A) 4.8 percent

B) 9.8 percent

C) 20 percent

D) 39.2 percent

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

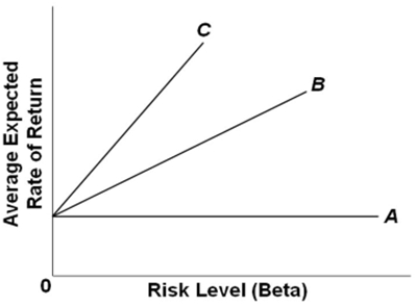

Refer to the graph.Which of the three Security Market Lines would represent a situation where investors do not care about the risk level of a financial asset?

Refer to the graph.Which of the three Security Market Lines would represent a situation where investors do not care about the risk level of a financial asset?

A) line A

B) line B

C) line C

D) none of these

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Rupert recently purchased a nonmaturing bond for $10,000 that pays $350 semiannual coupons.His expected rate of return per year on the bond is

A) 4 percent.

B) 7 percent.

C) 10 percent.

D) 12 percent.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

Short-term U.S.government bonds are considered to be risk-free.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Arbitrage is the process by which investors simultaneously sell

A) assets with higher rates of return and buy otherwise identical assets with lower rates of return.

B) assets with lower rates of return and buy otherwise identical assets with higher rates of return.

C) riskier assets and buy less risky assets.

D) less risky assets and buy riskier assets.

F) All of the above

Correct Answer

verified

Correct Answer

verified

True/False

The "time value" of money is based on the fact that prices may increase over time.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

George buys an antique car for $20,000 and sells it five years later for just over $24,000.George's per-year rate of return is

A) 20 percent.

B) 12 percent.

C) 10 percent.

D) 4 percent.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

Future value measures the present-day value of returns or costs expected to arrive in the future.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which one of the following is an example of a financial investment but not an economic investment?

A) renovating a shopping mall

B) constructing an addition to a petroleum refinery

C) building a new store

D) buying gold to sell later at a higher price

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

What concept describes how quickly an investment increases in value when interest is paid not only on the original amount invested, but also on the accumulated interest payments?

A) present value

B) future value

C) compound interest

D) real rate of interest

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Compound interest

A) describes how quickly an interest-bearing asset increases in value.

B) measures the rate of return of a portfolio of stocks and bonds.

C) measures the after-tax, inflation-adjusted rate of interest.

D) refers to the multiple rates of interest of various types of bonds in a portfolio.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Rates of return on short-term U.S.government bonds are compensation for

A) both the level of risk and the delaying of consumption.

B) delaying consumption only.

C) the level of risk only.

D) factors other than risk and delaying consumption.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The buying and selling process that leads profit-seeking investors to equalize average expected rates of return from identical assets is known as

A) diversification.

B) arbitrage.

C) hedging.

D) securitization.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Financial investment refers to

A) the same idea as economic investment.

B) earning profits from producing goods and services.

C) purchasing or building an asset for monetary gain.

D) making new additions to the capital stock.

F) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

Index funds consistently beat actively managed funds because actively managed funds incur greater management costs.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Arbitrage equalizes rates of return across similar investments because

A) arbitrage also equalizes the prices of the assets.

B) investors prefer diversity.

C) investors will want to replace lower rate of return assets with those generating higher rates of return.

D) investors will want to replace higher rate of return assets with those generating lower rates of return.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A key reason that actively managed funds have lower returns than index funds with a similar level of risk is that

A) index funds require more buying and selling to generate their returns.

B) management and trading costs reduce the returns of actively managed funds.

C) index funds spend more on research and management.

D) diversification is more important to actively managed funds.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

What do stocks represent?

A) shares of ownership in a corporation and a guaranteed stream of profits

B) shares of ownership in a corporation and an entitlement to its future profits

C) debt contracts with a corporation and regular interest payments on the loan

D) debt contracts with a corporation and variable interest payments on the loan

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Lucian buys a house for $400,000, rents it for one year for $1,500 per month, and sells it at the end of the year for $390,000.Lucian's rate of return

A) is 2 percent.

B) is 4.5 percent.

C) is negative 2.5 percent.

D) cannot be determined.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A bond that pays no annual interest (or coupons) and has a face value at maturity will fetch a price today that is equal to the

A) future value of its face value.

B) number of years in the life of the bond times its face value.

C) present value of the number of years in the life of the bond times its face value.

D) present value of its face value.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Showing 281 - 300 of 323

Related Exams