A) on the statement of cash flows as an operating activity.

B) on the statement of cash flows as an investing activity.

C) on the statement of cash flows as a financing activity.

D) as a supplementary disclosure to the statement of cash flows.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following represents a cash inflow from financing activities?

A) Issuing stock in exchange for another company's stock.

B) Paying a bond's face value at maturity.

C) Issuing long-term bonds at a discount.

D) Receiving interest on promissory notes.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Cash and cash equivalents include assets that:

A) have stable long-term value.

B) are short-term, highly liquid, and purchased by the entity within three months of maturity.

C) consistently grow in value over the long run.

D) are expected to be used up within a year.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Assume that the indirect method is used to determine net cash provided by (used in) operating activities and that Accounts Receivable balance decreased by $10 million during the year. That $10 million should be:

A) added to net income.

B) subtracted from net income.

C) added to investing activities.

D) subtracted from investing activities.

F) All of the above

Correct Answer

verified

Correct Answer

verified

True/False

Using the T-account approach to preparing the statement of cash flows, an increase in Accounts Payable would appear on the debit side of the Cash account

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Material noncash investing and financing transactions are:

A) reported within the body of the statement of cash flows.

B) reported in a supplementary schedule to the statement of cash flows.

C) not reported in any part of the financial statement because cash flow is not affected.

D) reported in the body of the income statement.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

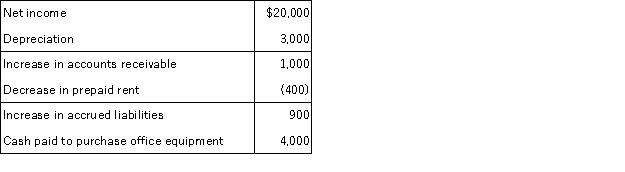

Consider the following information:  What is the net cash provided by operating activities?

What is the net cash provided by operating activities?

A) $17,500

B) $18,500

C) $21,500

D) $23,300

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If Insurance Expense is $7,000 and the beginning and ending balances of Prepaid Insurance are $1,500 and $2,000, respectively, the cash paid for insurance is:

A) $7,000.

B) $6,500.

C) $5,000.

D) $7,500.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A corporation had a net increase in Retained Earnings of $65,000 for the year. The corporation also paid $20,000 of cash dividends that had been declared in the previous year. This year, the corporation declared $18,000 of dividends but has not paid them as of year-end. Given this information, the net income for the current year must have been:

A) $63,000

B) $85,000

C) $65,000

D) $83,000

F) A) and D)

Correct Answer

verified

D

Correct Answer

verified

Multiple Choice

Chino Company reported net income of $20,000 for the current year. During the year, Inventory decreased by $7,000, Accounts Payable decreased by $8,000, Depreciation Expense was $10,000, and Accounts Receivable increased by $6,500. If the indirect method is used, what is the net cash provided by operating activities?

A) $10,500

B) $22,500

C) $38,500

D) $51,500

F) None of the above

Correct Answer

verified

B

Correct Answer

verified

Multiple Choice

A piece of equipment with a cost of $130,000 and accumulated depreciation of $85,000 is sold for $50,000 cash. The amount that should be reported as a cash inflow from investing activities is:

A) $50,000.

B) $5,000.

C) $45,000.

D) $0; this transaction is a financing activity.

F) B) and D)

Correct Answer

verified

A

Correct Answer

verified

Multiple Choice

Which of the following is the best measure of a company's profitability?

A) Cash-based net income

B) Accrual-based net income

C) Accounts Receivable

D) Sales Revenue

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is not needed to prepare a statement of cash flows?

A) Statement of Retained Earnings

B) Comparative balance sheets

C) Additional data concerning selected accounts that increase and decrease as a result of investing and/or financing activities

D) A complete income statement

F) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

Major investing and financing activities that do not involve cash do not have to be reported as part of the statement of cash flows

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

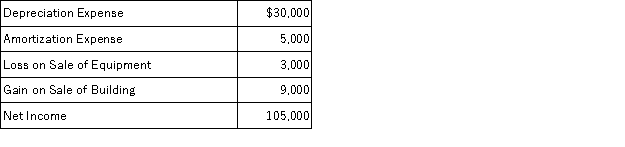

The following information is taken from the income statement of Muir Company:  Based on this information, what is the amount of net cash flow provided by operating activities?

Based on this information, what is the amount of net cash flow provided by operating activities?

A) $149,000

B) $140,000

C) $146,000

D) $134,000

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

What is the starting point for calculating cash flows from operations when the indirect method is used?

A) Find net income on the income statement.

B) Calculate the net change in the cash account.

C) Add the change in accounts receivable to sales revenue.

D) Identify the balance sheet accounts that relate to operating activities.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Repayments of loans will be reported as a:

A) negative cash flow under financing activities.

B) positive cash flow under financing activities.

C) negative cash flow under investing activities.

D) positive cash flow under investing activities.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A company bought $250,000 of equipment with an expected life of ten years and no residual value. After six years the company sold the equipment for $94,000. If the company uses straight-line depreciation and the indirect method is used to determine cash flows from operating activities, which of the following reflects how the sale of the equipment would be reported in the statement of cash flows?

A) $94,000 is recorded as a cash inflow from investing activities and no other sections of the statement are affected.

B) $94,000 is recorded as a cash inflow from investing activities and $6,000 is added to convert net income to net cash flow provided by operating activities.

C) $94,000 is recorded as a cash inflow from investing activities and $6,000 is subtracted to convert net income to net cash flow provided by operating activities.

D) $94,000 is recorded as a cash inflow from operating activities.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following equations is correct?

A) Change in cash = Change in noncash assets

B) Change in cash = Change in liabilities + Change in stockholders' equity

C) Change in cash = Change in liabilities + Change in stockholders' equity - Change in noncash assets

D) Change cash = Change in liabilities + Change in stockholders' equity + Change in noncash assets

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Using the indirect method, which of the following would be added to net income?

A) A decrease in Supplies

B) An increase in Prepaid Insurance

C) A decrease in Salaries and Wages Payable

D) An increase in Equipment

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Showing 1 - 20 of 208

Related Exams