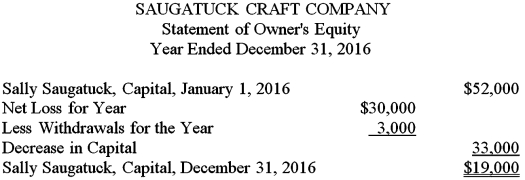

The beginning capital balance shown on a statement of owner's equity is $43,000.Net income for the period is $18,000.The owner withdrew $22,000 cash from the business and made no additional investments during the period.The owner's capital balance at the end of the period is

A) $39,000.

B) $47,000.

C) $61,000.

D) $83,000.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A total of $8,000 in supplies was purchased during the year.By the end of the year,the company had used up $5,300 of the supplies.The adjusting entry needed at the end of the year is:

A) ![]()

B) ![]()

C) ![]()

D) ![]()

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

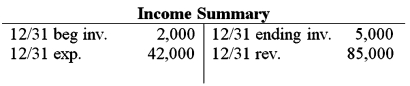

The accountant of Randy's Flooring has closed all of the temporary income statement accounts.The accountant is now ready to close the Income Summary account.Using the Income Summary T-account below,determine the correct closing entry the accountant needs to make in order to close the account.

A) ![]()

B) ![]()

C) ![]()

D) ![]()

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Essay

The ____________________ of a building is the portion of the original cost that has not yet been depreciated.

Correct Answer

verified

Correct Answer

verified

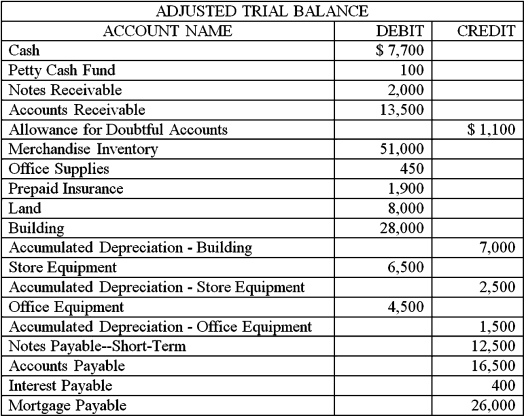

Multiple Choice

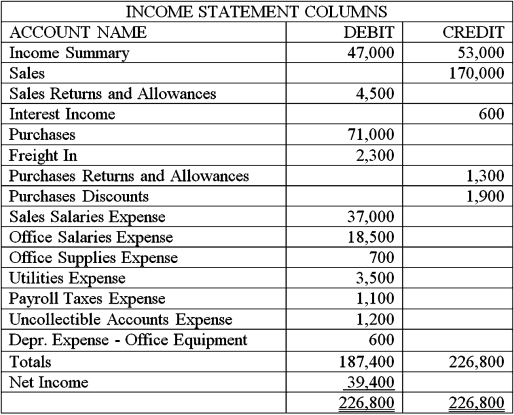

Use the following account balances from the adjusted trial balance columns of Goody Chocolate's worksheet to answer below question.  Using the adjusted trial balance above,select the correct closing entry that Goody Chocolate would make to close the expense accounts (and cost of goods sold accounts with debit balances) at the end of the accounting period.

Using the adjusted trial balance above,select the correct closing entry that Goody Chocolate would make to close the expense accounts (and cost of goods sold accounts with debit balances) at the end of the accounting period.

A) ![]()

B) ![]()

C) ![]()

D) ![]()

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Prepaid expenses appear in the

A) Operating Expenses section of the income statement.

B) Other Expenses section of the income statement.

C) Current Assets section of the balance sheet.

D) Current Liabilities section of the balance sheet.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Essay

A gross profit percentage of 45 percent means that for every $1 of net sales,gross profit amounts to ___________________.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Use the following account balances from the adjusted trial balance columns of Goody Chocolate's worksheet to answer below question.  Using the adjusted trial balance above,select the correct closing entry that Goody Chocolate would make to close their revenue accounts (and other temporary income statement accounts with credit balances) at the end of the accounting period.

Using the adjusted trial balance above,select the correct closing entry that Goody Chocolate would make to close their revenue accounts (and other temporary income statement accounts with credit balances) at the end of the accounting period.

A) ![]()

B) ![]()

C) ![]()

D) ![]()

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

When a firm experiences a net loss,the owner's capital is decreased.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

After all adjusting entries are posted,the balances of the general ledger accounts should match the amounts shown in the Adjusted Trial Balance section of the worksheet.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Interest on notes payable would be listed in the Other Income section of a classified income statement.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Current assets provide the funds needed to pay bills and meet expenses.

B) False

Correct Answer

verified

Correct Answer

verified

Showing 21 - 38 of 38

Related Exams