A) $1.00 per batch

B) $1.11 per batch

C) $7.50 per batch

D) $74.00 per batch

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

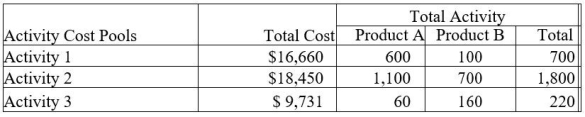

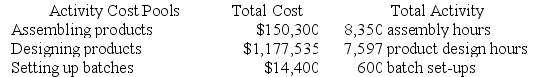

Abel Corporation uses activity-based costing. The company makes two products: Product A and Product B. The annual production and sales of Product A is 200 units and of Product B is 400 units. There are three activity cost pools, with total cost and activity as follows:  The activity rate for Activity 2 is closest to:

The activity rate for Activity 2 is closest to:

A) $24.91

B) $26.36

C) $16.77

D) $10.25

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

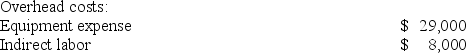

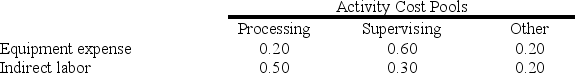

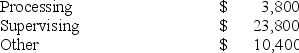

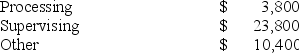

Bartow Corporation uses an activity based costing system to assign overhead costs to products. In the first stage, two overhead costs--equipment expense and indirect labor--are allocated to the three activity cost pools--Processing, Supervising, and Other--based on resource consumption. Data to perform these allocations appear below:  Distribution of Resource Consumption Across Activity Cost Pools:

Distribution of Resource Consumption Across Activity Cost Pools:

In the second stage, Processing costs are assigned to products using machine-hours (MHs) and Supervising costs are assigned to products using the number of batches. The costs in the Other activity cost pool are not assigned to products. Activity data for the company's two products follow:

Activity:

In the second stage, Processing costs are assigned to products using machine-hours (MHs) and Supervising costs are assigned to products using the number of batches. The costs in the Other activity cost pool are not assigned to products. Activity data for the company's two products follow:

Activity:

How much overhead cost is allocated to the Processing activity cost pool under activity-based costing in the first stage of allocation?

How much overhead cost is allocated to the Processing activity cost pool under activity-based costing in the first stage of allocation?

A) $5,800

B) $9,800

C) $4,000

D) $7,400

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

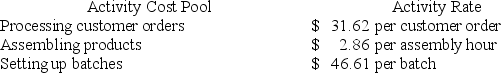

Activity rates from Lippard Corporation's activity-based costing system are listed below. The company uses the activity rates to assign overhead costs to products:  Last year, Product H50E involved 9 customer orders, 666 assembly hours, and 77 batches. How much overhead cost would be assigned to Product H50E using the activity-based costing system?

Last year, Product H50E involved 9 customer orders, 666 assembly hours, and 77 batches. How much overhead cost would be assigned to Product H50E using the activity-based costing system?

A) $60,979.68

B) $3,588.97

C) $5,778.31

D) $81.09

F) C) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Activity-based costing is a costing method that is designed to provide managers with product cost information for internal decision-making.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

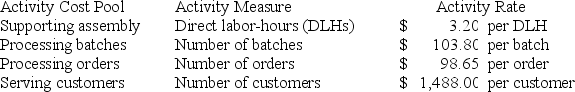

Bertsche Enterprises makes a variety of products that it sells to other businesses. The company's activity-based costing system has four activity cost pools for assigning costs to products and customers. Details concerning that ABC system are listed below:  The cost of serving customers, $1,488.00 per customer, is the cost of serving a customer for one year.

Yousif Corporation buys only one of the company's products which Bertsche Enterprises sells for $25.00 per unit. Last year Yousif Corporation ordered a total of 900 units of this product in 3 orders. To fill the orders, 11 batches were required. The direct materials cost is $8.20 per unit and the direct labor cost is $7.65 per unit. Each unit requires 0.40 DLHs.

