A) open market purchase.

B) reverse stock split.

C) tender offer.

D) rights offer.

E) targeted repurchase.

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Research conducted on firms' dividend policies over time support which one of the following conclusions?

A) Aggregate dividends and stock repurchases have steadily declined in real terms.

B) Dividends are required to be paid by all public corporations in existence for ten years or more.

C) Managers tend to smooth dividends.

D) Stock prices react quickly whenever an anticipated dividend amount is paid.

E) Firms generally commence paying dividends prior to doing any stock repurchases.

G) D) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which one of the following dates is the date on which the board of directors votes to pay a dividend?

A) Record date

B) Declaration date

C) Ex-dividend date

D) Payment date

E) Settlement date

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Flemington Farms is evaluating an extra dividend versus a share repurchase.In either case, $10,000 would be spent.Current earnings are $2.10 per share, and the stock currently sells for $52 per share.There are 2,000 shares outstanding.Ignore taxes and other imperfections.The PE ratio will be ____ if the firm issues the dividend as compared to ____ if the firm does the share repurchase.

A) 22.38; 22.38

B) 24.87; 22.38

C) 20.23; 24.87

D) 22.38; 20.23

E) 20.23; 22.38

G) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Kelsey International declared a dividend on Friday, November 13, that is payable on Friday, December 11, to holders of record on Monday, November 30.What is the latest date that you can purchase this stock if you wish to receive this dividend? Assume there are no banking holidays within this period of time.

A) Tuesday, November 24

B) Wednesday, November 25

C) Thursday, November 26

D) Friday, November 27

E) Monday, November 30

G) A) and C)

Correct Answer

verified

B

Correct Answer

verified

Multiple Choice

A share repurchase will:

A) increase both earnings per share and the PE ratio.

B) increase the earnings per share but not affect the PE ratio.

C) increase the earnings per share and decrease the PE ratio.

D) not affect either the earnings per share nor the PE ratio.

E) not affect the earnings per share but will decrease the PE ratio.

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

On which one of the following dates is the determination made as to which shareholders will receive a dividend payment?

A) Date of record

B) Ex-dividend date

C) Payment date

D) Declaration date

E) Public announcement date

G) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Normal cash dividends that are increased regularly tend to send which message?

A) The firm is attempting to reduce its tax bill.

B) The dividends are expected to increase the firm's agency costs.

C) The firm is planning on downsizing.

D) The firm is discontinuing all stock repurchases.

E) The firm expects to be profitable.

G) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Bob's Standard Station has 15,000 shares of stock outstanding at a market price of $15 a share.The current earnings per share are $1.26.The firm has total assets of $312,000 and total liabilities of $97,500.Next week, the firm will be repurchasing $37,500 worth of stock.Ignore taxes.What will be the earnings per share after the stock repurchase?

A) $1.598

B) $1.547

C) $1.335

D) $1.512

E) $1.563

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which one of the following is an example of a liquidating dividend?

A) Valley Feed Mills recently sold its grain storage facility and is distributing the proceeds of that sale to its shareholders.

B) Kate's Winery has excess cash that it wishes to distribute to its shareholders in addition to its normal cash dividend.This extra distribution usually occurs about once every year.

C) Kurt's Music is planning to increase its quarterly dividend by 3 percent.

D) The Dried Florist is preparing to pay its first annual dividend of $.08 per share.

E) Hi Tek had an extraordinarily profitable year and has decided to do a one-time only $10 per share cash dividend.

G) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Of the following, which two are the best reasons for doing a reverse stock split? I.Return a stock to its normal trading range II.Eliminate small shareholders III.Reduce shareholder costs IV.Avoid delisting

A) I and II

B) I and III

C) II and III

D) II and IV

E) III and IV

G) D) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Overboard Excursions just announced it will be paying an annual dividend of $1.37 a share plus an extra dividend of $.56 a share this year.The company also announced that its regular dividend, which is all it anticipates paying after this year, will increase by 1.5 percent annually.What is the anticipated dividend per share next year?

A) $1.3855

B) $1.3924

C) $1.3906

D) $1.8088

E) $1.3745

G) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A stock repurchase will:

A) increase the number of shares outstanding.

B) decrease the earnings per share.

C) decrease the market price per share.

D) increase the market value per share.

E) decrease the PE ratio.

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

JTL has 148,000 shares of stock outstanding.The firm has extra cash so it announced this morning that it is willing to repurchase 18,000 of its shares.What type of offer is the firm making?

A) Rights offer

B) Secondary issue

C) Targeted repurchase

D) Tender offer

E) Private issue

G) D) and E)

Correct Answer

verified

D

Correct Answer

verified

Multiple Choice

Taylor's stock has plummeted in value and is currently priced at $5 a share.The firm prefers the price exceed $10 a share and thus has decided to do a reverse stock split.However, when it does this, the firm wants the stock price increased to at least twice its preferred minimum as it is concerned the price will fall further.Which one of the following stock split ratios is most appropriate for this situation?

A) 1-for-3

B) 1-for-4

C) 2-for-7

D) 4-for-1

E) 7-for-2

G) B) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

M&N stock is currently selling for $22 per share.The firm just made an offer to one of its major shareholders to repurchase all the shares owned by that shareholder for $26 per share.What type of offer is being made?

A) Rights offer

B) Secondary issue

C) Targeted repurchase

D) Tender offer

E) Private issue

G) D) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Breakers Engineering is preparing to pay its quarterly dividend of $1.36 a share.The stock closed at $51.25 a share today and goes ex-dividend tomorrow.What will the ex-dividend stock price be if the relevant tax rate is 21 percent and all else is held constant?

A) $50.91

B) $50.83

C) $50.18

D) $49.96

E) $49.91

G) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The Meat Market has 16,000 shares of stock outstanding at a price per share of $7.What will be the price per share if the firm declares a 3-for-7 reverse stock split?

A) $11.80

B) $4.50

C) $3.00

D) $15.00

E) $16.33

G) C) and E)

Correct Answer

verified

E

Correct Answer

verified

Multiple Choice

Baby Fresh Diaper Service has 30,000 shares of stock outstanding at a market price of $37.50 each and earnings per share of $1.22.The firm has decided to repurchase $187,500 worth of stock.What will the PE ratio be after the repurchase, all else held constant?

A) 26.16

B) 27.85

C) 24.11

D) 25.30

E) 25.61

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

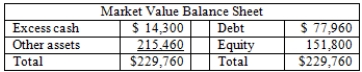

The Down Towner has a market value balance sheet as shown below.The firm currently has 12,000 shares of stock outstanding and net income of $17,500.  The firm has decided to repurchase 10 percent of its outstanding stock at the current market price and fund that purchase with new debt.After the repurchase there will be ____ shares outstanding at a price per share of ____.

The firm has decided to repurchase 10 percent of its outstanding stock at the current market price and fund that purchase with new debt.After the repurchase there will be ____ shares outstanding at a price per share of ____.

A) 10,200; $11.50

B) 10,200; $12.65

C) 10,800; $12.65

D) 10,800; $11.50

E) 10,800; $14.05

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Showing 1 - 20 of 96

Related Exams