A) $94,000 is recorded as a cash inflow from investing activities and no other sections of the statement are affected.

B) $94,000 is recorded as a cash inflow from investing activities and $6,000 is added to convert net income to net cash flow provided by operating activities.

C) $94,000 is recorded as a cash inflow from investing activities and $6,000 is subtracted to convert net income to net cash flow provided by operating activities.

D) $94,000 is recorded as a cash inflow from operating activities.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

During the current year,Woodson paid $9,000 which it owed from its prior year income tax liability and $60,000 for its current year tax liability.The company still owes $12,000 at the end of the current year.How much should the company report as cash paid for income taxes on its statement of cash flows for the current year?

A) $69,000

B) $81,000

C) $60,000

D) $7,000

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

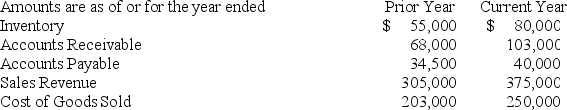

St.Pierre Enterprises reported the following information in its financial statements:  What is the amount of cash payments made to suppliers during the current year?

What is the amount of cash payments made to suppliers during the current year?

A) $280,500

B) $269,500

C) $394,500

D) $230,500

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

To determine net cash provided by or used in financing activities,one must analyze the:

A) Notes Receivable and Bonds Payable accounts.

B) Cash account.

C) Common Stock and Retained Earnings accounts.

D) Interest Expense and Dividend Income accounts.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The starting point for preparing the operating activities section using the indirect method is:

A) current assets.

B) current liabilities.

C) net income.

D) ending cash balance.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The repayment of the principal of a loan which had been used to finance the purchase of equipment should be reported on the statement of cash flows as a:

A) cash outflow from investing activities.

B) cash outflow from operating activities.

C) cash outflow from financing activities.

D) noncash investing and financing activities in a supplemental disclosure.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements best describes the reason Depreciation Expense is added to net income when preparing the statement of cash flows?

A) Depreciation expense originally reduced net income,but it actually represents a cash inflow for the company.

B) Depreciation expense originally reduced net income,but the expense does not involve paying cash.

C) Depreciation expense originally reduced net income,but it actually represents a cash outflow for the company.

D) Depreciation expense is not included in net income and,so,its cash effect must be accounted for separately.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

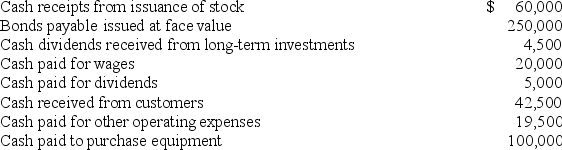

Marion Manufacturing had the following cash flows for the current year.The company uses the direct method in preparing the statement of cash flows.  If the cash balance at the beginning of the current year was $0,what is the amount of cash at the end of the year?

If the cash balance at the beginning of the current year was $0,what is the amount of cash at the end of the year?

A) $56,250

B) $212,500

C) $368,750

D) $155,750

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Assume a company uses the direct method to prepare its statement of cash flows.If the company's inventory and accounts payable both increase during the accounting period,how would these changes affect cash flow calculations?

A) The changes in each account are both added to net income.

B) The change in inventory is subtracted from cost of goods sold and the change in accounts payable is added to cost of goods sold to find the cash paid to suppliers.

C) The changes in each account are both subtracted from net income.

D) The change in inventory is added to cost of goods sold and the change in accounts payable is subtracted from cost of goods sold to find the cash paid to suppliers.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is the best measure of a company's profitability?

A) Cash-based net income

B) Accrual-based net income

C) Accounts Receivable

D) Sales Revenue

F) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

The payment of salaries and wages would be reported as an operating activity on the statement of cash flows.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The reporting of financing activities is identical under the indirect and direct methods for the statement of cash flows on the statement of cash flows.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Investing activities include receiving cash from the sale of land and also the resulting gain or loss on the sale.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A company loaned $1,000,000 with interest at 7% to another company.The interest revenue from this loan would be reported on the statement of cash flows as a:

A) cash inflow from operating activities.

B) cash inflow from investing activities.

C) cash inflow from financing activities.

D) noncash investing and/or financing activity.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose a company generally records revenues and expenses before receiving or making cash payments.Which of the following statements is not correct?

A) If revenues are falling,a net loss could result even though the company reports a net cash inflow from operating activities.

B) If revenues are rising,net income could result even though the company reports a net cash outflow from operating activities.

C) Net income and net cash flows provided by operating activities will always agree.

D) The income statement doesn't explain changes in cash because it focuses on just the operating results of the business.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Assume that the direct method is used to prepare the operating activities section of the statement of cash flows.Which related balance sheet account will explain the difference between revenues on the income statement and cash collected from customers?

A) Inventory

B) Accounts Payable

C) Cost of Goods Sold

D) Accounts Receivable

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When the direct method is used to determine the cash flows from operating activities,which of the following adjustments must be made to income tax expense to determine total income tax payments?

A) Add all changes in income taxes and income taxes payable.

B) Add decreases in income taxes payable and subtract increases in income taxes payable.

C) Add increases in income taxes payable and subtract decreases in income taxes payable.

D) Subtract all changes in income taxes payable.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Assume a company uses the direct method to prepare its statement of cash flows.If the company's Accounts Receivable increase during the accounting period,the change in Accounts Receivable is:

A) added to the change in the Cash account to calculate cash collected from customers.

B) subtracted from Sales Revenue to calculate the cash collected from customers.

C) added to Sales Revenue to calculate the cash collected from customers.

D) subtracted from the change in the Cash account to calculate cash collected from customers.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

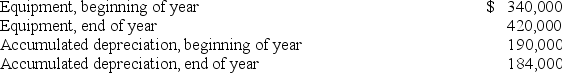

Equipment with a cost of $20,000 and a book value of $6,000 was sold during the year for cash of $18,000.Additional equipment was purchased during the year for cash.

The company uses the indirect method in preparing the statement of cash flows.What is the amount of depreciation expense that will be reported in the operating activities section of the statement?

Equipment with a cost of $20,000 and a book value of $6,000 was sold during the year for cash of $18,000.Additional equipment was purchased during the year for cash.

The company uses the indirect method in preparing the statement of cash flows.What is the amount of depreciation expense that will be reported in the operating activities section of the statement?

A) $8,000

B) $22,000

C) $14,000

D) $20,000

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

When preparing the operating activities section of the statement of cash flows using the indirect method,an increase in Income Taxes Payable is added to net income.

B) False

Correct Answer

verified

Correct Answer

verified

Showing 21 - 40 of 203

Related Exams