According to the ABC system, the total cost of the activity "Supporting assembly" for this customer this past year was closest to:

The cost of serving customers, $1,488.00 per customer, is the cost of serving a customer for one year.

Yousif Corporation buys only one of the company's products which Bertsche Enterprises sells for $25.00 per unit. Last year Yousif Corporation ordered a total of 900 units of this product in 3 orders. To fill the orders, 11 batches were required. The direct materials cost is $8.20 per unit and the direct labor cost is $7.65 per unit. Each unit requires 0.40 DLHs.

According to the ABC system, the total cost of the activity "Supporting assembly" for this customer this past year was closest to:

A) $2,880.00

B) $1.28

C) $1,152.00

D) $360.00

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

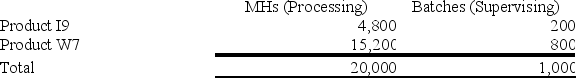

Sorice Corporation uses activity-based costing to assign overhead costs to products. Overhead costs have already been allocated to the company's three activity cost pools as follows: Processing, $20,200; Supervising, $11,000; and Other, $66,800. Processing costs are assigned to products using machine-hours (MHs) and Supervising costs are assigned to products using the number of batches. The costs in the Other activity cost pool are not assigned to products. Activity data appear below:  What is the overhead cost assigned to Product W7 under activity-based costing?

What is the overhead cost assigned to Product W7 under activity-based costing?

A) $8,800

B) $15,352

C) $49,000

D) $24,152

F) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

A traditional cost system is generally easier to set up and run than an activity-based costing system.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

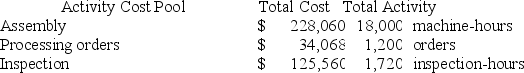

Dobles Corporation has provided the following data from its activity-based costing system:  The company makes 420 units of product D28K a year, requiring a total of 460 machine-hours, 80 orders, and 10 inspection-hours per year. The product's direct materials cost is $48.96 per unit and its direct labor cost is $25.36 per unit.

According to the activity-based costing system, the average cost of product D28K is closest to:

The company makes 420 units of product D28K a year, requiring a total of 460 machine-hours, 80 orders, and 10 inspection-hours per year. The product's direct materials cost is $48.96 per unit and its direct labor cost is $25.36 per unit.

According to the activity-based costing system, the average cost of product D28K is closest to:

A) $95.34 per unit

B) $93.60 per unit

C) $74.32 per unit

D) $89.93 per unit

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

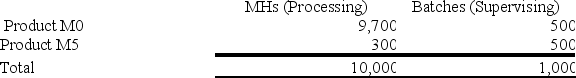

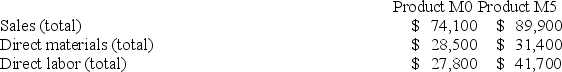

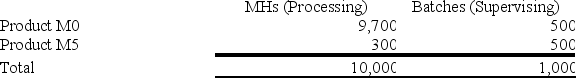

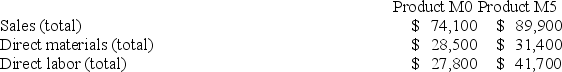

Mirabile Corporation uses activity-based costing to compute product margins. Overhead costs have already been allocated to the company's three activity cost pools--Processing, Supervising, and Other. The costs in those activity cost pools appear below:  Processing costs are assigned to products using machine-hours (MHs) and Supervising costs are assigned to products using the number of batches. The costs in the Other activity cost pool are not assigned to products. Activity data appear below:

Processing costs are assigned to products using machine-hours (MHs) and Supervising costs are assigned to products using the number of batches. The costs in the Other activity cost pool are not assigned to products. Activity data appear below:

Finally, sales and direct cost data are combined with Processing and Supervising costs to determine product margins.

Finally, sales and direct cost data are combined with Processing and Supervising costs to determine product margins.

