A) 9 years

B) 10 years

C) 11 years

D) 12 years

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

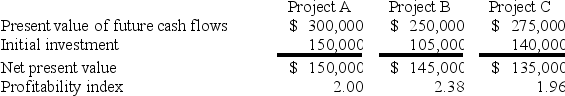

Carmen,Inc.is considering three different independent investment opportunities.The present value of future cash flows,initial investment,net present value,and profitability index for each of the projects are as follows:  In what order should Carmen prioritize investment in the projects?

In what order should Carmen prioritize investment in the projects?

A) A,C,B

B) B,C,A

C) A,B,C

D) B,A,C

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Newport Corp.is considering the purchase of a new piece of equipment.The cost savings from the equipment would result in an annual increase in cash flow of $200,000.The equipment will have an initial cost of $900,000 and have a 6-year life.There is no salvage value for the equipment.What is the payback period?

A) 1.33 years

B) 2.57 years

C) 4.50 years

D) 6.00 years

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Foster Inc.is trying to decide whether to lease or purchase a piece of equipment needed for the next ten years.The equipment would cost $45,000 to purchase,and maintenance costs would be $5,000 per year.After ten years,Foster estimates it could sell the equipment for $20,000.If Foster leases the equipment,it would pay $12,000 each year,which would include all maintenance costs.If the hurdle rate for Foster is 10%,Foster should: (Future Value of $1,Present Value of $1,Future Value Annuity of $1,Present Value Annuity of $1. ) (Use appropriate factor from the PV tables.Do not round intermediate calculations.Round your final answer to the nearest hundred. )

A) lease the equipment,as net present value of cost is about $5,700 less.

B) buy the equipment,as net present value of cost is about $5,700 less.

C) lease the equipment,as net present value of cost is about $2,000 less.

D) buy the equipment,as net present value of cost is about $45,000 less.

F) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

The net present value method compares a project's future net income to the initial investment.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is not a limitation of using the accounting rate of return method for capital budgeting?

A) The accounting rate of return method does not incorporate time value of money.

B) The accounting rate of return method is based on accounting income,rather than cash flow.

C) Net income-on which the accounting rate of return method is based-is more objective than cash flow.

D) The accounting rate of return method is subject to potential manipulation based on accounting choices made by management (e.g. ,the method used to depreciate a capital asset) .

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

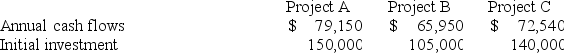

Iron,Inc. ,which has a hurdle rate of 10%,is considering three different independent investment opportunities.Each project has a five-year life.The annual cash flows and initial investment for each of the projects are as follows: (Future Value of $1,Present Value of $1,Future Value Annuity of $1,Present Value Annuity of $1. ) (Use appropriate factor from the PV tables.Do not round intermediate calculations.Round your final answer to the nearest hundred. )  In what order should Iron prioritize investment in the projects?

In what order should Iron prioritize investment in the projects?

A) A,C,B

B) B,C,A

C) A,B,C

D) B,A,C

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is the formula for accounting rate of return?

A) Initial investment/net income

B) Annual net cash flow/Initial investment

C) Initial investment/Annual net cash flow

D) Annual net income/Initial investment

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Belmont Corp.is considering the purchase of a new piece of equipment.The cost savings from the equipment would result in an annual increase in net income after tax of $200,000.The equipment will have an initial cost of $1,000,000 and have an 8-year life.If there is no salvage value of the equipment,what is the accounting rate of return?

A) 12.5%

B) 20%

C) 40%

D) 15%

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is not a characteristic of an annuity?

A) It is a series of equal payments.

B) It earns an equal interest rate each interest period.

C) Interest is compounded annually.

D) Interest periods are of equal length.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

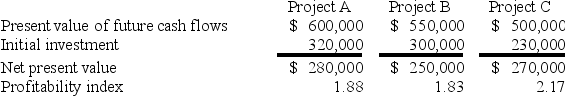

Norwood,Inc.is considering three different independent investment opportunities.The present value of future cash flows,initial investment,net present value,and profitability index for each of the projects are as follows:  In what order should Norwood prioritize investment in the projects?

In what order should Norwood prioritize investment in the projects?

A) A,B,C

B) C,B,A

C) A,C,B

D) C,A,B

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If a project has a positive net present value,it means the project is expected to provide returns that are ________ the cost of capital.

A) greater than

B) less than

C) equal to

D) not connected to

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

Preference decisions compare an investment with some minimum criteria.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Newport Corp.is considering the purchase of a new piece of equipment.The cost savings from the equipment would result in an annual increase in cash flow of $200,000.The equipment will have an initial cost of $900,000 and have a 6-year life.There is no salvage value for the equipment.If the hurdle rate is 8%,what is the approximate net present value? Ignore income taxes.(Future Value of $1,Present Value of $1,Future Value Annuity of $1,Present Value Annuity of $1. ) (Use appropriate factor from the PV tables.Round your final answer to the nearest dollar amount. )

A) $924,580

B) $24,580

C) $900,000

D) $300,000

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Dallas Corp.is trying to decide whether to lease or purchase a piece of equipment needed for the next five years.The equipment would cost $100,000 to purchase,and maintenance costs would be $10,000 per year.After five years,Dallas estimates it could sell the equipment for $30,000.If Dallas leased the equipment,it would pay a set annual fee that would include all maintenance costs.Dallas has determined after a net present value analysis that at its hurdle rate of 12% it would be better off by $11,000 if it leases the equipment.What would the approximate annual cost be if Dallas were to lease the equipment? (Future Value of $1,Present Value of $1,Future Value Annuity of $1,Present Value Annuity of $1. ) (Use appropriate factor from the PV tables.Do not round intermediate calculations.Round your final answer to the nearest hundred. )

A) $21,800

B) $27,800

C) $30,000

D) $34,700

F) C) and D)

Correct Answer

verified

Correct Answer

verified

True/False

The internal rate of return method uses cash flows rather than net income.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Devon Corp.is trying to decide whether to lease or purchase a piece of equipment.The total cost lease the equipment will be $150,000 over its estimated life,while the total cost to buy the equipment will be $120,000 over its estimated life.At Devon's required rate of return,the net present value of the cost of leasing the equipment is $108,000 and the net present value of the cost of buying the equipment is $119,000.Based on financial factors,Devon should:

A) lease the equipment,saving $30,000 over buying.

B) buy the equipment,saving $30,000 over leasing.

C) lease the equipment,saving $11,000 over buying.

D) buy the equipment,saving $11,000 over leasing.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A profitability index greater than ________ means that a project has a positive NPV.

A) negative one

B) zero

C) one

D) the hurdle rate

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is correct about capital assets?

A) For managerial accounting purposes,"capital assets" are defined more narrowly than for financial accounting purposes.

B) Human capital and research and development are both considered capital assets for financial accounting purposes,but not for managerial accounting purposes.

C) Capital assets are only those that can be depreciated,whether using managerial or financial accounting.

D) For managerial accounting purposes,"capital assets" are defined more broadly than for financial accounting purposes.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

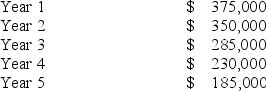

Wright Corp.is considering the purchase of a new piece of equipment,which would have an initial cost of $1,000,000 and a 5-year life.There is no salvage value for the equipment.The increase in net income each year of the equipment's life would be as follows:  What is the payback period?

What is the payback period?

A) 1.77 years

B) 2.06 years

C) 2.96 years

D) 3.51 years

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Showing 61 - 80 of 126

Related Exams