A) reserves to its liabilities and net worth.

B) stock shares to its total assets.

C) demand deposits to its total liabilities.

D) specified percentage of deposit liabilities a chartered bank chooses to keep as vault cash.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The cause of the skyrocketing mortgage default rates was:

A) government programs that encouraged and subsidized home ownership for renters.

B) declining real estate values.

C) bad incentives provided by mortgage-backed bonds.

D) all of the above.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the desired reserve ratio is 10 percent, how much excess reserves does a bank acquire when a business deposits a $500 cheque drawn on another bank?

A) $450

B) $550

C) $5000

D) $500

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

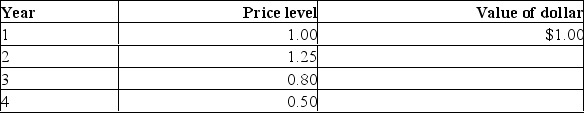

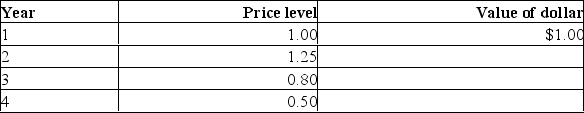

Refer to the above information.The value of the dollar in year 4 is:

Refer to the above information.The value of the dollar in year 4 is:

A) $.25.

B) $.33.

C) $.50.

D) $2.00.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

1.Foreign currency deposits of residents booked in Canada 2.Personal savings deposits at the chartered banks 3) Currency (coins and paper money) 4) Demand deposits 5) Government securities 6) Non-personal notice deposits at the chartered banks Refer to the above information.Which of the following is not included in any of the official definitions of money?

A) item 1

B) items 1 and 4

C) no item

D) item 5

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The two basic functions of the Canadian chartered banks and saving institutions are:

A) making loans to the public and the federal government.

B) holding the money deposits of businesses and households, and making loans to the public.

C) holding the money deposits of businesses and households, and lending to the federal government.

D) creating money and lending to the federal government.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

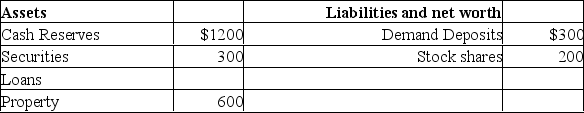

Refer to the information below.The monetary multiplier is: Consolidated balance sheet for the chartered banking system.All figures are in billions.Assume that the desired reserve ratio is 20 percent.

A) 4

B) 5

C) 8

D) 10

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The smallest component of the money supply (M1) is:

A) currency.

B) chequable deposits.

C) small time deposits.

D) large time deposits.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose a chartered banking system has $100,000 of outstanding demand deposits and actual cash reserves of $35,000.If the desired reserve ratio is 20 percent, the banking system can expand the supply of money by the maximum amount of:

A) $122,000

B) $175,000

C) $300,000

D) $75,000

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Refer to the information below.The maximum amount by which the chartered banking system can expand the supply of money by lending is about: Consolidated balance sheet for the chartered banking system.Assume the desired reserve ratio is 30 percent.All figures are in billions.

A) $27 billion.

B) $23.1 billion.

C) $30 billion.

D) $15 billion.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose a chartered bank has demand deposits of $500,000 and the desired reserve ratio is 10 percent.If the institution has excess reserves of $4,000, then its actual cash reserves are:

A) $46,000

B) $50,000

C) $4,000

D) $54,000

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Refer to the above information.The value of the dollar in year 3 is:

Refer to the above information.The value of the dollar in year 3 is:

A) $1.00.

B) $1.25.

C) $.80.

D) $.50.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Fiat money is valuable because:

A) it is backed by gold.

B) it is fractionally backed by gold.

C) it is generally acceptable.

D) it is convertible to gold.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A chartered bank has desired reserve of $6000 and the reserve ratio is 20 percent.What are the chartered bank's demand-deposit liabilities?

A) $1,200

B) $9,000

C) $30,000

D) $120,000

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

The banking system can lend by a multiple of its excess reserves because lending does not result in a loss of reserves to the banking system as a whole.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The chartered banking system can lend by a multiple of its excess reserves primarily because:

A) its reserves are on deposit with the Bank of Canada

B) its reserves are highly liquid assets.

C) it loses reserves when it extends credit.

D) its reserves are fractional.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A 15 percent increase in the price

A) increases the value of a dollar by 15 percent.

B) decreases the value of a dollar by about 13 percent.

C) decreases the value of a dollar by 15 percent.

D) decreases the value of a dollar by about 8 percent.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Near money means:

A) Money substitutes such as credit cards

B) Chequing accounts

C) They are not backed by gold

D) They do not function as a medium of exchange but they serve as a store of value

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

Currency and coins held by banks are part of the M1 definition of money supply.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If we let P equal the price level expressed as an index number and D equal the value of the dollar, then we can say that:

A) P = D - 1.

B) D = 1/P.

C) 1 = D/P.

D) D = P - 1.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Showing 161 - 180 of 206

Related Exams