A) not related.

B) inversely related.

C) directly related.

D) as often inversely related as they are directly related.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

(Consider This) The increased popularity of mutual funds

A) means that far more shares of corporate stock are owned by fund companies than individuals.

B) has greatly reduced diversification.

C) causes corporations to focus more on long-run profitability.

D) has increased overall market risk.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Orange Computers, Inc., is planning to spend $200,000 on the promotion of its new portable music player next year.The current market interest rate is 5 percent.What is the present value of this promotional budget?

A) $175,146

B) $185,123

C) $190,476

D) $200,000

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A strategy that attempts to reduce the overall risk of an entire investment portfolio by investing in a variety of assets is called

A) pooling.

B) arbitrage.

C) diversification.

D) weighted average.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

If investors are reasonably tolerant of risk, the Security Market Line will be relatively flat.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A change in Federal Reserve monetary policy will

A) have no effect on the Security Market Line.

B) invert the Security Market Line.

C) change the slope of the Security Market Line.

D) cause a vertical shift of the Security Market Line.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Compound interest

A) describes how quickly an interest-bearing asset increases in value.

B) measures the rate of return of a portfolio of stocks and bonds.

C) measures the after-tax, inflation-adjusted rate of interest.

D) refers to the multiple rates of interest of various types of bonds in a portfolio.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

$200 invested at an annual interest rate of 5 percent will be worth how much at the end of one year?

A) $205

B) $210

C) $240

D) $300

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which one of the following is a feature of all investments?

A) The future payments are typically risky.

B) The periodic payments they provide are regular.

C) They typically are short term.

D) They give the investor a stream of future payments, not just one payment.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

For any given financial asset, risk levels and average expected rates of return are

A) independent of each other.

B) negatively related because assets with higher average expected rates of return sell for higher prices, which are inversely related to risk.

C) positively related because both are inversely related to the rate of inflation.

D) positively related because investors must be compensated for taking greater risks.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Isaiah just purchased a house built in 1986 that he expects will appreciate in value over time.His purchase would be considered

A) an economic investment but not a financial investment.

B) a financial investment but not an economic investment.

C) both an economic and a financial investment.

D) neither an economic nor a financial investment.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements best describes the relationship between asset prices and average expected returns?

A) More risky assets will have similar prices to less risky assets.

B) Less risky assets will have lower prices than more risky assets.

C) Less risky assets will have higher prices than more risky assets.

D) More risky assets will have higher prices than less risky assets.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The type of risk that pushes the returns from all investment in the same direction at the same time is

A) idiosyncratic.

B) diversifiable.

C) systemic.

D) time preference.

F) All of the above

Correct Answer

verified

Correct Answer

verified

True/False

The risk-free market rate is essentially the rate of return that compensates solely for time preference.

B) False

Correct Answer

verified

Correct Answer

verified

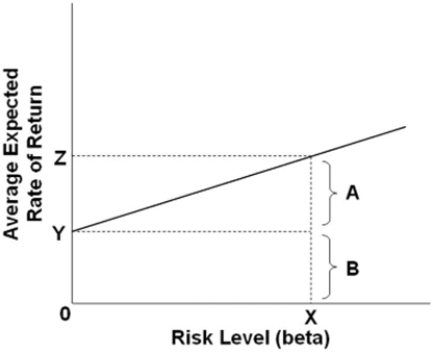

Multiple Choice

In the accompanying graph, bracket B represents the

In the accompanying graph, bracket B represents the

A) amount of arbitrage for this asset.

B) rate of return for the market portfolio.

C) risk premium for an asset's risk level.

D) compensation for time preference for an asset.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Indy owns 100 shares of stock in Pet Mart Corporation that he purchased for $20 per share.Every year he has received, from company profits, $1 for each share he owns.If Indy holds his shares for five years, he

A) will have received $500 in dividends.

B) will earn a capital gain of $500.

C) will receive $500 in interest.

D) should sell the stock to maximize the return on his investment.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

Stock investors can earn a return from stocks only in the form of dividends.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Risk in finance means

A) mostly positive outcomes.

B) mostly negative outcomes.

C) either positive or negative outcomes.

D) the same thing as risk in health science.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The average expected rate of return of a financial asset equals

A) the rate that compensates for time preference plus the rate that compensates for risk.

B) the rate that compensates for time preference plus the rate of inflation.

C) beta plus the rate that compensates for risk.

D) the risk-free interest rate plus the rate of inflation.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

You deposit $5,000 in a 5-year bank CD that pays 3 percent interest per year.How much will you get from this deposit at maturity?

A) $5,155

B) $5,751

C) $5,796

D) $6,500

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Showing 121 - 140 of 323

Related Exams