A) Reducing payroll costs from its current projection amount

B) Decreasing the accounts receivable period by changing the firm's credit policy effective the first of next year

C) Receiving more favorable credit terms from the firm's suppliers

D) Increasing the dividend per share on the firm's outstanding common stock

E) Refinancing the firm's long-term debt at a lower interest rate

G) B) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The Appliance Giant has annual credit sales of $2,846,334 and cost of goods sold of $2,112,882.The average accounts receivable balance is $47,280.How many days on average does it take the firm to collect its accounts receivable?

A) 5.64 days

B) 7.97 days

C) 8.94 days

D) 8.17 days

E) 6.06 days

G) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

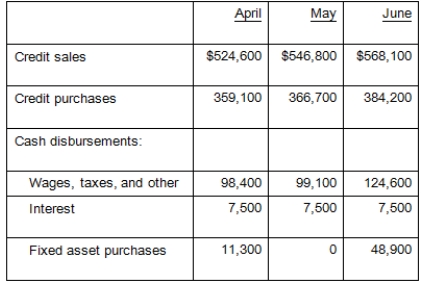

Here are some important figures from the budget of Global Enterprises for the second quarter:  The company predicts that 2 percent of its credit sales will never be collected, 45 percent of its sales will be collected in the month of sale, and the remaining 53 percent will be collected in the following month.Credit purchases will be paid in the month following the purchase.March credit sales were $487,900 and credit purchases were $349,500.What is the ending cash balance for April if the beginning cash balance was $39,500?

The company predicts that 2 percent of its credit sales will never be collected, 45 percent of its sales will be collected in the month of sale, and the remaining 53 percent will be collected in the following month.Credit purchases will be paid in the month following the purchase.March credit sales were $487,900 and credit purchases were $349,500.What is the ending cash balance for April if the beginning cash balance was $39,500?

A) $67,410

B) $67,457

C) $68,800

D) $64,440

E) $69,230

G) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

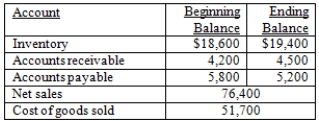

Consider the following financial statement information:  Assume all sales and purchases are on credit.How long is the cash cycle? (Use average balance sheet account balances.)

Assume all sales and purchases are on credit.How long is the cash cycle? (Use average balance sheet account balances.)

A) 80.21 days

B) 116.09 days

C) 101.03 days

D) 113.58 days

E) 73.57 days

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

You've worked out a line of credit arrangement that allows you to borrow up to $2.1 million at any time.The interest rate is .72 percent per month.In addition, 3 percent of the amount you borrow must be deposited in a non-interest-bearing account.Assume your lender uses compound interest and that you need $1.3 million today which you will repay in five months.How much interest will you pay?

A) $79,069

B) $48,947

C) $42,103

D) $47,479

E) $48,886

G) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Generally speaking, which of the following situations will occur if a seasonal company adopts a compromise financial policy? I.Periods where short-term financing is required II.Less long-term debt than if the firm followed a restrictive financial policy III.Periods of excess funds which can be invested in short-term marketable securities IV.Lower investment in fixed assets than if the firm adopted a flexible financial policy

A) I only

B) II only

C) I and III only

D) II and IV only

E) I, III, and IV only

G) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Dexter Companies has a conventional factoring arrangement with its local bank.Which of these would be a common characteristic of that type of financing arrangement?

A) Dexter Companies will receive the full amount of the accounts receivable included in this arrangement on an agreed upon date sometime in the future.

B) The responsibility for collecting the covered receivables lies with Dexter Companies.

C) Any bad debt that results from an account receivable included in this arrangement will be a cost to the bank.

D) Dexter Companies will pay a monthly fee to the bank and in turn will receive payment for the full amount of its accounts receivable.

E) The arrangement keeps the receivables as an asset of Dexter Companies but places a lien on those accounts in favor of the lending bank.

G) C) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

H&H Companies has an average collection period of 43 days and factors all of its receivables immediately at a discount of 1.1 percent.Assume all accounts are collected in full.What is the firm's effective cost of borrowing?

A) 9.68 percent

B) 9.73 percent

C) 9.97 percent

D) 9.84 percent

E) 10.07 percent

G) D) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Palm Beach Yachts has a line of credit with a local bank that permits it to borrow up to $1.8 million at any time.The interest rate is .78 percent per month.The bank charges compound interest and also requires that 5 percent of the amount borrowed be deposited into a non-interest-bearing account.What is the effective annual interest rate on this loan?

