B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A bank account pays 4 percent interest per year.If you deposit $1,000 into this account at the start of each year for three years, how much will your account balance be at the end of three years?

A) $3,122

B) $3,246

C) $3,600

D) $4,206

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Risk in finance means that an asset

A) does not pay dividends.

B) does not pay capital gains.

C) has a present value that is negative.

D) has future payments that are uncertain.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

Payments to holders of corporate bonds are known as dividends.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

During the financial crisis of 2007-2008, investors demanded much higher risk premiums in their investments.This caused the SML to

A) shift up.

B) shift down.

C) become steeper.

D) become flatter.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the Fed raises the interest rates on short-term U.S.government bonds, then the Security Market Line shifts

A) downward as the risk-free interest rate increases.

B) downward as the risk-free interest rate decreases.

C) upward as the risk-free interest rate increases.

D) upward as the risk-free interest rate decreases.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

A recession in an economy would be an example of a diversifiable risk.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The average expected rate of return on an asset can be fully understood as the rate that compensates for risk.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

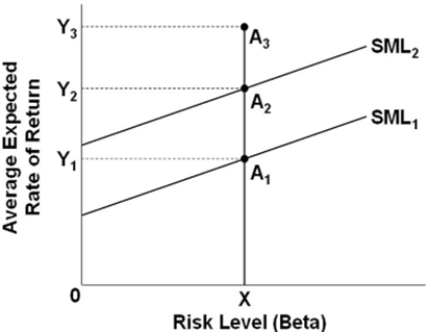

Refer to the graph. An increase in the Security Market Line from SML1 to SML2 and an increase in the average expected rate of return of asset A from Y1 to Y2 would be explained by

Refer to the graph. An increase in the Security Market Line from SML1 to SML2 and an increase in the average expected rate of return of asset A from Y1 to Y2 would be explained by

A) arbitrage only.

B) a restrictive monetary policy only.

C) both arbitrage and a restrictive monetary policy.

D) neither arbitrage nor a restrictive monetary policy.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Mutual fund managers tend to focus solely on the

A) short-term (quarterly) performance of the corporations whose securities they invest in.

B) long-term performance of the corporations whose securities they invest in.

C) assets of the corporations whose securities they invest in.

D) liabilities of the corporations whose securities they invest in.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Portfolio diversification

A) reduces the likelihood that the entire amount invested will be lost.

B) eliminates all risk of loss.

C) ensures that investors will receive a positive rate of return.

D) provides the maximum possible rate of return from an investment portfolio.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Isaiah just purchased a house built in 1986 that he expects will appreciate in value over time.His purchase would be considered

A) an economic investment but not a financial investment.

B) a financial investment but not an economic investment.

C) both an economic and a financial investment.

D) neither an economic nor a financial investment.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Present value is best defined as the

A) worth or value today of future expected returns or costs.

B) worth in the future of a current flow of returns or costs.

C) current worth of a financial asset purchased in the past.

D) expected future value of a financial asset purchased today.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

(Advanced analysis) Tani invests $100 in a financial asset earning an annually compounded interest rate of 5 percent.In about how many years will her investment be worth $150?

A) 5.2

B) 6.8

C) 8.3

D) 10

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Risk in finance means

A) mostly positive outcomes.

B) mostly negative outcomes.

C) either positive or negative outcomes.

D) the same thing as risk in health science.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

(Last Word) Passively managed funds produce higher rates of return for investors than actively managed funds because

A) trading and management costs are higher with actively managed funds.

B) passively managed funds invest in riskier assets that have higher rates of return.

C) actively managed funds invest in riskier assets that have not reached expected rates of return.

D) actively managed funds are taxed, while passively managed funds are not taxable.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the Federal Reserve conducts an open-market purchase, then the SML will

A) shift up.

B) shift down.

C) rotate and become steeper.

D) rotate and become flatter.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If an asset has a risk-return combination that is above the Security Market Line (SML) , then arbitrage will make that asset's

A) beta increase.

B) beta decrease.

C) average expected return increase.

D) average expected return decrease.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

The Security Market Line depicts the inverse relationship between the average expected rates of return and risk levels of financial assets.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Average expected rates of return and levels of risk are positively related.

B) False

Correct Answer

verified

Correct Answer

verified

Showing 181 - 200 of 323

Related Exams