A) total assets.

B) total liabilities.

C) net income.

D) total stockholders' equity.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If an analyst wants to examine a company's short-run ability to survive, which of the following would best be considered?

A) Liquidity

B) Market share

C) Profitability

D) Solvency

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following measures would assist in assessing the profitability of a company?

A) Fixed asset turnover

B) Times interest earned ratio

C) Inventory turnover ratio

D) Debt-to-assets ratio

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

If earnings per share (EPS) decreases, it must mean that the company's net income has fallen

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is calculated by dividing (net income less preferred dividends) by average common stockholders' equity?

A) Return on assets ratio

B) Return on equity ratio

C) Earnings per share

D) Net profit margin ratio

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Essay

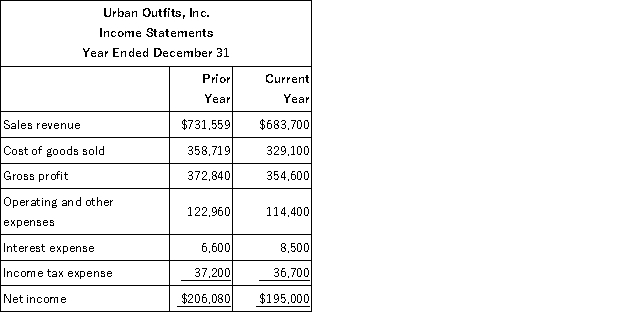

The income statements for Urban Outfits, Inc. are presented below:  Required:

Part a. Prepare a horizontal analysis of the income statement above. Round to the nearest whole percent.

Part b. Interpret your analysis. Comment on significant changes.

Required:

Part a. Prepare a horizontal analysis of the income statement above. Round to the nearest whole percent.

Part b. Interpret your analysis. Comment on significant changes.

Correct Answer

verified

Part a  Part b

Part b

Sales increased by 7% but...View Answer

Show Answer

Correct Answer

verified

Sales increased by 7% but...

View Answer

True/False

Horizontal analysis is the comparison of each financial statement amount to another amount on the same financial statement

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The assumption that a business is capable of continuing its operations long enough to meet its obligations is called the:

A) solvency assumption.

B) going-concern assumption.

C) profitability assumption.

D) liquidity assumption.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following ratios is used to evaluate a company's liquidity?

A) Debt-to-assets ratio

B) Fixed asset turnover ratio

C) Return on equity ratio

D) Current ratio

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements about trend analysis is correct?

A) Time-series analysis is an example of trend analysis.

B) Trend data are always in dollars.

C) Trend analysis is also known as vertical analysis.

D) Common-size analysis is an example of trend analysis.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The principle that requires companies to include notes to their financial statements is the:

A) full disclosure principle.

B) going-concern principle.

C) cost-benefit principle.

D) historical cost principle.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A current ratio of less than one is not so much of a concern when the company has a:

A) low fixed asset turnover ratio.

B) high days to collect number.

C) high inventory turnover ratio.

D) high debt-to-equity ratio.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

The higher the times interest earned ratio, the greater the risk of nonpayment of interest

B) False

Correct Answer

verified

Correct Answer

verified

Essay

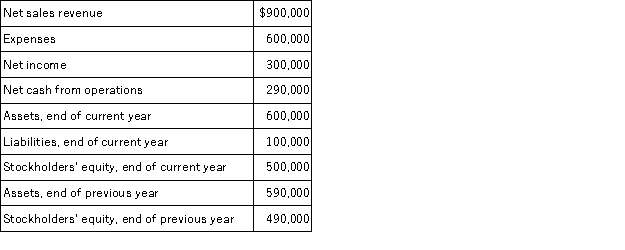

The following information is taken from the financial statements ofB. Darin Company:

Expenses include interest of $10,000 and income tax of $90,000. There was an average of 40,000 shares of common stock outstanding during the year and the market price of the stock is $15 per share at the end of the year. There was no preferred stock outstanding during the year.

Required:

Calculate the following ratios for the current year:

Part a. Fixed asset turnover

Part b. Return on equity (ROE)

Part c. Earnings per share (EPS)

Part d. Times interest earned

Part e. Price/Earnings ratio

Part f. Debt-to-assets ratio

Part g. Net profit margin

Expenses include interest of $10,000 and income tax of $90,000. There was an average of 40,000 shares of common stock outstanding during the year and the market price of the stock is $15 per share at the end of the year. There was no preferred stock outstanding during the year.

Required:

Calculate the following ratios for the current year:

Part a. Fixed asset turnover

Part b. Return on equity (ROE)

Part c. Earnings per share (EPS)

Part d. Times interest earned

Part e. Price/Earnings ratio

Part f. Debt-to-assets ratio

Part g. Net profit margin

Correct Answer

verified

Part a

Average total assets = ($600,000 ...View Answer

Show Answer

Correct Answer

verified

Average total assets = ($600,000 ...

View Answer

Multiple Choice

If cost of goods sold remains unchanged, an increase in the inventory turnover ratio is indicative of a(n) :

A) reduction in the cost of goods sold.

B) decrease in inventory.

C) increase in inventory.

D) increase in sales revenue.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Essay

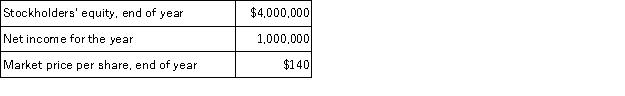

A company had 10,000 shares of common stock outstanding throughout the year. The following information is also available:  Required:

Calculate the Price/Earnings ratio at the end of the current year.

Required:

Calculate the Price/Earnings ratio at the end of the current year.

Correct Answer

verified

EPS = Net income/Average commo...View Answer

Show Answer

Correct Answer

verified

View Answer

True/False

The fixed asset turnover ratio is a profitability ratio

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is calculated by dividing net revenue by average net fixed assets?

A) Net profit margin

B) Fixed asset turnover

C) Total asset turnover

D) Current ratio

F) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

The going-concern assumption is also known as the continuity assumption

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following ratios is a solvency ratio?

A) Net profit margin ratio

B) Current ratio

C) Fixed asset turnover ratio

D) Debt-to-assets ratio

F) All of the above

Correct Answer

verified

Correct Answer

verified

Showing 61 - 80 of 145

Related Exams