B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose that Clint wins a lottery jackpot of $300 million.He can receive it over the next 30 years in annual payments of $10 million, or he can receive a lump sum of $100 million immediately.Assuming that taxes are not a consideration, should Clint take his winnings as a lump sum?

A) Yes, but only if rapid inflation is expected over the next 30 years.

B) Yes, but only if deflation is expected over the next 30 years.

C) No, the rate of return will always be higher with the 30 annual payments.

D) Yes, if he can invest in financial assets that will yield greater returns than the interest rate implicit in the annual payments.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Orange Computers, Inc., is planning to spend $200,000 on the promotion of its new portable music player next year.The current market interest rate is 5 percent.What is the present value of this promotional budget?

A) $175,146

B) $185,123

C) $190,476

D) $200,000

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose stock A sells for $50 per share and pays dividends of $2 per share per year.Stock B sells for $100 per share and pays dividends of $4 per share per year.Through the process of arbitrage, we would expect the price of

A) stock A to fall and/or the price of stock B to rise.

B) stock A to rise and/or the price of stock B to fall.

C) both stocks to rise or fall together.

D) neither stock to change.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Economic investment refers to

A) buying a financial asset for a gain.

B) selling a financial asset for a gain.

C) postponing purchases of goods and services.

D) making new additions to a firm's stock of capital.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

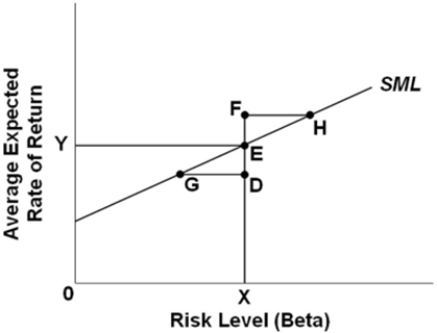

Refer to the graph.If a financial asset's average expected rate of return and beta put it at point F,

Refer to the graph.If a financial asset's average expected rate of return and beta put it at point F,

A) arbitrage will push down the price of the asset and lower the average expected rate of return to Y.

B) arbitrage will push up the price of the asset and lower the average expected rate of return to Y.

C) a restrictive monetary policy is needed to move the asset onto the Security Market Line.

D) an expansionary monetary policy is needed to move the asset onto the Security Market Line.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose two corporate bonds with similar risk pay different rates of return.The process of arbitrage should

A) not affect their rates of return.

B) increase the return on the asset with the higher rate of return as the demand for it increases.

C) increase the gap between the two rates of return.

D) eventually equalize their rates of return.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

An expansionary monetary policy will shift the Security Market Line down.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If i is the interest rate and X is the number of dollars to be received after t years, the formula to calculate the present value of a future payment is

A) (1 + i) tX.

B) X/(1 + i) t.

C) it/(1 + X) .

D) (X/i) t.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If a corporation goes bankrupt,

A) neither stockholders nor bondholders receive any money.

B) stockholders get paid from the sale of company assets before bondholders do.

C) bondholders get paid from the sale of company assets before stockholders do.

D) stockholders must honor the debts to bondholders out of personal assets if necessary.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

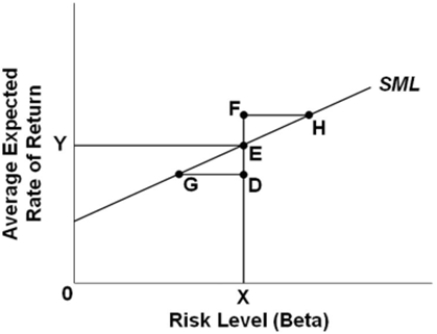

Refer to the graph.Each labeled point represents a different asset.For which of these assets would we expect arbitrage to cause movement to a different point?

Refer to the graph.Each labeled point represents a different asset.For which of these assets would we expect arbitrage to cause movement to a different point?

A) D and F

B) G and H

C) D, F, G and H

D) D, E, and F

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

Diversification is an investment strategy that seeks to reduce the overall risk in an investment portfolio by selecting a group of assets whose risks differ from one another.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Hermione is considering an investment that has a ¾ chance of paying a 10 percent rate of return and a ¼ chance of paying 2 percent.What is the average expected rate of return on the investment?

A) 2 percent.

B) 6 percent.

C) 8 percent.

D) 10 percent.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If an investment is 80 percent likely to gain 40 percent but also 20 percent likely to lose 10 percent, then its average expected rate of return is

A) 34 percent.

B) 32 percent.

C) 30 percent.

D) 12 percent.

F) All of the above

Correct Answer

verified

Correct Answer

verified

True/False

Stockholders of a company can benefit from either capital gains or dividends when the company is profitable.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

(Advanced analysis) Indy has $2,000 invested in a financial asset earning an annually compounded interest rate of 6 percent.Approximately how many years will it take before Indy's investment is worth $5,000?

A) 25

B) 10.5

C) 12.8

D) 15.7

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If an investor owns a well-diversified portfolio, then

A) his portfolio does not involve any risk.

B) the idiosyncratic risk in his portfolio is minimized.

C) the systemic risk in his portfolio is minimized.

D) his portfolio will have the highest expected return.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Diversifiable risk refers to risk

A) faced by a portfolio in general.

B) that can be reduced with appropriate fiscal and monetary policy.

C) posed by business cycle fluctuations.

D) specific to a particular investment.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Augi buys a bond for $10,000 and receives interest payments of $400 every six months.The interest rate on the bond is approximately

A) 4 percent.

B) 8 percent.

C) 12.5 percent.

D) 25 percent.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose stock A sells for $30 per share and pays dividends of $1 per share per year.Stock B sells for $40 per share and pays dividends of $2 per share per year.Through the process of arbitrage, we would expect the price of

A) stock A to fall and/or the price of stock B to rise.

B) stock A to rise and/or the price of stock B to fall.

C) both stocks to rise or fall together.

D) neither stock to change.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Showing 61 - 80 of 323

Related Exams