A) Ed must include $150 in his gross income.

B) Ed may exclude the cost of the copies as a no-additional cost fringe benefit.

C) Ed may exclude the cost of the copies only if the organization is a client of Mauve.

D) Ed may exclude the cost of the copies as a de minimis fringe benefit.

E) None of the above.

G) B) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Low- and middle-income taxpayers may make nondeductible contributions up to $4,000 per child per year to a Coverdell Education Savings Account (CESA).

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

One of the tax advantages of being self-employed (rather than being an employee) is:

A) The self-employment tax is lower than the Social Security tax.

B) The cutback adjustment does not apply.

C) The actual cost method for deducting the business use of an automobile can be selected.

D) Job-related expenses are deductions for AGI.

E) A deduction for an office in the home is available.

G) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Merrill is a participant in a SIMPLE § 401(k) plan,and he elects to contribute 4% of his $40,000 compensation to the account,while his employer contributes 3%.What amount will vest immediately,if any?

A) $0.

B) $1,200.

C) $1,600.

D) $2,800.

E) None of above.

G) A) and E)

Correct Answer

verified

Correct Answer

verified

True/False

Kelly,an unemployed architect,moves from Boston to Phoenix to accept a job as a chef at a restaurant.Kelly's moving expenses are not deductible because her new job is in a different trade or business.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

If a taxpayer does not own a home but rents an apartment,the office in the home deduction is not available.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Mary establishes a Roth IRA at age 50 and contributes the maximum amount per year to the Roth IRA for 15 years.The account is now worth $199,000,consisting of $75,000 in contributions plus $124,000 in accumulated earnings.How much can Mary withdraw tax-free?

A) $0.

B) $75,000.

C) $124,000.

D) $199,000.

E) None of the above.

G) B) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Under the actual cost method,which,if any,of the following expenses will not be allowed?

A) Car registration fees.

B) Auto insurance.

C) Interest expense on a car loan (taxpayer is an employee) .

D) Dues to auto clubs.

E) All of the above will be allowed.

G) B) and E)

Correct Answer

verified

Correct Answer

verified

True/False

If an individual is subject to the direction or control of another only to the extent of the end result but not as to the means of accomplishment,an employer-employee relationship does not exist.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

After she finishes working at her main job,Ann returns home,has dinner,then drives to her second job.Ann may deduct the mileage between her first and second job.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Employees of the Valley Country Club are allowed to use the golf course without charge before and after working hours on Mondays,when the number of players on the course is at its lowest.Tom,an employee of the country club played 40 rounds of golf during the year at no charge when the non-employee charge was $20 per round.

A) Tom must include $800 in gross income.

B) Tom is not required to include anything in gross income because it is a de minimis fringe benefit.

C) Tom is not required to include the $800 in gross income because the use of the course was a gift.

D) Tom is not required to include anything in gross income because this is a "no-additional-cost service" fringe benefit.

E) None of the above.

G) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The taxpayer's marginal tax bracket is 25%.Which would the taxpayer prefer?

A) $1.00 taxable income rather than $1.25 tax-exempt income.

B) $1.00 taxable income rather than $.75 tax-exempt income.

C) $1.25 taxable income rather than $1.00 tax-exempt income.

D) $1.40 taxable income rather than $1.00 tax-exempt income.

E) None of the above.

G) D) and E)

Correct Answer

verified

Correct Answer

verified

True/False

An education expense deduction may be allowed even if the education results in a promotion or pay raise for the employee.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

A U.S.citizen who works in France from February 1,2013 until January 31,2014 is eligible for the foreign earned income exclusion in 2013 and 2014.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Sick of her 65 mile daily commute,Edna purchases a condo that is only four miles from her job.Edna's moving expenses to her new condo are not allowed and cannot be claimed by her as a deduction.

B) False

Correct Answer

verified

Correct Answer

verified

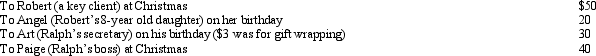

Multiple Choice

Ralph made the following business gifts during the year.  Presuming proper substantiation,Ralph's deduction is:

Presuming proper substantiation,Ralph's deduction is:

A) $0.

B) $53.

C) $73.

D) $78.

E) $98.

G) B) and D)

Correct Answer

verified

Correct Answer

verified

True/False

By itself,credit card receipts will not constitute adequate substantiation for travel expenses.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

If a taxpayer cansatisfy the three-out-of-five year presumption test associated with hobby losses,then expenses from the activity can be deducted in excess of the gross income from the activity.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Roger is in the 35% marginal tax bracket.Roger's employer has created a flexible spending account for medical and dental expenses that are not covered by the company's health insurance plan.Roger had his salary reduced by $1,200 during the year for contributions to the flexible spending plan.However,Roger incurred only $1,100 in actual expenses for which he was reimbursed.Under the plan,he must forfeit the $100 unused amount.His after-tax cost of overfunding the plan is $65.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

A participant who is at least age 59 1/2 can make a tax-free qualified withdrawal from a Roth IRA after a five-year holding period.

B) False

Correct Answer

verified

Correct Answer

verified

Showing 81 - 100 of 168

Related Exams