A) $12,800

B) $12,870

C) $14,365

D) $13,585

E) $12,850

G) B) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Gaming Station has to restock a popular electronic game every five days as it completely sells out in that period of time.What is the inventory turnover rate for this game?

A) 115 times

B) 105 times

C) 99 times

D) 118 times

E) 73 times

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which activity is most apt to reduce the inventory period for a grocery store?

A) Replacing slow-moving items with faster-selling products

B) Replacing fresh foods with canned goods

C) Decreasing the amount of discounts offered to customers

D) Increasing the amount of inventory on hand

E) Decreasing the number of times the inventory turns over per year

G) B) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Wrecker Automotive has sales for the year of $356,450, cost of goods sold equal to 59 percent of sales, and an average inventory of $42,500.The profit margin is 6 percent and the tax rate is 21 percent.How many days on average does it take the firm to sell an inventory item?

A) 75.68 days

B) 81.46 days

C) 73.76 days

D) 78.74 days

E) 82.03 days

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of these is the most indicative of a flexible short-term financial policy?

A) High ratio of short-term debt to long-term debt

B) Relatively small investment in current assets

C) High ratio of current assets to sales

D) Low level of net working capital

E) Relatively low level of liquidity

G) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Pepito's has sales for the year of $166,569 and cost of goods sold of $94,600.The firm carries an average inventory of $21,100 and has an average accounts payable balance of $19,600.What is the inventory period?

A) 89.02 days

B) 81.41 days

C) 31.29 days

D) 60.20 days

E) 81.06 days

G) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which one of the following commences on the day inventory is purchased and ends on the day the payment for the sale of that inventory is collected? Assume all sales and purchases are on credit.

A) Inventory period

B) Accounts receivable period

C) Accounts payable period

D) Operating cycle

E) Cash cycle

G) B) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which industry is most apt to have the shortest operating cycle?

A) Toy store

B) Car manufacturer

C) Local restaurant

D) Furniture store

E) Plastics manufacturer

G) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Candy Supplies purchases are equal to 68 percent of the following quarter's sales.Assume each month has 30 days, the accounts receivable period is 30 days, and the accounts payable period is 45 days.The estimated quarterly sales for next year, starting with Quarter 1, are $38,900, $40,600, $58,900, and $69,200, respectively.How much will the firm pay its suppliers in the third quarter?

A) $41,379

B) $46,811

C) $44,514

D) $40,947

E) $43,554

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which characteristic applies to commercial paper?

A) Maturities of 270 days or more

B) Offerings registered with the SEC

C) Interest rates higher than comparable bank loans

D) Issued directly by large-sized firms

E) Issued primarily by low-rated firms

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Brilliant J Company has estimated quarterly sales for next year, starting with Quarter 1, of $16,974, $18,696, $21,279, and $20,295.Purchases are equal to 60 percent of the following quarter's sales.What is the cash outlay for accounts payable for Quarter 3 if the firm has a 30-day accounts payable period? Assume each month has 30 days.

A) $12,250.80

B) $12,373.80

C) $12,486.67

D) $12,966.67

E) $12,503.33

G) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The length of time a retailer owes its supplier for an inventory purchase is called the:

A) inventory period.

B) accounts receivable period.

C) accounts payable period.

D) operating cycle.

E) cash cycle.

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which statement is true?

A) A decrease in the accounts receivable turnover rate decreases the cash cycle.

B) Paying a supplier within the discount period rather than waiting until the end of the normal credit period will decrease the cash cycle.

C) The number of days in the cash cycle can be positive, negative, or equal to zero.

D) An increase in the inventory turnover rate must increase the cash cycle.

E) The payables period must be shorter than the receivables period.

G) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

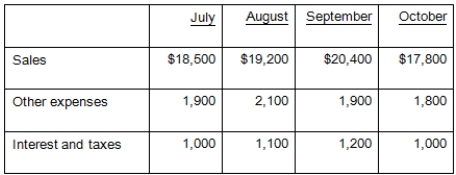

D's Hardware's monthly purchases are equal to 72 percent of the following month's sales.The accounts payable period for purchases is 45 days.All other expenses are paid when incurred.Assume each month has 30 days.The company has compiled the following information:  What is the projected amount of disbursements for the month of September?

What is the projected amount of disbursements for the month of September?

A) $16,910

B) $19,708

C) $19,490

D) $17,356

E) $20,311

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which one of the following is a graphical representation of the operating and cash cycles?

A) Operations line

B) Production period

C) Cash flow time line

D) Inventory flow chart

E) Customer service line

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following tend to rise when a firm switches to a flexible financial policy from a restrictive financial policy? I.Restocking costs II.Price reductions to offset limited selection III.Storage costs IV.Current asset opportunity costs

A) I and II only

B) III and IV only

C) I, III, and IV only

D) I, II, and III only

E) II, III, and IV only

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which statement related to a cash budget is correct?

A) Capital expenditures are treated as a cash inflow on a cash budget.

B) The cumulative surplus is computed prior to adjusting for the minimum cash balance.

C) A positive net cash inflow for a period indicates the cash disbursements exceed the cash collections for the period.

D) Financially healthy firms can have a negative quarterly net cash inflow.

E) Firms generally set the minimum cash balance at zero for planning purposes.

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Robert's Cards and Gifts has estimated quarterly sales for next year, starting with Quarter 1, of $43,930, $47,495, $37,835, and $91,655.The accounts receivable period is 13 days.What is the expected accounts receivable balance at the end of the second quarter? Assume each month has 30 days.

A) $6,068.39

B) $13,239.06

C) $6,860.39

D) $6,345.44

E) $5,465.06

G) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The Happy Flapjack Diner increased its operating cycle from 72 days to 74 days while the cash cycle decreased by 3 days.How have these changes affected the accounts payable period?

A) Decreased by 5 days

B) Decreased by 4 days

C) Decreased by 2 days

D) Increased by 2 days

E) Increased by 5 days

G) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Moore & Moore has just finished projecting its expected cash receipts and expenditures for next year.What is this projection called?

A) Operating projection

B) Receivables schedule

C) Balance sheet

D) Cash budget

E) Compromise policy

G) None of the above

Correct Answer

verified

Correct Answer

verified

Showing 61 - 80 of 113

Related Exams