A) To set long-term goals and objectives.

B) To arrange for the necessary resources to achieve a plan.

C) To provide information for decision making.

D) To motivate others to work towards a plan's success.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following changes introduced by the Sarbanes-Oxley Act is intended to counteract incentives for fraud?

A) Stronger oversight by directors

B) Code of ethics

C) Stiffer fines and prison terms

D) Anonymous tip lines

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

What determines the difference between a product cost and a period cost?

A) Whether the cost changes when activity levels change.

B) Whether the cost is relevant to a particular decision.

C) Whether the cost can be traced to a specific cost object.

D) When the cost will be matched against revenue on the income statement.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is not one of the categories used to sort costs in managerial accounting?

A) Relevant or irrelevant

B) Variable or fixed

C) Out-of-pocket or opportunity

D) Direct or indirect

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A fixed cost:

A) goes up in total when activity increases.

B) goes up per unit when activity increases.

C) goes down in total when activity increases.

D) goes down per unit when activity increases.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following types of reports is more characteristic of managerial accounting than financial accounting?

A) An internal report used by management

B) An external report used by investors

C) A report prepared according to GAAP

D) A report prepared periodically (monthly, quarterly, annually)

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A direct cost is one that:

A) involves an actual outlay of cash for a specific cost object.

B) can be traced to a specific cost object.

C) cannot be traced to a specific cost object.

D) is not worth the effort of tracing to a specific cost object.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is correct about the triple bottom line?

A) The triple bottom line measures a company's social impact, without regard for profit.

B) The triple bottom line captures three factors: People, Profit, and Planet.

C) The triple bottom line has replaced net income as the most crucial measure of a company's success.

D) The triple bottom line reports profit at the expense of social factors.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

You are to receive five gold coins from your great uncle as an incentive to study hard. The coins were originally purchased in 1982. Your great uncle will deliver the coins the week after finals (assuming your grades are "acceptable") . The amount your great uncle paid for the coins is a(n) :

A) opportunity cost.

B) indirect cost.

C) sunk cost.

D) overhead cost.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

An irrelevant cost:

A) is also called a differential cost.

B) must differ between decision alternatives.

C) must be incurred in the future rather than in the past.

D) will not influence a decision.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is not a characteristic of financial accounting?

A) Information is reported at the decision making level.

B) Information is used by external parties.

C) Information is objective, reliable and historical.

D) Reports are prepared periodically.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

An opportunity cost is:

A) the foregone benefit of the path not taken.

B) an actual outlay of cash.

C) the initial investment required to pursue an opportunity.

D) a cost that cannot be traced to a specific cost object.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is not true about how the Sarbanes-Oxley Act counteracts incentives for committing fraud?

A) It provides for stiffer monetary penalties.

B) It increases the maximum jail sentence for fraudulent reporting.

C) It removes legal protection from whistleblowers.

D) It provides that violators must repay any money obtained via fraud and pay fines.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is not a manufacturing cost?

A) Raw materials cost.

B) Marketing cost.

C) Direct labor cost.

D) Manufacturing overhead cost.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

Managers of small, private corporations use managerial accounting information whereas managers of large, public corporations use financial accounting information

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Of the following groups, which is the primary user of managerial accounting information?

A) Investors

B) Creditors

C) Regulators

D) Managers

F) A) and C)

Correct Answer

verified

Correct Answer

verified

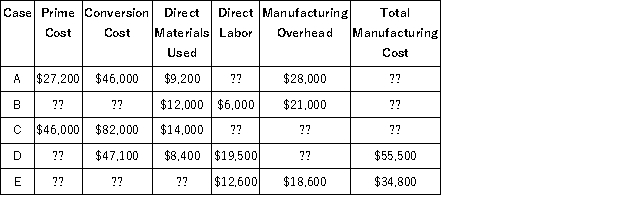

Essay

For each of the following independent cases, compute the missing values:

Correct Answer

verified

Correct Answer

verified

Multiple Choice

To earn summer money, Joe could mow lawns in his neighborhood, or he could work at a local grocery store. Which of the following is an opportunity cost of mowing lawns?

A) Cash paid for gas to run the lawnmower.

B) The time spent mowing the lawns.

C) The wages he could have earned working at the grocery store.

D) Depreciation on the lawnmower.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is true about product and period costs?

A) Product costs are usually manufacturing costs, and period costs are usually nonmanufacturing costs.

B) Product costs are usually nonmanufacturing costs, and period costs are usually manufacturing costs.

C) Both product and period costs are usually manufacturing costs.

D) Both product and period costs are usually nonmanufacturing costs.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Prime costs are defined as:

A) manufacturing costs plus non-manufacturing costs.

B) direct labor plus direct materials.

C) variable costs equal fixed costs.

D) manufacturing overhead plus direct labor.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Showing 21 - 40 of 131

Related Exams