A) Shanghai

B) India

C) Nikkei

D) U.S.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Home bias refers to

A) the tendency to vacation in your home country instead of traveling abroad.

B) the tendency to believe that your home country is better than other countries.

C) the tendency to give preferential treatment to people from your home country.

D) the tendency to overweight investments in your home country.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose the 1-year risk-free rate of return in Canada.is 4.5% and the 1-year risk-free rate of return in Britain is 7.7%.The current exchange rate is 1 pound = Cad.$1.60.A 1-year future exchange rate of __________ for the pound would make a Canadian investor indifferent between investing in the Canadian security and investing in the British security.

A) 1.5525

B) 2.0411

C) 1.7500

D) 2.3369

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

WEBS portfolios

A) are passively managed.

B) are shares that can be sold by investors.

C) are free from brokerage commissions.

D) are passively managed and are shares that can be sold by investors.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The EAFE is

A) the East Asia Foreign Equity index.

B) the Economic Advisor's Foreign Estimator index.

C) the European and Asian Foreign Equity index.

D) the European, Asian, French Equity index.

E) the European, Australian, Far East index.

G) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Assume there is a fixed exchange rate between the Canadian and U.S.dollar.The expected return and standard deviation of return on the U.S.stock market are 18% and 15%, respectively.The expected return and standard deviation on the Canadian stock market are 13% and 20%, respectively.The covariance of returns between the U.S.and Canadian stock markets is 1.5%. If you invested 50% of your money in the Canadian stock market and 50% in the U.S.stock market, the expected return on your portfolio would be

A) 12.0%.

B) 12.5%.

C) 13.0%.

D) 15.5%.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

__________ refers to the possibility of expropriation of assets, changes in tax policy, and the possibility of restrictions on foreign exchange transactions.

A) Default risk

B) Foreign exchange risk

C) Market risk

D) Political risk

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which equity index had the lowest volatility in terms of U.S.dollar-denominated returns for the period of five years ending in October 2016?

A) Korea

B) U.S.

C) Toronto

D) Nikkei

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In 2015, the U.S.equity market represented __________ of the world equity market.

A) 19%

B) 60%

C) 43%

D) 41%

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The interest rate on a 1-year Canadian security is 7.8%.The current exchange rate is C$ = US $0.79.The 1-year forward rate is C$ = US $0.77.The return (denominated in U.S.$) that a U.S.investor can earn by investing in the Canadian security is

A) 3.59%.

B) 4.00%.

C) 5.07%.

D) 8.46%.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

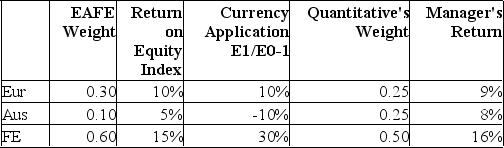

The manager of Quantitative International Fund uses EAFE as a benchmark.Last year's performance for the fund and the benchmark were as follows:  Calculate Quantitative's stock selection return contribution.

Calculate Quantitative's stock selection return contribution.

A) 1.0%

B) -1.0%

C) 3.0%

D) 0.25%

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Exchange-rate risk

A) results from changes in the exchange rates between the currency of the investor and the country in which the investment is made.

B) can be hedged by using a forward or futures contract in foreign exchange.

C) cannot be eliminated.

D) results from changes in the exchange rates between the currency of the investor and the country in which the investment is made and cannot be eliminated.

E) results from changes in the exchange rates between the currency of the investor and the country in which the investment is made and can be hedged by using a forward or futures contract in foreign exchange.

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which country has the highest in GDP per capita?

A) Luxembourg

B) Canada

C) Germany

D) U.S.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

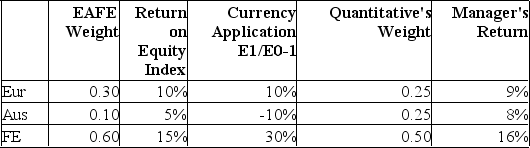

The manager of Quantitative International Fund uses EAFE as a benchmark.Last year's performance for the fund and the benchmark were as follows:  Calculate Quantitative's country selection return contribution.

Calculate Quantitative's country selection return contribution.

A) 12.5%

B) -12.5%

C) 11.25%

D) -1.25%

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The present exchange rate is C$ = U.S.$0.78.The 1-year future rate is C$ = U.S.$0.76.The yield on a 1-year U.S.bill is 4%.A yield of __________ on a 1-year Canadian bill will make an investor indifferent between investing in the U.S.bill and the Canadian bill.

A) 2.4%

B) 1.3%

C) 6.4%

D) 6.7%

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The possibility of experiencing a drop in revenue or an increase in cost in an international transaction due to a change in foreign exchange rates is called

A) foreign exchange risk.

B) political risk.

C) translation exposure.

D) hedging risk.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The possibility of experiencing a drop in revenue or an increase in cost in an international transaction due to a change in foreign exchange rates is called

A) foreign exchange risk.

B) political risk.

C) translation exposure.

D) hedging risk.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose the 1-year risk-free rate of return in Canada is 4% and the 1-year risk-free rate of return in Britain is 6%.The current exchange rate is 1 pound = Cad.$1.67.A 1-year future exchange rate of __________ for the pound would make a Canadian investor indifferent between investing in the Canadian security and investing in the British security.

A) 1.6385

B) 2.0411

C) 1.7500

D) 2.3369

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The interplay between interest rate differentials and exchange rates, such that each adjusts until the foreign exchange market and the money market reach equilibrium, is called the

A) Purchasing Power Parity Theory.

B) Balance of Payments.

C) Interest Rate Parity Theory.

D) None of the options are correct.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which country has the largest stock market compared to GDP?

A) Japan

B) Germany

C) Hong Kong

D) U.S.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Showing 21 - 40 of 48

Related Exams