A) 75 percent less nondiversifiable risk than the asset with a beta of 1.5.

B) 75 percent more nondiversifiable risk than the asset with a beta of 1.5.

C) twice as much nondiversifiable risk as the asset with a beta of 1.5.

D) one-half as much nondiversifiable risk as the asset with a beta of 1.5.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Maria is looking to buy one of two houses to rent out for additional income.She determines that the first house, priced at $200,000, could rent for $1,500 per month.If the second house is priced at $280,000, how much rent would Maria have to charge to get an equivalent yearly rate of return?

A) $2,100 per month

B) $2,600 per month

C) $2,800 per month

D) It cannot be determined with the information given.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Other factors constant, the future value will be smaller,

A) the larger is its present value.

B) the higher is the interest rate.

C) the shorter is the time period t.

D) the larger is the number of periods.

F) All of the above

Correct Answer

verified

Correct Answer

verified

True/False

Arbitrage activities will make the price of the asset with the higher initial return increase, while the price of the asset with the lower return will decrease.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

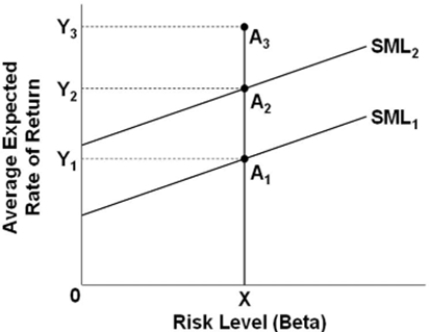

Refer to the graph. An increase in the Security Market Line from SML1 to SML2 and an increase in the average expected rate of return of asset A from Y1 to Y2 would be explained by

Refer to the graph. An increase in the Security Market Line from SML1 to SML2 and an increase in the average expected rate of return of asset A from Y1 to Y2 would be explained by

A) arbitrage only.

B) a restrictive monetary policy only.

C) both arbitrage and a restrictive monetary policy.

D) neither arbitrage nor a restrictive monetary policy.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The U.S.federal government is unlikely to default on its bonds because

A) the bonds are all long-term bonds and they are insured.

B) the federal government has the ability to collect taxes and to sell securities to the Fed.

C) foreigners are willing to buy the federal government bonds and lend to the U.S.government.

D) the federal government can always borrow from the states and from businesses.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If an investor owns a well-diversified portfolio, then

A) his portfolio does not involve any risk.

B) the idiosyncratic risk in his portfolio is minimized.

C) the systemic risk in his portfolio is minimized.

D) his portfolio will have the highest expected return.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

An investor with a diversified portfolio is generally less concerned about

A) the diversifiable risk of potential new investments.

B) rates of return of potential new investments.

C) the nondiversifiable risk of potential new investments.

D) recessions.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

$500 invested at an annual interest rate of 8 percent will be worth how much at the end of one year?

A) $504

B) $508

C) $540

D) $580

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

When the Security Market Line shifts up, the average expected rate of return on investment assets with given risk levels is increasing.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Alex wants to borrow $1,000 from Kara.If he repays the loan in one year, Kara will require him to pay 5 percent interest on the loan.If Alex wants to repay the loan over three years, but Kara strongly prefers present to future consumption, we would expect the interest rate on a three-year loan to be

A) lower than for a one-year loan.

B) greater than for a one-year loan.

C) the same as for a one-year loan.

D) higher if Kara expected there to be no inflation over the loan repayment period.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

(Advanced analysis) Kara has $2,000 to invest today that she wants to grow to $3,000 in five years.What annually compounded rate of interest would she have to earn to reach her goal?

A) 4.6 percent

B) 6.5 percent

C) 8.4 percent

D) 9.3 percent

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Calculate the present value of an asset worth $2,000 four years from now if the interest rate is 6 percent.

A) $2,480

B) $2,524.95

C) $1,584.19

D) $1,520

F) All of the above

Correct Answer

verified

Correct Answer

verified

True/False

Payments to holders of corporate bonds are known as dividends.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose stock A sells for $30 per share and pays dividends of $1 per share per year.Stock B sells for $40 per share and pays dividends of $2 per share per year.Through the process of arbitrage, we would expect the price of

A) stock A to fall and/or the price of stock B to rise.

B) stock A to rise and/or the price of stock B to fall.

C) both stocks to rise or fall together.

D) neither stock to change.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Investments that are designed to match exactly the performance of a group of stocks like the Dow Jones Industrial Average or the S&P 500 are called

A) index funds.

B) dividend funds.

C) portfolio funds.

D) capital gain funds.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements best reflects the concept of present value?

A) "The savings bond I bought five years ago is now worth $1,000."

B) "My $100 savings bond will be worth $200 in 10 years."

C) "You owe me $500, due at the end of the year, but I will reduce your debt to $450 if you pay me now."

D) "The $5,000 in my savings account is worth less today than five years ago because of inflation."

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

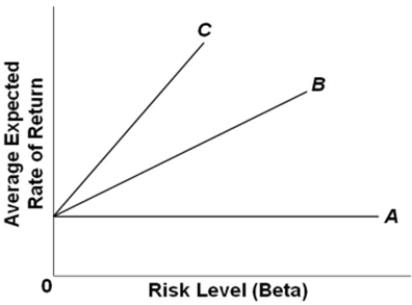

The process of arbitrage

A) raises or lowers the average expected rate of return of a financial asset with a given level of risk.

B) vertically shifts the Security Market Line.

C) moves a financial asset along the Security Market Line.

D) pushes all financial assets to the same average expected rate of return and risk level.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Economic investment refers to

A) buying a financial asset for a gain.

B) selling a financial asset for a gain.

C) postponing purchases of goods and services.

D) making new additions to a firm's stock of capital.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Refer to the graph.The intercept of the three Security Market Lines is determined by

Refer to the graph.The intercept of the three Security Market Lines is determined by

A) the risk-free interest rate.

B) the interest rate on financial assets with a beta of 1.

C) the rate on long-term U.S.government bonds.

D) all of these.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Showing 81 - 100 of 323

Related Exams