The activity rate for the Supervising activity cost pool under activity-based costing is closest to:

The activity rate for the Supervising activity cost pool under activity-based costing is closest to:

A) $38.00 per batch

B) $7.00 per batch

C) $23.80 per batch

D) $14.00 per batch

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Essay

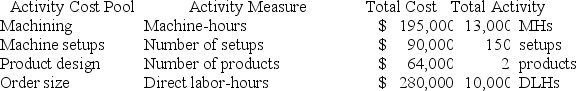

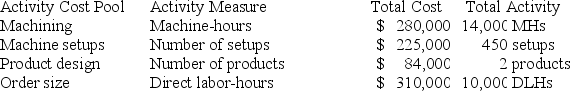

Data concerning three of Kilmon Corporation's activity cost pools appear below:

Required:

Compute the activity rates for each of the three cost pools. Show your work!

Required:

Compute the activity rates for each of the three cost pools. Show your work!

Correct Answer

verified

Correct Answer

verified

Multiple Choice

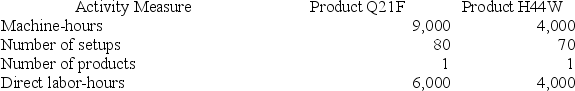

Hails Corporation manufactures two products: Product Q21F and Product H44W. The company uses a plantwide overhead rate based on direct labor-hours. It is considering implementing an activity-based costing (ABC) system that allocates its manufacturing overhead to four cost pools. The following additional information is available for the company as a whole and for Products Q21F and H44W.

Using the ABC system, the percentage of the total overhead cost that is assigned to Product H44W is closest to:

Using the ABC system, the percentage of the total overhead cost that is assigned to Product H44W is closest to:

A) 39.11%

B) 21.30%

C) 50.00%

D) 17.81%

F) C) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Activity-based costing is best proposed, designed and implemented by the accounting department without requiring the time of busy managers.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

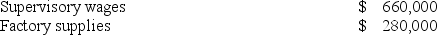

Tomasini Corporation has provided the following data from its activity-based costing accounting system:  Distribution of Resource Consumption across Activity Cost Pools:

Distribution of Resource Consumption across Activity Cost Pools:

The "Other" activity cost pool consists of the costs of idle capacity and organization-sustaining costs that are not assigned to products.

How much supervisory wages and factory supplies cost would be assigned to the Batch Processing activity cost pool?

The "Other" activity cost pool consists of the costs of idle capacity and organization-sustaining costs that are not assigned to products.

How much supervisory wages and factory supplies cost would be assigned to the Batch Processing activity cost pool?

A) $940,000

B) $470,000

C) $305,500

D) $258,000

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Mirabile Corporation uses activity-based costing to compute product margins. Overhead costs have already been allocated to the company's three activity cost pools--Processing, Supervising, and Other. The costs in those activity cost pools appear below:  Processing costs are assigned to products using machine-hours (MHs) and Supervising costs are assigned to products using the number of batches. The costs in the Other activity cost pool are not assigned to products. Activity data appear below:

Processing costs are assigned to products using machine-hours (MHs) and Supervising costs are assigned to products using the number of batches. The costs in the Other activity cost pool are not assigned to products. Activity data appear below:

Finally, sales and direct cost data are combined with Processing and Supervising costs to determine product margins.

Finally, sales and direct cost data are combined with Processing and Supervising costs to determine product margins.

What is the overhead cost assigned to Product M5 under activity-based costing?

What is the overhead cost assigned to Product M5 under activity-based costing?

A) $11,900

B) $19,000

C) $114

D) $12,014

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When switching from a traditional costing system to an activity-based costing system that contains some batch-level costs:

A) the unit product costs of both high and low volume products typically increase.

B) the unit product costs of both high and low volume products typically decrease.

C) the unit product costs of high volume products typically increase and the unit product costs of low volume products typically decrease.