A) 10.68 percent

B) 10.43 percent

C) 9.74 percent

D) 10.29 percent

E) 9.91 percent

G) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The operating cycle:

A) illustrates the sources and uses of cash.

B) is equal to the cash cycle plus the accounts receivable period.

C) begins when a product is sold to a customer.

D) is based on a 360-day year.

E) describes how a product moves through the current asset accounts.

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Juno's has projected its Q1 sales at $46,000 and its Q2 sales at $48,000.Purchases equal 71 percent of the next quarter's sales.The accounts receivable period is 30 days and the accounts payable period is 45 days.At the beginning of Q1, the accounts receivable balance is $12,200 and the accounts payable balance is $14,800.The firm pays $1,500 a month in cash expenses and $400 a month in taxes.At the beginning Q1, the cash balance is $280 and the short-term loan balance is zero.The firm maintains a minimum cash balance of $250.Assume each month has 30 days.What is the cumulative cash surplus (deficit) at the end of the Q1, prior to any short-term borrowing?

A) $9,210

B) $9,684

C) $8,633

D) $8,880

E) $9,157

G) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

P&M Industries has projected quarterly sales for the coming year, starting with Quarter 1, of $6,200, $6,500, $6,300, and $6,700, respectively.Sales in the year following this one are projected to be 4 percent greater in each quarter.Assume the company places orders during each quarter equal to 74 percent of projected sales for the next quarter.How much will the firm pay its suppliers in Q3 if the firm has a 30-day payables period?

A) $4,859.33

B) $4,826.67

C) $4,603.18

D) $4,890.22

E) $4,711.46

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of these best describes a line of credit?

A) Long-term, prearranged, committed bank loan

B) Short-term loan secured by accounts receivable

C) Short-term loan secured by inventory

D) Long-term, prearranged, non committed bank loan

E) Short-term prearranged bank loan that can be either committed or noncommitted

G) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The cash cycle is equal to the:

A) inventory period minus the accounts payable period.

B) operating cycle plus the accounts payable period.

C) operating cycle minus the accounts receivable period.

D) accounts receivable period minus the accounts payable period plus the inventory period.

E) inventory period minus the accounts receivable period minus the accounts payable period.

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

To ensure an unsecured line of credit is used solely for short-term purposes, the loan arrangement frequently includes which one of the following?

A) Cleanup period

B) Grace period

C) Revolver

D) Factoring arrangement

E) Lien on the borrower's inventory

G) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The operating cycle is equal to the:

A) inventory period plus the accounts payable period.

B) accounts receivable period plus the cash cycle.

C) inventory period minus the accounts payable period plus the accounts receivable period.

D) accounts receivable period plus the inventory period.

E) inventory period plus the cash cycle.

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which one of the following is directly related to increases in a firm's current assets?

A) Reorder costs

B) Shortage costs

C) Restocking costs

D) Out-of-stock events

E) Carrying costs

G) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Kacie's has an average collection period of 23 days and factors all receivables immediately at a discount of .95percent.What is the effective cost of borrowing? Assume that default is extremely unlikely.

A) 16.32 percent

B) 16.28 percent

C) 16.36 percent

D) 16.52 percent

E) 16.49 percent

G) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Tri-City Grocers is a chain of grocery stores that just hired a new CFO.Which of the following actions would you expect this CFO to adopt given her statement that she wants to implement a more flexible financing policy for the firm? I.Easing the credit terms given to customers II.Increasing the amount of inventory carried by each grocery store III.Borrowing funds to keep more cash available for store operations IV.Decreasing the firms' investments in marketable securities

A) I and III only

B) II and IV only

C) I, II, and III only

D) II, III, and IV only

E) I, II, III, and IV

G) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Midwest Candles has estimated quarterly sales for next year, starting with Quarter 1, of $50.020, $54,619, $105,403, and $46,510.The accounts receivable period is 15 days.What is the expected accounts receivable balance at the end of the second quarter? Assume each month has 30 days.

A) $8,419.92

B) $17,567.21

C) $9,103.21

D) $7,251.71

E) $6,465.06

G) B) and C)

Correct Answer

verified

Correct Answer

verified

Showing 21 - 40 of 113

Related Exams