B) False

Correct Answer

verified

Correct Answer

verified

True/False

The current ratio is a good indicator of the degree to which a firm relies on borrowed funds in its operations.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

A firm's balance sheet reports its financial condition on a specific date.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Although accounting has several specific uses, the overall purpose of accounting can be summarized as

A) to provide financial information that is useful to decision makers.

B) to meet the legal requirements of the Financial Accounting Standards Board (FASB) .

C) to allow the government to track business activity levels.

D) to compute the profit or loss and declared dividend of a business firm.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

A firm's annual report is a yearly statement of the financial condition, progress, and expectations of an organization.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The statement of cash flows shows a firm's revenues, costs of goods sold, expenses, and net income.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The accounting profession follows generally accepted accounting principles as defined by

A) GAAP.

B) the PCAOB (Public Company Accounting Oversight Board) .

C) the FASB (Financial Accounting Standards Board) .

D) the Sarbanes-Oxley Act.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Financial ratios that reflect the degree to which a firm relies on borrowed funds are called ________ ratios.

A) leverage

B) liquidity

C) activity

D) profitability

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

PharmaONE plans to use its computers to post information from journals to the ledger instantaneously. One obvious benefit of this technology is

A) a reduction in the number of accountants required by the firm.

B) less scrutiny from agencies such as the Internal Revenue Service.

C) to shift financial decision making from people to programmed technology.

D) readily available financial information.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

One way to make ratio analysis more meaningful is to compare the ratios of one firm to those of other firms in the same industry.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Churches, schools, and charitable organizations all need accountants.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

In addition to the tasks of recording and classifying accounting information, the best accounting software programs currently available for small businesses have the ability to make financial decisions, thus eliminating the need for owners of small businesses to consult with accountants or understand accounting terminology.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The current ratio is used to evaluate a firm's ability to pay its short-term debts.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The basic earnings per share and the diluted earnings per share would have quite different values for a firm that relied heavily on preferred stock and convertible debt securities to acquire funds.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

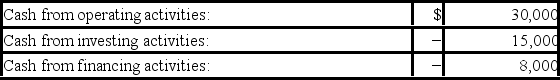

Day-by-Day Calendar Company's statement of cash flows showed the following activities for the year ended December 31, 2019:  The year-end cash balance for this firm is:

The year-end cash balance for this firm is:

A) $7,000.00

B) $53,000.00

C) $23,000.00

D) $30,000.00

F) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Net income is simply the difference between revenue and cost of goods sold.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Recent accounting scandals raised serious questions about the legitimacy of an accounting firm performing both auditing and consulting work for the same company.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Kimberly has been helping Jonah in preparing his personal income tax forms for a couple of years. Jonah's boss recommended Kimberly because she had done a good job setting up the company's new accounting system. Jonah is very satisfied with Kimberly's work and feels that the fees she charges are quite reasonable. Kimberly would be classified as a(n)

A) independent auditor.

B) private accountant.

C) public accountant.

D) accounting broker.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The ________ shows how the capital is structured in the business, including the value of assets and the amount the firm owes at a specific point in time.

A) income statement

B) balance sheet

C) statement of cash flows

D) trial balance

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

It is impossible to run a company effectively without the ability to read and understand basic accounting reports and financial statements.

B) False

Correct Answer

verified

Correct Answer

verified

Showing 341 - 360 of 362

Related Exams