D) the unit product costs of high volume products typically decrease and the unit product costs of low volume products typically increase.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

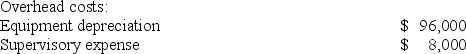

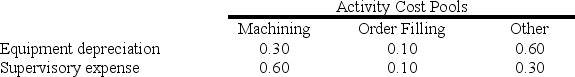

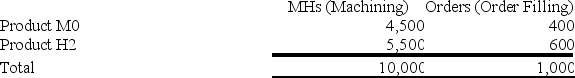

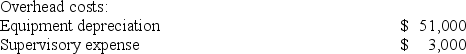

Meester Corporation has an activity-based costing system with three activity cost pools--Machining, Order Filling, and Other. In the first stage allocations, costs in the two overhead accounts, equipment depreciation and supervisory expense, are allocated to three activity cost pools based on resource consumption. Data used in the first stage allocations follow:  Distribution of Resource Consumption Across Activity Cost Pools:

Distribution of Resource Consumption Across Activity Cost Pools:

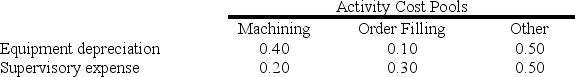

Machining costs are assigned to products using machine-hours (MHs) and Order Filling costs are assigned to products using the number of orders. The costs in the Other activity cost pool are not assigned to products. Activity data for the company's two products follow:

Activity:

Machining costs are assigned to products using machine-hours (MHs) and Order Filling costs are assigned to products using the number of orders. The costs in the Other activity cost pool are not assigned to products. Activity data for the company's two products follow:

Activity:

How much overhead cost is allocated to the Order Filling activity cost pool under activity-based costing?

How much overhead cost is allocated to the Order Filling activity cost pool under activity-based costing?

A) $60,000

B) $800

C) $10,400

D) $9,600

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

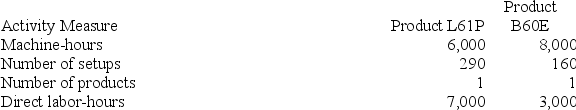

Meli Corporation manufactures two products: Product L61P and Product B60E. The company uses a plantwide overhead rate based on direct labor-hours. It is considering implementing an activity-based costing (ABC) system that allocates its manufacturing overhead to four cost pools. The following additional information is available for the company as a whole and for Products L61P and B60E.

Using the plantwide overhead rate, the percentage of the total overhead cost that is allocated to Product L61P is closest to:

Using the plantwide overhead rate, the percentage of the total overhead cost that is allocated to Product L61P is closest to:

A) 50.00%

B) 31.37%

C) 10.34%

D) 70.00%

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Goertz Corporation has an activity-based costing system with three activity cost pools--Machining, Order Filling, and Other. In the first stage allocations, costs in the two overhead accounts, equipment depreciation and supervisory expense, are allocated to the three activity cost pools based on resource consumption. Data used in the first stage allocations follow:  Distribution of Resource Consumption Across Activity Cost Pools:

Distribution of Resource Consumption Across Activity Cost Pools:

Machining costs are assigned to products using machine-hours (MHs) and Order Filling costs are assigned to products using the number of orders. The costs in the Other activity cost pool are not assigned to products. Activity data for the company's two products follow:

Activity:

Machining costs are assigned to products using machine-hours (MHs) and Order Filling costs are assigned to products using the number of orders. The costs in the Other activity cost pool are not assigned to products. Activity data for the company's two products follow:

Activity:

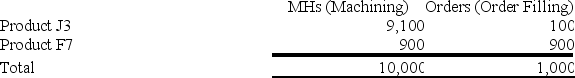

Finally, the costs of Machining and Order Filling are combined with the following sales and direct cost data to determine product margins.

Sales and Direct Cost Data:

Finally, the costs of Machining and Order Filling are combined with the following sales and direct cost data to determine product margins.

Sales and Direct Cost Data:

What is the overhead cost assigned to Product F7 under activity-based costing?

What is the overhead cost assigned to Product F7 under activity-based costing?

A) $5,400

B) $1,890

C) $27,000

D) $7,290

F) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

When activity-based costing is used for internal decision-making, the costs of idle capacity should be assigned to products.

B) False

Correct Answer

verified

Correct Answer

verified

Showing 181 - 200 of 213

Related Exams