A) a purchase of land.

B) collections from customers on account.

C) payments to employees for hours worked.

D) receipt of cash dividends.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When the indirect method is used to determine net cash provided by (used in) operating activities,subtracting an increase in Accounts Receivable from net income eliminates the effect of recording revenue that:

A) increased net income,but did not impact cash.

B) decreased net income,but did not impact cash.

C) increased net income and increased cash flow.

D) decreased net income and decreased cash flow.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The introductory phase of a company's life cycle will most likely have net cash:

A) provided by investing activities.

B) used in financing activities.

C) used in investing activities.

D) provided by operating activities.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

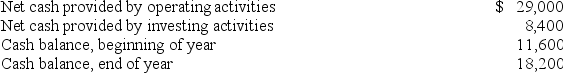

Bardell,Inc.prepared its statement of cash flows for the year.The following information is taken from that statement:  What is the amount of net cash provided by (used in) financing activities?

What is the amount of net cash provided by (used in) financing activities?

A) $30,800

B) ($6,600)

C) ($30,800)

D) $6,600

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If sales are $680,000 and the beginning and ending balances of Accounts Receivable are $34,400 and $38,400,respectively,the cash collected from customers is:

A) $680,000.

B) $641,600.

C) $676,000.

D) $684,000.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements about the statement of cash flows is not correct?

A) GAAP requires every company to report a statement of cash flows.

B) The statement of cash flows is contained in the notes to the financial statements.

C) The statement of cash flows is needed because the income statement and balance sheet do not provide adequate information about the changes in cash.

D) The statement of cash flows provides information about how each major type of business activity causes a company's cash to change.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following would be classified as a financing activity on the statement of cash flows?

A) Cash receipts from accounts receivable collections.

B) Cash receipts from sale of equipment.

C) Cash paid to purchase treasury stock.

D) Cash paid for interest on notes payable.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following represents a cash inflow from financing activities?

A) Issuing stock in exchange for another company's stock.

B) Paying a bond's face value at maturity.

C) Issuing long-term bonds at a discount.

D) Receiving interest on promissory notes.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The cash flow statement should be evaluated by examining the cash flow pattern suggested by the:

A) subtotals of each of the three main sections.

B) operating activities section since this section details the day to day operations of the business.

C) change in cash regardless of which section had the biggest impact on the change.

D) financing section since this section details how much debt the company has incurred.

F) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

The receipt of dividends and interest are both reported as cash inflows from investing activities on the statement of cash flows.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Castle Company's sales revenue was $584,696 and cash collected from customers was $587,003,which of the following would be consistent with this difference?

A) Accounts Receivable could have increased.

B) Cash payments could have been larger than the related expense accounts.

C) Accounts Receivable could have decreased.

D) Cash payments could have been smaller than the related expense accounts.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Blanton Ridge,Inc.'s Salaries and Wages Expense is $900,000 during the year and the beginning and ending balances of Salaries and Wages Payable are $36,000 and $33,000,respectively,the cash paid to employees is:

A) $900,000.

B) $867,000.

C) $897,000.

D) $903,000.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When the indirect method is used,if accounts payable increases during the accounting period,the change in accounts payable is:

A) added to the change in the cash account.

B) added to net income.

C) subtracted from net income.

D) subtracted from the change in the cash account.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

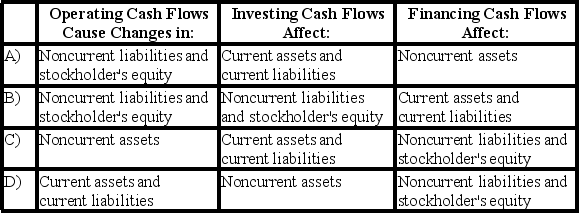

Multiple Choice

A general rule for the relationship between operating,investing,and financing cash flows and the financial statements is:

A) Option A

B) Option B

C) Option C

D) Option D

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In calculating the net cash provided by or used in operations using the indirect method,which of the following items would be added to net income?

A) An increase in Accounts Receivable.

B) A decrease in Prepaid Rent.

C) An increase in long-lived assets.

D) A decrease in Salaries and Wages Payable.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Assume that the direct method is used to prepare the operating activities section of the statement of cash flows.When Accrued Liabilities increase,it means that the company:

A) paid more cash than it recorded as operating expenses.

B) paid less cash than it recorded as operating expenses.

C) prepaid the operating expenses before they were incurred or recorded.

D) paid for the operating expenses as they were recorded.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Free cash flow may be used for all of the following except:

A) expanding the business.

B) paying off debt.

C) building up the cash balance.

D) paying employees.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements about cash flows from financing activities is correct?

A) When a company borrows from lenders,a cash outflow from financing activities has occurred.

B) When a company receives cash dividends,a cash inflow from financing activities has occurred.

C) When a company repurchases its own stock,a cash outflow for financing activities has occurred.

D) When a company pays cash dividends,a cash inflow from financing activities has occurred.

F) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

When preparing the operating activities section of the statement of cash flows using the indirect method,accumulated depreciation is added to net income in the operating section.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The direct exchange of debt for equipment would be shown:

A) on the statement of cash flows as an operating activity.

B) on the statement of cash flows as an investing activity.

C) on the statement of cash flows as a financing activity.

D) as a supplementary disclosure to the statement of cash flows.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Showing 121 - 140 of 203

Related Exams