A) the company paid additional premiums this period in excess of the Insurance Expense recorded on the income statement.

B) a decrease in Prepaid Insurance causes an increase in Insurance Expense and a decrease in net income,but it does not involve cash so it is added back to net income.

C) it includes the impact of increasing cash and increasing net income.

D) it accounts for purchasing more insurance during the period than has been expensed.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

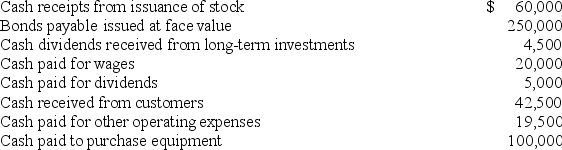

Marion Manufacturing had the following cash flows for the current year.The company uses the direct method in preparing the statement of cash flows.  What is the net cash provided by (used in) operating activities?

What is the net cash provided by (used in) operating activities?

A) $7,500

B) $3,000

C) ($2,000)

D) ($37,500)

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The purchase of $100,000 of equipment by issuing a note would be reported:

A) as a $100,000 investing inflow,and a $100,000 financing outflow.

B) as a $100,000 investing outflow,and a $100,000 financing inflow.

C) as a $100,000 operating inflow,and a $100,000 financing outflow.

D) in a supplementary schedule.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Repayments of loans will be reported as a:

A) cash outflow under financing activities.

B) cash inflow under financing activities.

C) cash outflow under investing activities.

D) cash inflow under investing activities.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

Treasury stock purchases made with cash are classified as cash outflows from financing activities on the statement of cash flows.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Major investing and financing activities that do not involve cash do not have to be reported as part of the statement of cash flows.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is correct?

A) The Accumulated Depreciation account includes cash flows that may be categorized as both operating and investing.

B) Inventory includes cash flows that may be categorized as both operating and investing.

C) Retained Earnings includes cash flows that may be categorized as both operating and investing.

D) Bonds Payable includes cash flows that may be categorized as both operating and financing.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The statement of cash flows may be viewed in terms of the balance sheet equation.Which of the following expressions below is correct?

A) Change in Cash = Change in (Liabilities + Stockholders' Equity − Noncash Assets)

B) Change in Cash = Change in (Stockholders' Equity − Liabilities + Noncash Assets)

C) Change in Cash = Change in (Liabilities �− Noncash Assets)

D) Change in Cash = Change in (Stockholders' Equity − Liabilities)

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

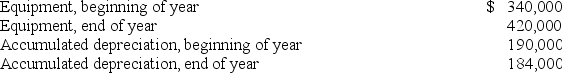

Equipment with a cost of $20,000 and a book value of $6,000 was sold during the year for cash of $18,000.Additional equipment was purchased during the year for cash.

What was the amount of cash paid for purchases of equipment during the year?

Equipment with a cost of $20,000 and a book value of $6,000 was sold during the year for cash of $18,000.Additional equipment was purchased during the year for cash.

What was the amount of cash paid for purchases of equipment during the year?

A) $80,000

B) $86,000

C) $100,000

D) $62,000

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Patterson Co.'s Depreciation Expense is $56,000 and the beginning and ending Accumulated Depreciation balances are $420,000 and $434,000,respectively.What is the cash paid for depreciation?

A) $56,000

B) $14,000

C) $0

D) $70,000

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Cash flows from investing activities include all of the following except a(n) :

A) purchase of an automobile.

B) sale of a trademark.

C) purchase of stock of another company.

D) issuance of bonds.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements about preparation of the statement of cash flows is correct?

A) GAAP allows the indirect method only.

B) GAAP allows the direct method only.

C) GAAP allows either the indirect or direct method.

D) Although GAAP allows either method for the preparation of the operating activities section of the statement of cash flows,the indirect method must be used to prepare the investing activities section of the statement of cash flows.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements about classification choices is correct?

A) GAAP classifies cash dividends paid as a financing activity,but IFRS allows them to be classified as either an operating or financing activity.

B) GAAP allows interest paid to be classified as either an operating or financing activity,but IFRS requires that it be classified as a financing activity.

C) GAAP classifies cash dividends received as an investing activity,but IFRS allows them to be classified as either an operating or investing activity.

D) GAAP classifies interest received as either an operating or investing activity,but IFRS requires it to be classified as an investing activity.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Sunnyside Co.'s comparative balance sheet indicated that the Equipment account increased by $112,000.Upon further investigation of the account changes,it is determined that Sunnyside purchased equipment totaling $196,000 for the year.It also sold equipment with an original cost of $84,000 for $22,400 cash.Assuming these are the only transactions affecting the investing activities,Sunnyside will report net cash flows provided by (used in) investing activities of:

A) ($112,000) .

B) ($196,000) .

C) ($89,600) .

D) ($173,600) .

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The advantages of the direct method include all of the following except:

A) it allows for more detailed analysis of operating cash flows.

B) it provides more information than the indirect method to relate cash inflows and outflows.

C) it allows for more reliable prediction of future cash flows.

D) comparisons between companies are facilitated since most U.S.companies use the direct method.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In arriving at cash from operating activities,adding a decrease in Supplies to net income eliminates the effect of recording expenses that:

A) increased net income,but has not been paid in cash this period.

B) decreased net income,but has not been paid in cash this period.

C) decreased net income and decreased cash.

D) flow this period increased net income and increased cash flow this period.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

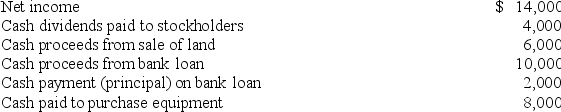

The company would report net cash provided by (used in) financing activities of:

The company would report net cash provided by (used in) financing activities of:

A) $(5,000) .

B) $4,000.

C) $10,000.

D) $12,000.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Cash provided by issuing stock to owners should be reported as cash:

A) inflows from financing activities.

B) outflows from financing activities.

C) inflows from investing activities.

D) outflows from investing activities.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The statement of cash flows cannot be used to determine:

A) changes in working capital.

B) expenditures on long-term assets.

C) profitability as measured by specific revenues and expenses.

D) reliance on external financing.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Cash flows from financing activities include all of the following except:

A) payment of long-term debt.

B) payment of interest.

C) proceeds from stock issuance.

D) cash dividends paid.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Showing 141 - 160 of 203

Related Exams