A) the prime interest rate.

B) Federal Reserve monetary policy.

C) the average beta of the market.

D) investor tolerance of risk.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The price of an asset should

A) exactly equal the total present value of all of the asset's future payments.

B) exactly equal the total future value of all of the asset's future payments.

C) approximately equal X(1 + i) t, where X is the value of the asset, i is the interest rate, and t is the number of years.

D) exactly equal the total present and future value of all of the asset's future payments.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Short-term U.S.government securities are practically risk-free, and thus their rates of return are payments solely for

A) diversifiable risk.

B) time preference.

C) idiosyncratic risk.

D) pure profit.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

"Default" occurs when

A) bond issuers fail to make promised payments.

B) corporations go bankrupt and stock becomes worthless.

C) bond purchasers fail to pay full price for a bond.

D) stocks are not federally insured.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which one of the following is an example of an economic investment?

A) putting money in a bank CD

B) buying a corporate bond or stock

C) purchasing shares of a mutual fund

D) building a new bank office

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Other factors constant, the future value will be smaller,

A) the larger is its present value.

B) the higher is the interest rate.

C) the shorter is the time period t.

D) the larger is the number of periods.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Investors diversify portfolios

A) because diversified portfolios pay the highest rates of return.

B) because diversified portfolios are guaranteed not to lose money.

C) to reduce the risk of losing their investment.

D) to guarantee minimum returns on their investment.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

For any given financial asset, risk levels and average expected rates of return are

A) independent of each other.

B) negatively related because assets with higher average expected rates of return sell for higher prices, which are inversely related to risk.

C) positively related because both are inversely related to the rate of inflation.

D) positively related because investors must be compensated for taking greater risks.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Mark buys a bond for $8,000 and receives interest payments of $100 every three months.The interest rate on the bond is approximately

A) 1.3 percent.

B) 2 percent.

C) 5 percent.

D) 20 percent.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

(Last Word) Actively managed funds

A) generate lower costs than passively managed funds.

B) generally outperform passively managed funds.

C) generally perform the same as passively managed funds.

D) are generally outperformed by passively managed funds.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

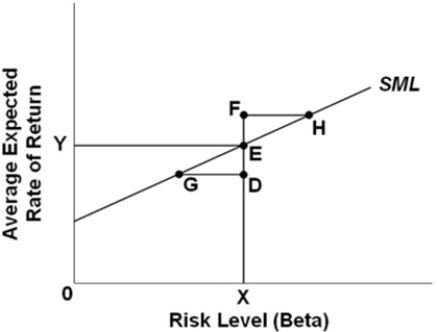

Refer to the graph.Each labeled point represents a different asset.For which of these assets would we not expect arbitrage to change the average expected rate of return?

Refer to the graph.Each labeled point represents a different asset.For which of these assets would we not expect arbitrage to change the average expected rate of return?

A) E only

B) D, E, and F

C) E, G, and H

D) D, E, F, G, and H

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The line that depicts the relationship between the average expected rate of return and the risk level of a financial asset is known as the

A) Beta Line.

B) Security Market Line.

C) Risk Premium Line.

D) Risk-Return Line.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The so-called market portfolio used as a benchmark in financial economics is

A) the lowest risk portfolio.

B) the most diversified portfolio.

C) the portfolio with the highest expected return.

D) the portfolio with zero systemic risk.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

When the Security Market Line shifts up, the average expected rate of return on investment assets with given risk levels is increasing.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Susan recently purchased a home for $150,000.She plans to rent it out for $1,000 per month for a year.Had the house cost $200,000 instead, her expected rate of return would have

A) decreased by 1 percentage point.

B) decreased by 2 percentage points.

C) increased by 2 percentage points.

D) increased by 3 percentage points.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Professional athletes attempting only to maximize income will defer larger salaries if

A) deferred payouts are adjusted upward to compensate for forgone interest.

B) it increases the team's chance to win.

C) there is no chance of inflation.

D) it allows them to stay in a city and not to have to move their family.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Arbitrage will cause a shift in the Security Market Line.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

You deposit $5,000 in a 5-year bank CD that pays 3 percent interest per year.How much will you get from this deposit at maturity?

A) $5,155

B) $5,751

C) $5,796

D) $6,500

F) All of the above

Correct Answer

verified

Correct Answer

verified

True/False

The key difference between bonds and stocks is that stocks' income streams are more predictable than those of bonds.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Stock investors can earn a return from stocks only in the form of dividends.

B) False

Correct Answer

verified

Correct Answer

verified

Showing 201 - 220 of 323

Related Exams