A) 98; 105

B) 88; 81

C) 98; 81

D) 98; 91

E) 95;81

G) B) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The HOT Truck operates several specialty vehicles that provide hot food and beverages for firms that have workers employed in outlying regions.The company has annual sales of $489,500.Cost of goods sold average 59 percent of sales and the profit margin is 6.1 percent.The average accounts receivable balance is $41,700.On average, how long does it take this food truck to collect payment for its services?

A) 27.84 days

B) 28.17 days

C) 31.09 days

D) 38.33 days

E) 41.90 days

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which one of the following actions will decrease the operating cycle?

A) Increasing inventory

B) Paying suppliers faster

C) Paying for more inventory with cash rather than credit

D) Granting customers more time to pay for their credit purchases

E) Lessening the production time needed to manufacture a good for sale

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of these is most apt to decrease the cash cycle?

A) Decreasing the credit period granted to a customer

B) Decreasing the inventory turnover rate

C) Decreasing the accounts payable period

D) Decreasing the accounts receivable turnover rate

E) Increasing the receivables period

G) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Furniture Outlet has an accounts receivable period of 63 days and an accounts payable period of 87 days.The company turns over its inventory 4.3 times per year and marks up the inventory an average of 38 percent over its wholesale cost.What is the length of the firm's operating cycle?

A) 125.36 days

B) 147.88 days

C) 89.22 days

D) 60.88 days

E) 125.68 days

G) C) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

All else held constant, which of these statements is correct concerning the accounts payable period?

A) The accounts payable period is equal to 360/(Sales/Average accounts payable) .

B) A decrease in the accounts payable period will increase the operating cycle.

C) An increase in the accounts payable period will decrease the cash cycle.

D) A decrease in the accounts payable period will decrease the operating cycle.

E) An increase in the accounts payable turnover rate decreases the cash cycle.

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

By definition, an inventory loan is which one of the following types of loan?

A) Secured short-term loan

B) Unsecured short-term loan

C) Secured long-term loan

D) Unsecured long-term loan

E) Trust receipt loan

G) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

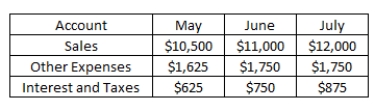

Diva Donuts purchases are equal to 79 percent of the following month's sales.The accounts payable period for purchases is 30 days while all other expenditures are paid in the month in which they are incurred.Assume each month has 30 days.The company has compiled the following information.  What is the total amount of the firm's disbursements for the month of June?

What is the total amount of the firm's disbursements for the month of June?

A) $10,500

B) $ 8,795

C) $10,795

D) $13,500

E) $11,190

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which type of financing is generally used by new car dealers to finance their inventories?

A) Blanket inventory lien arrangement

B) Trust receipt loans

C) Committed line of credit

D) Trade credit financing

E) Field warehousing financing

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The Corner Store is a small-sized, general store that stocks a minimal level of basic supplies and offers gasoline to a rural community.Which type of credit is probably best-suited for financing this store's inventory?

A) Trust receipt financing

B) Receivables factoring

C) Field warehousing

D) Blanket inventory lien

E) Receivables assignment

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which firm is most apt to have the shortest inventory period?

A) General merchandise retail store

B) Hardware store

C) Furniture store

D) Locomotive manufacturer

E) Delicatessen

G) C) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which statement is correct?

A) Firms should generally finance all of their assets with long-term debt.

B) Firms that follow restrictive financial policies can generally avoid short-term debt financing.

C) Short-term borrowing is generally more expensive than long-term borrowing.

D) Long-term interest rates tend to be more volatile than short-term rates.

E) A firm is less apt to face financial distress if it adopts a flexible financial policy rather than a restrictive policy.

G) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Northern Beef has estimated quarterly sales for the coming year, starting with Quarter 1, of $680, $725, $740, and $720, respectively.The accounts receivable balance at the beginning of Q1 is $330 and the collection period is 60 days.How much cash will the firm collect in Q1, Q2, and Q3, respectively?

A) $695.00; $498.03; $730.00

B) $695.00; $466.67; $626.67

C) $556.67; $695.00; $730.00

D) $556.67; $367.33; $626.67

E) $647.33; $626.67; $730.00

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Second Chance Gaming has to restock a popular electronic game every 2.5 days as it completely sells out in that period of time.What is the inventory turnover rate for this game?

A) 115 times

B) 105 times

C) 99 times

D) 118 times

E) 146 times

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Fido's Markets has a cash cycle of 24 days, an operating cycle of 39 days, and an inventory period of 2.3 days.The company reported cost of goods sold in the amount of $465,250, and credit sales were $600,000.What is the company's average balance in accounts payable?

A) $19,120

B) $18,414

C) $20,203

D) $22,344

E) $23,515

G) C) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A committed line of credit:

A) guarantees that a set amount of funds will be available to a firm for a stated period of time regardless of events that might occur during that time period.

B) is a guarantee that a bank will purchase a firm's accounts receivable at full value.

C) provides greater assurance than a noncommitted credit line that funds will be available when needed by a firm.

D) guarantees that any funds borrowed during a stated period of time will be charged the lowest rate of interest the lending bank offers to any of its customers.

E) is a loan arrangement for a stated period of time which is free of all costs and fees other than the actual interest paid on the funds borrowed.

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose MMP changes its policy and starts requiring all of its customers to pay within 20 days rather than the 30 days that it currently allows.Which one of the following will result from this change?

A) Increase in receivables period

B) Increase in inventory period

C) Decrease in cash cycle

D) Increase in operating cycle

E) Increase in accounts payable period

G) B) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A company has expected sales for January through April of $9,800, $9,500, $13,800, and $9,500, respectively.Assume each month has 30 days and the accounts receivable period is 38 days.How much does the company expect to collect in the month of May?

A) $10,646.67

B) $15,880.00

C) $9,720.00

D) $12,213.33

E) $15,406.00

G) C) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The Brown Squirrel has estimated sales for January through May of $14,700, $16,900, $23,500, $36,700, and $42,300, respectively.Assume there are 30 days in each month and the accounts receivable period is 45 days.How much should the firm expect to collect in May?

A) $36,700

B) $20,200

C) $30,100

D) $28,450

E) $39,500

G) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The accounts receivable period is the time that elapses between the _____ and the ____.

A) purchase of inventory; payment to the supplier

B) purchase of inventory; collection of the receivable

C) sale of inventory; payment to supplier

D) sale of inventory; collection of the receivable

E) sale of inventory; billing to customer

G) D) and E)

Correct Answer

verified

Correct Answer

verified

Showing 81 - 100 of 113

Related Exams